You must have read about whitepaper which defines all the features about a cryptocurrency to be launched, but today, you have to understand whitelist in cryptocurrency. This term indicates to list of enabled and identified individuals, cryptocurrency addresses, computer programs. In another way, it is connected with a piece of information, certain service, and event. Whitelists are defined as the separate way of the different contexts of their use.

When any company’s mailing list is signed by the users, they are supposed to fill up the email of the firm to their whitelist. It is all done to avoid messages going into spam folders, directly. In other cases, fees are also being paid by the companies to get themselves whitelisted by internet service providers, to avoid emails from being tagged as spams. To understand whitelist in the cryptocurrency means whitelisting an email address and getting assured of future emails displaying in the inbox.

Whitelists also find its best use in network security. As for an example, LAN popularly known as local area networks can generate a list of reliable MAC addresses to avoid joining of any outsider. In the same way, whitelists can also be used by wireless internet providers and benefit only those users with identification to avail service of internet connection.

To understand whitelist, there is another concept, which is linked with computer programs that can be used safely. There is several anti-virus software that is featured with reliable applications and is free from affected at the time of system scanning. But whitelists can also be manually created by the users.

If you are abreast of cryptocurrency regulation news, then you will understand whitelist is part of withdrawal events or ICOs in the cryptocurrency and blockchain zone. Talking about the first case, an offer of whitelisting phase can be initiated by cryptocurrency projects for investors to take active participation in the public sale of tokens. So to be a part of ICO, investors are supposed to give their personal information. And they have to do this before getting whitelisted by the KYC procedure.

When it comes to withdrawal addresses, then whitelist addresses can be defined as crypto addresses list which users can consider as per the trust. In this case, funds are withdrawn from the exchange account to the addresses whitelisted before. On a worldwide crypto exchange like Binance, it is also called a withdrawal address whitelist or address management. Users can find it helpful mean for their fund security from the prying eyes of hackers.

Conclusion

So this is all you need to understand whitelist in cryptocurrency. Whitelist is the list of enabled and identified individuals, cryptocurrency addresses, computer programs. In another way, it is connected with a piece of information, certain service, and event. Whitelists are defined as a separate way of the different contexts of their use. It is the best method to not let messages reaching spam folders. By following all crypto news, you will understand that in the context of cryptocurrency, it is an email address and assurance of upcoming emails coming to inbox. Whitelist also finds its best use in wireless internet providers and benefit only those identified users to explore the service of internet connection.

Articles You May Read

To make a career in the cryptocurrency field, it is much important to stay abreast of live crypto news and grasp as much understanding about the important terminologies related to the field. There are various cryptocurrency terms that you will find while browsing through. Among these terms, there is a term called UTXO. Do you know what is UTXO? If not, then today we will let you know about UTXO.UTXO is defined as Unspent Transaction Output. It is the remaining amount of cryptocurrency change that you get from every transaction.

Importance Of UTXO

An important thing to know about UTXO is that it indicates blockchain’s method of accounting. There is no need to keep an eye on or storing all solo transactions. All it needs is to discover coins that are not being spent, called to be as UTXOs. Note that in the Bitcoin ecosystem, a coin cannot be spent more than once. In the wallet, if all the bitcoins go unspent, then there are two reasons for it. First, bitcoins must have been received as a mining award by the miner or, secondly, during the transaction, each bitcoin must have been minted.

UTXOs play an important role in keeping double-spending attacks at bay. It will also intercept in spending the non-existent coins. The maintenance and recording of the database by network nodes feature all UTXO that are present for spending. If there is an attempt to send a transaction with a coin, not in the database, will be rejected by the nodes.

Problem In Storage

Storage of the UTXO database in RAM is done by nodes. So this becomes important in storing data in a manageable size. With the growth of data, it simultaneously leads to the growth of the full node with it. But when full nodes become too costly, then it is expected to observe centralization in the Bitcoin network amongst the richer some who can operate them. The risk of centralization is the main problem and a barrier to Bitcoin block size increases. This is the major issue about UTXO.

Solution To This Problem

To face the problem of storage, there are solutions also. And one of the best solutions is no compulsion of storing all UTXO database in RAM by the nodes. A part of it for storage can be the best option in much less costly SSD (solid-state disk) or revolving hard disk. Adding on to it, steps are being taken for improving the transaction mechanism by Bitcoin developers regarding optimizing the UTXO database.

Conclusion

So today, you got to know about UTXO and its problem and solution. In short, UTXO is the remaining amount of cryptocurrency change that you get from every transaction. It is implemented by Bitcoin and other cryptocurrencies like Komodo, Bitcoin Cash, Litecoin, and many others. There are other cryptocurrencies like Ethereum that use other accounting mechanisms. Ethereum, as the name mentioned, comprises a transaction model-based on accounts. This mechanism consists of better space and easier code to work with. But the problem you will face is losing a transaction privacy level and operate into scalability issues. To know any updates about Bitcoin, keep following the latest news on Bitcoin.

Articles You May Read

If you want to enhance your knowledge about cryptocurrency, then it is better you should follow breaking crypto news, to get an update about the latest developments which are taking place in the crypto sphere. If you are newly introduced to this digital world, then you should also brush up your crypto vocabulary by learning new terminologies. Today we are going to tell you about the term mooning.

With the appearance of term mooning, you might be relating it to the moon, but this term has nothing to do with astronomical science. Rather it is a term which is related to cryptocurrency. So let us explore its actual meaning in this blog. Whenever we discuss the term mooning, it means a major price movement upwards.

Now, let us take you to your school memories for a short while, where you have studied all about moon having the mass, and mass results in gravitational force. This force plays a pivotal role in holding everything on our mother planet, earth. It either leads us to be more stable or less. This concept matches completely with the stability (more or less) of cryptocurrency. However, in comparison to human stability, cryptocurrency is a bit stable. When it comes to term mooning, we can relate the cryptocurrency with the moon in terms of stability.

The term mooning can be described as a situation when cryptocurrency falls under the upward market trend that is strong. The term can also be related to the phrase that reads ‘’to the moon’’. This indicates a firm belief about the possibility of the price rise of a particular cryptocurrency. Akin to several specific fields, the eco-system of financial or cryptocurrency has spawned the number of terminologies, memes and slangs. It is not limited to the popular digital ledger, blockchain. The term mooning finds its wider space in the cryptocurrency community. It is much special for traders and investors.

Apart from the term mooning, there are many several terminologies, like HODL, Escrow, Nodes, Bear, Bull and several others, which you must grasp if you want to make your career in cryptocurrency. Now it has been decades since the launch of popular crypto coin, Bitcoin. And now there are several other alternate coins like Ethereum, Litecoin, Neo, Dash, Tron and so many. So if you are keen to find cryptocurrency jobs, then better gulp all these important terms that are mentioned above including the term mooning.

Conclusion

So now you understand what is the meaning of term mooning. The term can be best explained by linking it to the astronomical study about the moon having a gravitational force. This force plays a pivotal role in holding everything on our mother planet, earth. If being asked to define mooning in one single sentence, then it all means a major price movement upwards. Besides mooning, there are several other terminologies like HODL, mining, market capitalization, liquidity, lightening network and various others. If you want to explore jobs for cryptocurrency as a career, then you are expected to be knowing all these terms at the back of your hand.

Articles You May Read

Bitcoin has been a major underlying factor in introducing the concept of cryptocurrencies to the whole world. Kudos to its mysterious founder, popularly known as Satoshi Nakamoto, to develop the idea of digital financial technology that could replace traditional currencies. However, we are not sure whether it will come true or not. However, today, the success of cryptocurrencies is not merely limited to Bitcoin, but also by altcoins. Being an ardent crypto enthusiast, you must be knowing that Ethereum stands as the second worthiest cryptocurrency after Bitcoin. Even though it came much later in the year 2015, still, it is being regarded as the closest competitor crypto coin to the latter crypto coin (Bitcoin). But today, we will be emphasizing more on ERC-20 and how does it mean so important for Ethereum.

Ethereum, being the second-most well-known cryptocurrency and system of blockchain, signifies token utility for trading and also for buying and selling. Tokens are classified into different ranges including real tangible objects, vouchers, and IOUs. So now we can define tokens as smart contracts where Ethereum blockchain is used.

Power Of Authorizing Developers

ERC-20 is one of the noted tokens that came as a technical utility for smart contracts on the Ethereum blockchain for executing token. If you are abreast of the latest news on Ethereum, then you will know that around 181K ERC-20 tokens were present in the main network of Ethreum on April 16, 2019. ERC-20 token plays a very prominent role in laying out rules that are applicable for all Ethereum tokens to follow it. Besides this, it also makes developers authorized to speculate about the functioning of newbie tokens in the big Ethereum system. This eases the tasks for developers, as they can continue with their work because they are well-aware of the fact that no new project will not be done again all the time when there is a possibility of a new release of a token. Luckily, many token developers have adhered to rules of ERC-20, indicating about the release of the majority of tokens via Ethereum ICOs are amenable to ERC-20.

Performing Different Functions

ERC-20 performs multiple functions so that other tokens could benefit inside the Ethereum system. All these comprise basic functional methods that include transferring of tokens and data accessing by the users for a specific token. All these functions are supposed to be sure about the different Ethereum tokens to remain consistent in the Ethereum system. Most of the digital wallets that back Ether currency are also supportive of amenable ERC-20 tokens. But since the standard of ERC-20 is in the developing stage, there are possibilities of bugs that must be ward away, to let Ethereum grow. Direct sending of Ethereum tokens to a smart contract will result in money loss. It is all because of protocol error that signifies unresponsiveness of the contract of token for direct transfer. Because of this reason, a heavy amount of token has been lost. However, it does not have any impact on ERC-20, as it continues to be an important aspect of Ethereum.

Conclusion

So today you got to know much about ERC-20 and how does it mean important to Ethereum. In short, ERC-20 token is very prominent in implementing rules that are necessary to be followed for all Ethereum tokens. Besides this, developers are also being empowered to speculate about the operating of new tokens in the big Ethereum system. Just like Bitcoin, now people are also inquisitive to know about Ethereum. Being much younger to Bitcoin, this altcoin can compete against the latter coin. If you are interested to know about the Ethereum price prediction for the current year, then it is estimated to touch around $100K in 2024 and might reach the target to $1 million in 2025.

Articles You May Read

The concept of cryptocurrency has now become a popular financial technology that keeps the potential to compete with traditional currencies. Since it is a decentralized concept, so there is no interference from a central authority or middleman. Now it has been decades, since the launch of Bitcoin, who is the underlying factor behind the popularity of cryptocurrency. The curiosity to buy cryptocurrency in India is now can be fulfilled by many crypto lovers. It is because the ban which was levied upon the cryptocurrencies has been lifted off by the Supreme Court of India. This must-have sound so much afresh and good news for all those crypto enthusiasts, who now can trade in digital currency. The removal of the ban has paved many cryptocurrency startups to grow.

There is a ray of hope among the founders of cryptocurrency startups in India. Now they don’t expect any other ban on cryptocurrency by Centre government. According to the CEO of a popular exchange, as of now, no further worries are coming in the way of cryptocurrency. Also, it is not much sure whether there will be any implementation of the old bill on cryptocurrency or any expectation of a new bill to emerge someday.

Banning must not be a preferred solution to ban technology, by not understanding its depth. In this fast-paced world of technology, India has progressed so much. Hopefully, the country might analyze the approach of developed countries in accepting digital currencies. The growth of cryptocurrency startups can be seen with the emergence of DCX Learn, a new online platform launched by CoinDX. DDCX Learn aims to focus on the content of education, meant for blockchain and cryptocurrency. Founder of the CoinDCX states about no new current update about the banning.

Amid all the doubts revolving around regulations, some people are needed to grasp the knowledge about the crypto concept, and DCX Learn provides that opportunity. Another example is the launch of Kuber, a mobile application of crypto exchange of Indian rupee by CoinSwitch on 1st June. It is being developed especially for the Indian market. Kuber helps the user to trade, buy, and sell their crypto assets with the Indian rupee. It is supportive of around 100 cryptocurrencies.

Ever since the pre-launch of the CoinSwitch Kuber announcement in May, the number of user signups has reached to 100K, which is far better than the estimated target before. The objective of CoinSwitch Kuber is to enhance the acceptance list of cryptocurrency in a big nation like India. To fulfil this desired aim, it provides an easy and affordable way through the mobile application. Pundi X and Paxful are another two examples that can be cited as the growth of cryptocurrency startups.

Conclusion

Many experts have expressed a positive future for cryptocurrency startups. But at the same time, they have signalled them to be aware of the undetermined regulatory bill in India. Well, let us not speculate or instil the fear among these flying kites. Now the question about is Bitcoin legal in India can be answered with the rise of cryptocurrency startups. All kudos to the apex court of India by lifting off the ban from controversial currency, i.e. cryptocurrency. Now since India has shown the green flag for trading in digital currencies, it must keep on boosting for crypto investment and pave a better future for crypto technology.

Articles You May Read

DYOR is among those pivotal concepts in cryptocurrency. It stands for Doing Your Own Research. It is a very general positive term that is commonly used in the blockchain community and cryptocurrency of course. Due to the announcement of the partnership, there is a trend of hyping the crypto projects. It is also possible to hear about the announcement of the newbie partnership in some cases. The latest example to quote is the TRON CEO, Justin Sun. This person is applauded for his marketing tactics by promoting his project on popular social media. Today we will let you know about how DYOR is essential for crypto investment.

Some may say that this tactic will not stay for a longer period. And because of this, announcements won’t be taken into much seriously and will result in floating memes. But the announcement cannot be underestimated, as they can result in to rise in digital currency trading prices. Now if there is any doubt that comes in your mind about the hyped partnerships and also announcements, then you might be criticized or held for FUDDING, which indicates fear, doubt, and uncertainty. This is when the DYOR comes in as an important concept.

Advocating The Concept Of DYOR

The hype of crypto projects or crypto investment makes people urging others with genuine advice to DYOR. If considered, then it will lead to a similar consistent end. With this fact, we can say that DYOR is essential to let investors informed and putting upon value to the whole community.

DYOR Is Essential For Everyone

While investing in Bitcoin you need to know about the background of the token, development team, technology, and planning. It must be noted that for investors, testing and tracking of the crypto project is not a first and final deal. It is a constant process, for which investors must know about the following factors like development in the regulatory environment, project success, any add on to teams of development, challenges from rival projects. This is why DYOR is essential.

Don’t Bother About Doubters Regarding DYOR

Through, there is no serious issue in promoting DYOR, but for skeptics, it is considered as a sluggish method. But don’t get so influenced by their approach about DYOR. Maybe these people are not much aware of its relevance as investment advice to save oneself from big financial trouble. So DYOR is essential to stay away from any risks.

Conclusion

So now you know why DYOR is essential and why is it important to be known for investors. DYOR as the name suggests means Do Your Own Research. Now the term itself is enough to guide before you aim for investing in cryptocurrency. And even if you plan to do, then you must follow DYOR and must do in-depth research about a cryptocurrency asset, the development team, the success, and threat from competent projects. For an investor, it cannot be a one-time deal for testing and tracking the projects that are related to cryptocurrency. If you want to experience in crypto trading, then follow the cryptocurrency trading guide for beginners.

Articles You May Read

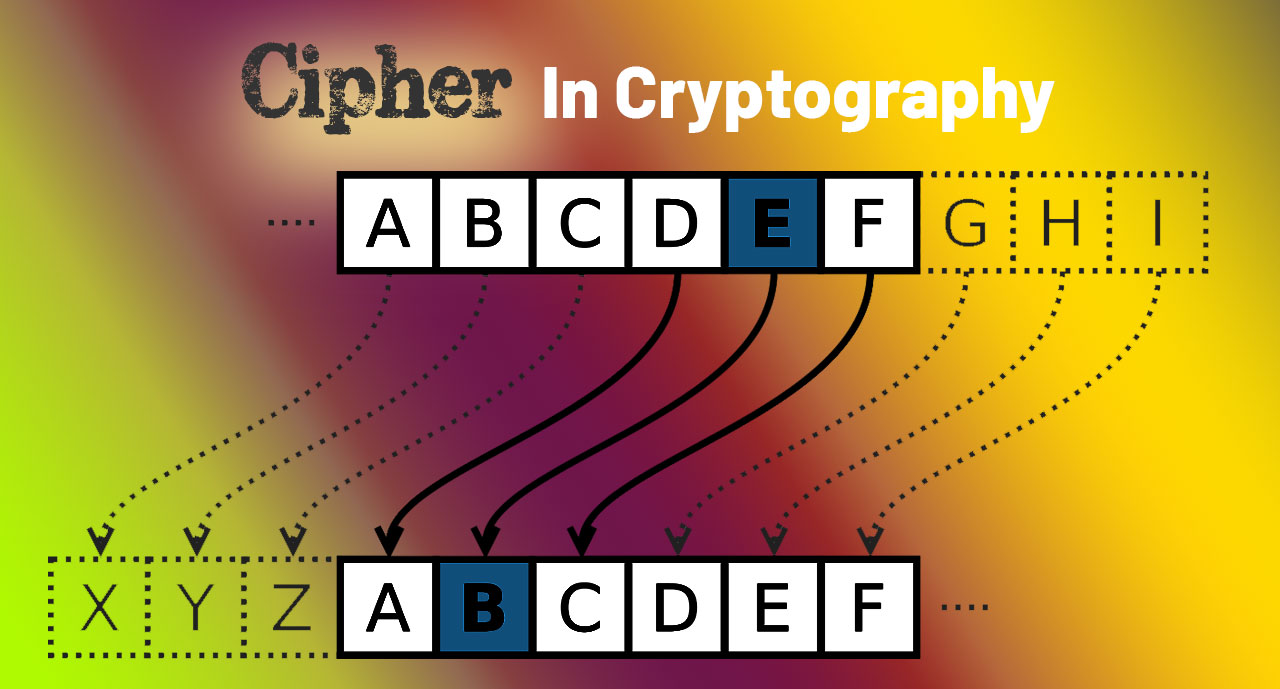

Cryptocurrency comprises so many important terminologies that are must understand for all those who want to explore this new digital financial world. Besides being abreast of the latest news on cryptography, if you don’t have any idea about what is cryptography, then you have not explored the crypto world in depth. Well, let us tell you that cryptography is a mechanism to secure the information with the help of codes. However, our main focus is on the use of cipher in cryptography.

Now, what do you understand by this term? If you don’t have much idea about it, then let us brief you about it. Cipher is akin to codes, or you can say a kind of synonym. In other words, it can be defined as an algorithm for functioning encryption or decryption. These two operations are a chain of steps that adhere to run with a followed method. As mentioned above cipher in cryptography is like a synonym to code, because of both features as steps for message encryption. But there is not much similarity between these two crypto entities. But let us keep the main focus on cipher in cryptography.

At times when cipher is used the real information is called plaintext. But when it is encrypted, then it becomes ciphertext. This encrypted formed message comprises all plaintext message information, but can’t be read easily by human and even computer unless there is a provision of decryption via the perfect mechanism. The functioning of a cipher depends upon complementary information, defined as key. To decrypt the ciphertext into plaintext that is readable, it is very important to know a key. Otherwise, if not impossible, it would be difficult to perform this function. The selection of the key is a must before encrypting a message by cipher in cryptography.

In previous times, the word ‘’cipher’’ indicated zero. Later on, cipher found its best use for any number or decimal digit. There are many different theories about the cipher and how it came to mean as encoding. Previously, cryptography was divided into the difference of cipher and codes. Coding differed in terms of its specific terminology, similar to cipher like decoding, encoding, and others. But many drawbacks of coding were spotted which included difficulty of sensitivity to cryptanalysis and problem in managing tougher codebook. These became the reason for the fall of codes and the dawn of cipher in cryptography.

Encryption consists of different types. Earlier, in the history of cryptography, the use of algorithms was opposite to contemporary methods. The confidentiality of cipher can be understood through their functioning and their use of keys (either one or two).

Conclusion

So this is all about the use of cipher in cryptography. By summarising, the cipher can be defined as an algorithm that has two major functions, encryption or decryption. These two operating methods are clear-cut steps following a procedure. The objective of encoding is the transfer of information to cipher. In typical dialect, the cipher can be considered as synonymous with code, because both define steps for message encryption. Cipher operates on auxiliary information called as key. Knowledge of the key is very important to decrypt the ciphertext into plaintext, to make it readable. To know about any latest crypto update follow the recent bitcoin news.

Articles You May Read

If you are a regular follower of Bitcoin news today, then you must be equipped with all the latest developments that are taking place in the crypto world. Now being an ardent crypto enthusiast you might be aware of the fact that whenever you hold a certain cryptocurrency, the changes in the price of that particular cryptocurrency will surely going to affect you. The main reason behind all this problem is the holders, which are also being termed as ‘whales’. These holders control the crypto prices for their own best interest. These crypto whales do not find it interesting to enable price rise to a certain level; till the time they gather as many cryptocurrencies like Bitcoin, Ripple, Ethereum, or any other digital currency. These whales are involved in generating buy and sell walls with the intention of currency price manipulation.

Know The Concept Of Buy And Sell Walls

Buy and sell walls depends upon the facilitation of cryptocurrency transactions. Most of the time, transactions are done on the order book, when a certain price is revealed by the buyer to be enabled in buying the currency units. This is done regarding the price where a currency is being traded, at the time of initiating the transaction. Apart from this, it can also be guaranteed for the upcoming time. Suppose if the currency is being traded at $20, and you want to purchase it for $20 units for $19, then the order can be placed by you, resulting in the activation, at the time when the price touches $19. This will make a match between you and the curious seller.

With the entry of the whale, it is expected to see the placing a large order by putting a wall. As for an example, if a whale does not agree for a drop in the price of currency below $20, then the order is expected to be placed for a majority of units. (like 20,000) at $20. Before the currency price is dropped below $20, it is important to complete the big order. This means the piling of the total 20,000 units for $20 initially should be done by sellers. The dropping of the price gets blocked effectively.

Spreading Of Buy And Sell Walls

Buy and Sell walls are not confined away from a sole trader. With the emergence of big buy and sell order, it is most probably expected about the placing of orders by other investors for a similar price. Buy and sell walls are not created by exchanges alone. This indicates that it is the investors who are involved in the manipulation of prices. Can there be any reason for a casual emergence of a big buy or sell order exempting price manipulation? Some say that high liquidity is the hint of sell walls. They even suggest the availability of currency units for buying.

Conclusion

If you are abreast with the live crypto news, then it is expected that you must be knowing the recent crypto developments. Cryptocurrency is a pool of many important terminologies, which every newbie crypto enthusiast must understand. Just like Whales and buy ad sell walls, both are inter-related to each other. The term ‘whales’ is given to those crypto holders or big names in the cryptocurrency, who with their clever tactics are involved in the manipulation of the prices. The greed of gaining more and more crypto coins including Bitcoin, Ethereum, or any other currencies prompts them to do it. Buy and sell walls is also the strategy that is influenced by these big players or whales.

Articles You May Read

Since the rise of cryptocurrencies, people have become very keen to know every update by following crypto news. People from all over the world, have been considering digital currencies as a new form of investment. Many technophiles now see them as the best alternate option for traditional currencies. Today, it has become challenging to opt for any cryptocurrency from the remaining options on the market. Many crypto enthusiasts are eyeing on the new entrants in the crypto market. Today, it will be interesting for you to know about fast-growing cryptocurrencies in 2019-2020.

Ethereum

No matter what uncertainty has been binding the Ethereum currently, this altcoin remains to be a worthy altcoin after Bitcoin. This altcoin is very favourable with the speedy transaction. Despite lacking in the value and facing scaling issues, investors are still confident about its comeback and its growth. If you have been following the latest news on Ethereum, then you will come to know that it is being considered as one of the fast-growing cryptocurrencies in 2019 t0 2020.

ZCash

Another runner-up name in the list of fast-growing cryptocurrencies in 2019 to 2020 is ZCash. This is another trustworthy digital currency promising with complete privacy and optional transparency preferable for the user. Akin to other cryptocurrencies, ZCash too suffered an impact on its price. In terms of value and market capitalization, however, this altcoin still registered itself in the brigade of 30 major cryptocurrencies. It is estimated that ZCash might become a game-changer in the year 2020 by revealing its true worth.

Bitcoin

Ever since mining of Bitcoin block took place in 2009, the cryptocurrency has been gaining much popularity among the users from all over the world. Investors too acknowledged its worth and came in much support for its rising graph. Microsoft, one of the popular software company too accepted it as a mode of payment. One of the major reasons that make Bitcoin high on the list is its value, growth, and minimal risk. So it is obvious to see it in the list of fast-growing cryptocurrencies in 2019- 2020.

Litecoin

Joining the list of fast-growing cryptocurrencies also includes the name of Litecoin. According to experts, this altcoin is supposed to increase its previous records. Other than Ethereum, Litecoin also seems to be a worthy opponent of Bitcoin. Currently, it ranks sixth in position as a digital asset. Bitcoin and Litecoin almost share a similar feature in operation. The processing rate of a transaction is much faster in Litecoin. There is no issue with complex algorithms and has a larger supply.

Monero

Monero is one of the promising cryptocurrency, that joined the market in 2014 and is constantly rising. This altcoin is sufficient in providing complete privacy which is secure and is not traceable by an unknown person. This makes it appealing to users. Based on 2019 market capitalization, Monero ranks 12th among the largest cryptocurrency. It won’t be wrong to say that this altcoin is worth mining, because it is efficient in scalability and decentralization.

Conclusion

ZCash, Bitcoin, Ethereum, Monero, and Litecoin are the fast-growing cryptocurrencies in 2019 – 2020. All these cryptocurrencies are worthy contenders that comprise promising features to gain users’ attention and liking. There are issues in Ethereum, like lacking in value and scalability, but despite that, it has successfully gained investors’ trust. They are very much confidant about its bounce back and are expecting to see it growing in the coming years. What to say about Bitcoin? It remains the undisputed digital coin since its debut. But it would be wrong to underestimate other coins in the list like ZCash and Litecoin. To know any latest update about crypto coins, stay abreast of the breaking crypto news.

Articles You May Read

The sight of experienced visionaries and cheaters are always glued towards new ideas. Where the former can analyze it well and aims to enhance it in a new manner, the latter has a different approach to new ideas by worthless hope and blind parroting. If you are abreast of altcoin news today, then you can very well co-relate this analogy with alternate currencies or altcoins that are carved from Bitcoin. By doing technical analysis, you will find that these alternate coins share similarities with Bitcoin including the cryptographic protocol for transaction registration and blockchain to store the transactions. Freicoin, Litecoin, PPCoin, and Primecoin are the few big examples to mention. But today, we will be focussing on the disadvantages of altcoins.

There are interesting new ideas incorporated by the altcoins, but the disadvantage of altcoins proves when Bitcoin becomes ahead of them in comprising essential features. It does not imply technology but community and history. Simply saying, the use of crypto exchange might be more acceptable to the other one on the market. This defines the network effect. The difference between any two crypto exchanges depends upon either exchange which is accepted widely.

The effect seems to be unlimited. Anyone would hope for a single currency to outshine its rivals. There are other reasons which define the disadvantages of altcoins. Bitcoin had an early advantage of the opportunity to make a mark of itself by dragging the users’ interest. In comparison to altcoins, Bitcoin has a larger market, which makes it much worthy as a currency. If an altcoin aims to pull away from the latter crypto coin, then it needs to acquire an extra superficial technology to become an alternative to fiat currency, as Bitcoin has.

It has been noticed that Bitcoin is a centre of interest among the actual entrepreneurs as per its use, whereas, altcoins are surrounded by a bunch of inexperienced people who make airy hopes of cloning Satoshi’s creation. The reason why altcoins drag behind the Bitcoin is its existence, which brings no possible reason for additional value from the financial point of view. It is very tough to imagine the duplication of Bitcoin. And with the growing Bitcoin community, it attracts more entrepreneurs because of its worth. Whereas the altcoin community has no option but to cry for being noticed.

Altcoins cannot be blindly relied upon for stability, which is why there is less expected in terms of use. Moreover, they are used for money laundering. If you are keen on this, then you can rely on ZeroCoin. If ever it comes to define altcoins, then it all depends on the belief on the purpose of cryptocurrencies for money generating, instead of merely being a financial option. You need to be smart enough to ploy people to accept a new altcoin for investment. Then it becomes an opportunity to gain profit via mining, selling, or trading it.

Conclusion

Cryptocurrency today has become a popular phenomenon as an alternate source of money digitally. If you are abreast of the best altcoin news, then you will know that besides Bitcoin, there are altcoins that too are in the race for becoming the best alternate choice for fiat currencies, like Bitcoin. However, there are disadvantages of altcoins which pushes them behind the latter coin. Now it is a trust or liking which Bitcoin has gained amongst the users. Also, it is the first cryptocurrency, which people are more associated with. To outshone Bitcoin, altcoins need to equip with special technology traits. Only then they can come at par with Bitcoin.