Bitcoin was launched by Satoshi Nakamoto (pseudonymous creator of Bitcoin) in 2009. He would have never thought that Bitcoin will be dominating the crypto space for a number of upcoming decades. On the contrary, blockchain-based Bitcoin facilitates the peer-to-peer- exchange and is gaining popularity at an exponential rate. Bitcoin is a digital currency that follows the decentralized model that excludes the need for intermediary while doing the transaction. Undoubtedly, Bitcoin is fascinating both in terms of operation and lucrative profits. But at this nascent stage, predicting the future of digital currency is a difficult task. Some of the analysts and crypto enthusiasts are still trying to find the responses for Bitcoin future value predictions and putting their point of view on the crypto table. However, the volatile nature of Bitcoin and the present economic condition has the potential to wipe off the calculations and analysis, and thereby finally behaving in a way that no one has ever imagined. Lets attempt to dig out about the bitcoin future value predictions and investigate about condition of liquidity of Bitcoin.

Analyzing Bitcoin Future Value Predictions

Bitcoin future value or price prediction refers to the performance of Bitcoin in the future on the basis of detailed research and technical analysis. Predictions can be made after considering the historical trends, using the cryptoanalysis tools, and taking the volatile nature of Bitcoin in account. How does cryptocurrency value increase? Before the liquidity of Bitcoin hit globally, the majority of predictions were in favor of the growth of the price of Bitcoin.

- Tom Lee, head of research of FundStrat and ex-Chief Equity Strategist JP Morgan predicted the highest returns after the bitcoin halving event (happens almost every four years, reward price of miner get halved). He believed that BTC has the potential to hit an all-time high of $27,000 by June, 2020.

- Fran Stranjar, CEO of cryptocurrency research firm Brave New Coin who seeks that the price of Bitcoin depends on the market forces of demand and supply. When the demand for the Bitcoin increase, the price is supposed to rise. He employed that the profits associated with BTC is attracting the community at every corner of the world and predicted that BTC price will rise due to increase adoptability.

- John McAfee, one of the renowned crypto enthusiast is famous in crypto space for highly optimistic predictions. As per his latest prediction, he expected Bitcoin to reach $1 million worth of USD by the end of 2020. Again he showed his overoptimism in relation to the future prediction of Bitcoin and advocated that Bitcoin is better than conventional currency and might replace it.

- Anthony Pompliano, one of the personality in the crypto space who is the founder and partner at Morgan Creek Digital (crypto-friendly asset management firm). He is staunch believer of the bright future of the bItcoin and other alternative coins. He predicted that Bitcoin might hit $100,000 till the end of December 2021. That could be an impossible target to achieve as Bitcoin has to rise by 1000% by the end of 2021. Anyways, this prediction might help in attracting more of the investors in crypto space.

By considering the predictions of some of the renowned personalities of crypto space and analyzing the previous trends, we might tend towards the positive future of Bitcoin. The main reasons could be the experience of financial freedom, the security of the network, the anonymity of sellers and buyers, and also the maintenance of transparency. Bitcoins won’t be excluded from the financial system in the coming years but the prediction of value might be a challenge after the global economic slowdown caused by the COVID 19. One of the major questions which need to be responded in present times might be-Will crypto recover 2020? Let us try to have a closer look over the condition predicted for Bitcoin in the near future.

Will Bitcoin Recover 2020? | Predictions Related To Recovery

As per the Washington Post reports, the global economy is in total shock and nearly every asset class like stocks, bonds, gold, oil, and even the crypto space which is not supposed to get affected by the global conditions are in deep crisis. The panic situation was noticed in the crypto markets when billions of funds were taken away by investors in just 24 hours on March 12(resulted in a plunge in BTC prices). Bitcoin was performing outstandingly before the health crisis impacted the worldwide (when it touch almost $10,000 in mid of January, 2020). It would be interesting to look at the future transformation in the prices of Bitcoin and its recovery when the bitcoin halving is about to take place around May 20, 2020.

- Tim Draper, one of the Bitcoin bulls believes that the price of Bitcoin will recover after the halving event and is expected to touch $250,000 by 2022. According to him, the breakthrough feature of decentralization will aid the Bitcoin to come out of the dearth of the crisis.

- Richard Ells, CEO of Electroneum told about the story of an impressive rebound of 80% in the prices of Bitcoin amid the global economic slowdown. He advocated that Bitcoin will certainly flourish due to the high crypto adoption after the event of Bitcoin halving.

- Dan Schatt, CEO of one of the prominent crypto lending firm Cred that liquidity crisis may affect the Bitcoin in the short term but the resilient nature of Bitcoin is there to prevail. He explained that Bitcoin will gain the favor of investors due to its non-inflationary store value unlike the inflation crisis associated with US Dolar or any fiat currency.

- Jeffery Liu, CEO of one of the known crypto processing company XanPool, tried to signify the bullish picture of prices of Bitcoin. According to his analysis, the customer base has certainly decreased but the fact cannot be denied that the fresh investments are also entering into the markets. He is also expecting the Bitcoin Halving to be the positive event by clarifying that demand might stay similar or increase, the price of Bitcoin will certainly rise.

Thus, Bitcoin has been experiencing the fluctuations in prices but still standing strong compare to the assets of traditional financial markets even when the COVID 19 had caused the global crisis. Is cryptocurrency really the future? The global base and interest of investors is increasing gradually towards the Bitcoin. So, it could certainly be advocated that the prices of Bitcoin will recover soon. Without any hesitation but with bitcoin technical analysis, you can aim for your next bitcoin investment and expect the positive Bitcoin future value predictions.

Articles You May Read

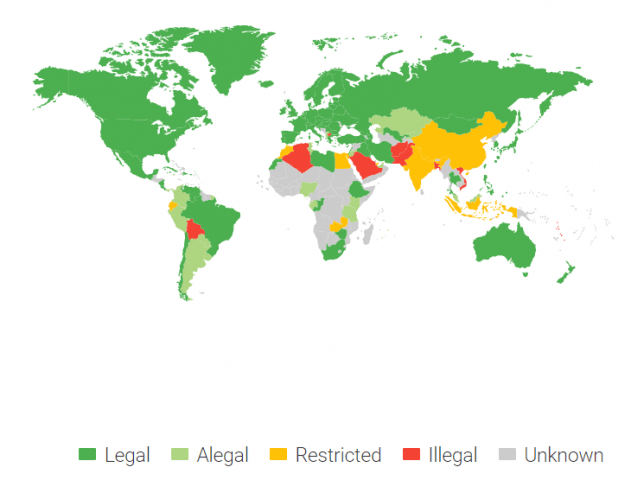

Bitcoin has become the new buzzword among the digital financial markets. One of the striking features which makes it unique than the conventional currency is that it is decentralized. Bitcoin does not need to be passed via an intermediary or backed or managed by any central institutions like banks. Cryptocurrency or Bitcoin is being managed and recorded on a blockchain network which makes the transaction transparent and secured, thereby Bitcoin is better than conventional currency. As the Bitcoin started getting popular, regulatory authorities of countries all across the world seemed to be confused in handling the currency. Some countries legalized it while others made the Bitcoin illegal. While some other restricted and regulated the crypto markets in their country. In this article, let us explore the response to- Should Bitcoin be legalized?

Should Bitcoin Be Legalized? | Should Bitcoin Be Illegalised?

After reading about the lucrative profits associated with investment in Bitcoins, are you thinking of buying some of them? Or at the time of crisis, you want to sell or spend them? I would recommend checking the status of the cryptocurrency in your country.

If Bitcoin Is Legalised!

Amid the chaotic financial environment, where most of the fiat currencies are evaluated on the basis of the behavior of the US dollar, rates of crude oil, and the social and political conditions of the country, some of the countries took the decision to legalize the controversial Bitcoin. More than 100 countries (till 2020) including Japan, Singapore, Switzerland, Malta, and many more had recognized the status of Bitcoin and legalized it. As reported by many of the nations, legalizing the Bitcoin is helping them to revolutionize the financial system in the following ways:

- Lower down the need for infrastructure as Bitcoin follows a decentralized model based on clear understanding blockchain technology where the coins are mined or the transaction is verified by the participants or miners on their systems connected to the network, and the transaction gets completed. There is no need to set up the huge physical infrastructure or maintain the manpower, and the money saved can be utilized to improve the health and education sector.

- The risk of leakage of personal information associated with buyers and sellers is minimized as the blockchain network assures anonymity by transferring the payment from seller to receiver wallet. Thereby, database management is no more a tedious job and the risk of misuse of data can be reduced.

- Counterfeiting of the currency is one of the major issue which is being faced by the nations as this problem leads to financing terrorism, illicit activities, and many more. Bitcoin can prove as the solution as it is immutable. Each transaction is recorded on blockchain so any alteration will inform all the nodes or systems involved with that particular block.

- Smooth cross border transaction with less transaction time and lower transaction fees is possible with Bitcoins. By strengthening the digital infrastructure, cryptocurrency can easily be sent and received in every corner of the country or world.

- Bitcoin transaction deploys cryptographic techniques to successfully encrypt the information related to the transaction amount, wallet addresses, and other data which need to be filled during the transaction. Cryptography ensures the security of the network and safeguard the money from stealing or data leakage.

According to the nations who have legalized the digital currency are exploring more of the benefits to enhance the experience of their citizens while confirming the payment. But, should other countries legalize Bitcoin?

If Bitcoin Is illegalized!

Bitcoins are still seen as the doubtful currency in many of the nations. Even in some of the nations, you might be imprisoned if you withhold the coins or are involved in the transaction of cryptocurrency. While in some others, the government authorities are still struggling to define the legal terms of Bitcoin in their jurisdiction and ended up in making it illegal. Saudi Arabia, Algeria, Vietnam, Qatar, and many more countries banned the Bitcoins due to one or the other reasons as stated below:

- The decentralized nature of cryptocurrency makes the government skeptical and makes them feel like losing control over the financial system. Besides the concern of the protection of citizens, authorities are also concerned about the notorious crypto exchanges involved in promoting a decentralized payment structure.

- Semi anonymous behavior of the transaction associated with Bitcoins is a big question mark to the government. Anonymity can result in money laundering, tax evasion, and creating the haven for black markets as per the nations who banned the digital currency.

- Tax evasion is also one of the main bones of contention for the authorities. As the transaction can be traced but not the amount which is being transacted, this can result in evading the taxes and also make it difficult for the legal and financial system to form the laws in the first place.

- Money can be laundered easily with the help of cryptocurrency or Bitcoin. A person needs two crypto accounts to launder the money, and the transfer looks perfectly legitimate. The lack of central authority, proper regulations, and anonymity can help in easy evasion.

According to me, making the currency completely illegal deprives the countries from utilizing the potential benefits of the cryptocurrency. Some of the features can make the system operational in a hassle-free manner.

Summing Up

Should Bitcoin be legalized? Or Should Bitcoin be illegalized? Some of the countries have found the middle path of creating a regulatory environment. They are seeking to utilize the potential benefits of the cryptocurrency while providing the structure to safeguard investors. Nations like the United States of America, countries of the European Union, Egypt, Indonesia, and many more have restricted the environment but did not outrightly treat the trade in Bitcoin as illegal. Countries are constantly strengthening their digital payment infrastructure and providing a favorable environment for Bitcoin transactions while at the same time assures the rules related to anti-money laundering, tax evasion, financing terrorism can be properly followed. Predicting the future of Bitcoin is might be difficult at this moment of economic slowdown, the future of cryptocurrency regulation is difficult to comment on but it is certain to stay and revolutionize the digital payment infrastructure.

Articles You May Read

Blockchain technology is gaining popularity not only in the financial sector with its breakthrough cryptocurrency but is diversifying omnidirectional. The key features of blockchain-like decentralization which excludes the need of intermediary while facilitating the peer-to-peer transaction of payment, immutability which prohibits the data alteration and the transparency of network due to the record of the transaction being maintained on a distributed ledger, captivating the interest of various sectors to overcome the challenges faced by the community. One of the budding industries of gaming trying to revolutionize the experience of the players by deploying blockchain technology in their network. Particularly, Esports or electronic sports or umbrella term for video games competition is utilizing the blockchain networks to overcome the hurdles being faced to reach enthusiasts all across the world. Let us try to understand the implications of blockchain for Esports gaming.

Esports: Quick Overview | Blockchain For Esports Gaming

One of the constant growing sectors among the video games lovers is that of esports gaming. In simpler terms, it is an online competition of video games (played by anyone with upgraded systems!). Gamers can compete for one-on-one or in teams, winners are rewarded heavily and their prospects in the esports industry pace up. Some of the trendy games are Defence of Ancients 2 (Dota 2), Counter-Strike: Global Offensive, League of Legends, Heroes of the Storm, and Call of Duty: Infinite Warfare.

Esports is one of the digital markets which is growing at the fastest pace in the gaming industry wiping off the millions in terms of revenue. Analysts predicted that the global esports market might cross $1.70 billion by the end of 2020 (Obviously they did not know about a pandemic at that time!). So, when billions of dollars are at stake, technologies must intervene to boost up the growth which could be hampered by a few of the problems associated with esports.

Challenges Arresting The Growth Of Esports

When any industry starts advancing, it always faces some or the other challenges, which become necessary for the industry to conquer. Presently, the esports industry is also confronting a few of the obstacles as following:

- The absence of transparency in the network results in delaying funds received (from sponsors to winners), rewards payment controversies, and exploitation of players (unprotected rights!). Developers also suffer due to the lack of transparent networks.

- Esports is still not completely legalize industry, thereby issues related to the mode of payments remain prevalent in present conditions

- Match-fixing is popping as one of the latest issues as the organizers are continuously involved in bribing the players (to win the betting money), as they can easily trace them. Hence, the problem of anonymity is being faced by the esports industry.

- Players either face difficulty or have to charge heavy commission fees while withdrawing their funds after winning a game.

- Lack of a secured network hampers the growth of industry whether in terms of the upgrading of games, entry of new players, and majorly crowd funders.

The industry of Esports may have slowed down by problems like lack of transparency, anonymity, security, data management, and many more. But, as the industry is itself based on hi-technology, it started utilizing the potential of blockchain technology to maintain its exponential traction. Blockchain for esports gaming had already initiated to provide the new dimension to the esports or online video games. Let us try to explore the magic of blockchain technology which is reshaping the gaming industry.

Implementation Of Blockchain In Esports Gaming

When blockchain technology was first introduced via cryptocurrency, nobody imagined it can be employed in the gaming industry. But, currently, the technology assures the level playing field not only for the players but for developers, sponsors, media houses, streamers, etc. The implementation of blockchain in Esports gaming can be summarised as:

- Decentralized ledger in combination with smart contracts aids players to receive their rewards on time with the preferred mode of payment. It also facilitates timely payment for media rights, sponsorship, and fees of developers. Thereby providing a decentralized network to the stakeholders of the industry.

- Blockchain technology helps in lowering down maintenance costs and operating secured databases. As blockchain is based on the model of peer-to-peer exchange, the build-in redundancy bolsters the esports network

- The gaming industry is generally involved in illegal gambling, match-fixing, fraudulent practices, and many more. Esports is also facing similar hurdles that can be overcome by deploying blockchain-based cryptocurrency. Payments in crypto assets are immutable, transparent, and also there is no need for central authorities to manage and back them.

- Anonymity can be maintained with the stimulation of blockchain for esports gaming. This feature of blockchain can reduce the challenges of match-fixing, pressure of sponsors on players, and ultimately decrease the cost to run or organize tournaments.

- One of the situations related to “chargebacks” puts the players in a position of disadvantage. In the esports industry, many times viewers donate to their favorite players but sometimes scammers ask for “chargeback” or request the player to return the money back. The problem of chargeback can be avoided by utilizing the transparent ledger system which will make it easier to justify the chargebacks.

- DApps or Decentralised Applications with blockchain platforms of Etherum, NEO, Eos, and Lisk have the potential to completely revolutionize the experience of esports gaming. Developers can easily implement the changes, develop the most trendy features in the games associated, assure consumers and other players of the industry about the user-friendly gaming industry.

Thus, the use of blockchain in gaming cannot be ignored to become the multi-billionaire sector of the gaming and entertainment industry.

Some of the blockchain projects:

- Enjin: provides integrated blockchain software products to gamers, developers, enthusiasts, and many more.

- FirstBlood: Allow user to test skills and bets with no transaction fees or any regulation charges in secured network

- Izetex Network: Provides a platform for developers to develop new games

- Unikoin Gold: decentralize secured platform for sports betting

- DreamTeam: Combination of smart contracts and blockchain platform providing a secured network for payment.

- Tron: Platform which provides foundational layer for game developers

Summing Up

Gaming is constantly growing at an exponential rate and now when blockchain technology is providing the extra power to the industry (players, coaches, regulatory, and many more), it is expected to rise up in upcoming years. The blockchain for esports gaming is successfully bringing the new platforms, better experiences, hassle-free approaches, and returning the sportsman spirit among players (degraded by fraud practices!). Though it is too early to decide the future of any industry but the esports sector of the gaming industry would certainly flourish in the coming decades.

Articles You May Read

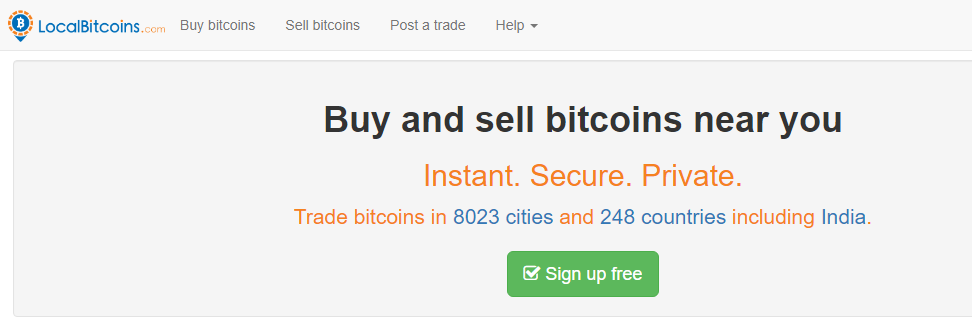

Presently, cryptocurrency or Bitcoin is known to be associated with high profits, enrapturing the interest and funds of the investors all across the world. Blockchain technology-based Bitcoins need no intermediary while completing the transaction as it follows the decentralized model where investors actually own and control their currency. Various crypto exchanges, crypto brokers, decentralized platforms and also P2P marketplace helps you in buying and selling Bitcoins. Every crypto exchange lacks some or the other features associated with transaction fees, speed of transaction, acceptance of fiat, and many more which somehow deaccelerates the movement of the digital financial revolution. To rescue the majority of problems, the peer-to-peer marketplace came into the picture. In this guide to LocalBitcoins, I will let you explore the platform of LocalBitcoins which is a P2P marketplace to buy and sell Bitcoins (only!)

What Is LocalBitcoins? | Guide To LocalBitcoins

You might have landed on this guide after thinking- What is LocalBitcoins? It is a website (not the normal one) founded way back in 2012 that aims to connect the sellers and buyers of Bitcoins through an open, peer-to-peer marketplace. It is like an online shopping portal where Bitcoins are supposed to exchange amongst the members of a network without any crypto exchange or brokerage platform. It just provides a secured “platform” but does not hold any token of itself.

Why Choose LocalBitcoins Over Crypto Exchanges?

The unique platform of LocalBitcoins allows users of the site to create and display their advertisement related to buying and selling, allowing them to communicate with an interested party (includes negotiating of rates too!) and confirm details securely prior to the completion of a transaction. It has the following benefits:

- Lower transaction fees with faster transaction

- Maintains complete anonymity yet secured

- Number of payment options (more than 60+) can be deployed depending on buyer and seller

- Available for the customers of more than 150 countries

- Service of escrow account assures the protection of both buyers and sellers

- “Reputation system” aids customers to review old buyers or sellers.

How To Buy On LocalBitcoins?

After reading the guide to LocalBitcoins till now, you might be wondering- How to buy LocalBitcoins? It is just a five-step process but you need to be cautious and alert at every step (After all you money is involved!)

Step 1. Sign Up On Website

Just like you have to create an account to use the services of the particular website, with LocalBitcoins also, the first step is to register your account with the P2P platform.

Step 2. Search for the Best Sellers

If you have made up your mind regarding the funds you want to spend, you have to go on the main page of the website and start filling the form to buy the Bitcoins. You need to fill the columns like the amount of Bitcoin you wish to buy, your location, and finally select the most comfortable payment method for yourself. You can also opt for “All online offers” if you are uncertain about choosing the mode of payment. Hurrah! The page will list you the available traders in your region.

Step 3. Pick Up an advertisement

Now you just have to thoroughly look at the advertisements associated with selling Bitcoin and check the reputation score of the sellers. If you are sure with the seller, you just need to click “ Buy” to read the complete advertisement along with terms and conditions mentioned by the trader. ( Don’t worry you have the option to go back if you are not satisfied with conditions)

Step 4. Paytime!

You just need to calm your breath as you’re going to have Bitcoins in exchange for your funds. Fill the required details in a box saying “How much you want to buy” and enter a message for the seller. After you are done with the message, Click “Send Trade Request” and get ready to pay for your transactions.

Step 5. Don’t Forget to mark payment complete!

Once the payment has been done from your side, you need to click on “I have paid” and wait for the seller to verify the receiving of payment. Tick..Tick..! You may check your wallet of LocalBitcoins (received when you registered on the website) after a few minutes, maybe you have received your Bitcoin from the escrow account of the platform.

Congratulations!! You have your Bitcoins now.!

Tips To Invest Or Buy Bitcoins Safely!

The platform of LocalBitcoins might be relatively new for you, so now when you know how to invest in LocalBitcoins, you must follow some of the tips before investing.

- Carefully compare the reputation score of the seller

- Before initiating the payment, do not forget to check if the account details of the seller are compatible with the verified name of LocalBitcoins

- Always try to take the screenshot of the receipt of payment as an evidence

- Fill your details fastly before the trading window gets expired (otherwise you have to start the process all over again!)

- Don’t just select a buyer in one go, carefully skim through the advertisement, and the details given.

- After you received your Bitcoins, do not forget to transfer the private keys to your own crypto wallet which can be either hot or cold crypto wallet.

Summing Up

In this guide To LocalBitcoins, we made sure that you are well aware of everything you need to know about LocalBitcoins associated with buying Bitcoins. Besides regular crypto exchanges, LocalBitcoins is one of the most intuitive and user-friendly platforms to purchase Bitcoins. The platform of LocalBitcoins is available for the customers of almost every corner of the world, allows for private purchases with a number of modes of payments, and also does not put any limit on buying and selling of Bitcoins. Though, the team of LocalBitcoins always aims to revolutionize the experience of the financial system digitally, they continuously update the platform for sellers and buyers. Nonetheless, some untrustworthy buyers and sellers exist on the platform which to be taken care of while trading or investing on the platform, though the service of an escrow account is provided to safeguard your funds on the platform.

Articles You May Read

As the era of blockchain is continuously diversifying in the multi-dimensions, the majority of the blockchain community is expecting the technology to lead to the digital financial revolution in the future. Entrepreneurs and startups are getting ready to launch their projects based on the latest distributed technology. Some companies are already self-sufficient but some need to raise funds from the crypto marketplace to complete and launch their projects. Various crowd fundraising tools are available in the crypto marketplace. Initial Coin Offering (ICO) is one of the most popular easy to implement tool to raise the funds for new ventures. But, before launching an ICO to crypto space, you need to develop Public Relations or have to launch a PR Campaign so that mass audiences can become aware and interested in your project. In this article, you will get to know about the ICO’s PR Campaign from scratch.

What Is An ICO? | ICO’s PR Campaign

An Initial Coin Offering(ICO) is a tool required to raise funds from investors majorly by the companies or startups associated with blockchain businesses. Companies issue tokens of their newly launched projects at highly minimal price to exchange them with crypto coins (especially Bitcoins and Ethereum). Once the sufficient quantity of tokens released is purchased, the newly launched token gets listed on the exchanges (if not associated with the Ponzi scheme) and can be utilized as other crypto coins. The launch of ICO can prove to be a success for the project, but only if it is promoted in a strategized way. Let us further understand the PR or launch campaign, a mandatory requirement before the launch of ICO.

What Is ICO’s PR Campaign?

One of renowned crypto enthusiast said “A well-promoted ICO could potentially attract millions in investment, but if it is poorly promoted it might not earn enough to create the coin”

To reach the targeted audience and also captivating their interest to invest in your venture is certainly a task that needs to strategize. Properly curated and implemented PR campaign allows you to demonstrate your idea behind the project to the wider audience and indirectly convincing them to trust on the new venture and invest in it. When the blockchain was relatively new and ICO was just introduced for startups, it was nearly an instant success like that of Mastercoin in 2013 or Ethereum blockchain. But, presently a few challenges need to overcome before launching ICO which can be successfully done by a PR campaign.

Need Of ICO’s PR Campaign

In the era of social media marketing, you might think that why do you even need a traditional PR campaign in the first place? For quite a few reasons, there is a need for a launch campaign:

- Publication on any third-party platform (which is already specialized in PR activities) might increase the credibility of your project while reaching a wider audience.

- Multiple publication platforms even if paid facilitates you in reaching the different audiences and their suggestions might help you in improving your project.

- If you add the multiple publication links on your own website, the audience will be boosted after learning about your connectivity and may invest more.

Tips For Successful Campaign

Innovative and fresh campaigns grabs the attention of more of investors. Great promotions are equal to successful ICO’s PR campaign. You just need to read and research the earlier successful campaigns and implement the following tips to reinforce the position of your ICO:

- Sufficient budget must be allocated to PR activities as a failed campaign may even not raise a penny for your ICO.

- Market research must be carefully done and a reputed PR agency must be chosen who particularly focuses on the startups associated with blockchain.

- Targeted audiences must carefully understand which can help you in better ways to pitch your idea and impacting them becomes an easy task.

- Your business pitching, content curated for publishing platforms, announcements on various mediums, in short, while spreading your word, you must use as interesting ways as much you can like exemplify stories, explaining case studies and even intended pun can also prove to be a good idea.

- Publish your content on as many platforms(business media, corporate blogs, corporate social media, Reddit, and any more) as you can to reach wider audiences.

- Hard pitches to Press, Guest posting and sponsored placements must not be ignored.

How To Launch An ICO or Initial Coin Offering? | ICO’s PR Campaign

If you are ready with your project and want to launch ICO for the purpose of raising sufficient funds to kickstart your project, and wondering- how to launch an ICO? You need to follow four stages:

First Stage: Preparation

In the preparation stage, you must double-check your idea if it is fresh, innovative, and has practical applications in the real world. When you are confident with your project or venture, draft a whitepaper and design a website mentioning the project details, visions and missions, future of the project, details of the team, about authenticity and the information you consider must be known to your audiences or can help you in maintaining credibility.

Second Stage: Pre ICO Launch

Announce about your ICO launch date by listing it on some of the popular platforms(mentioned below) mentioning the link of a whitepaper published, your website, and also the relevant links of social media platforms. For the announcement, you can run the ICO’s PR Campaign, use social media marketing, email listings, and the mentioning on the popular platforms to reach targeted audiences.

In Pre ICO stage, you need to demonstrate the potential and feasibility of your project by displaying the prototype or Proof-of-concept supporting at least bare minimum features. Also, the roadmap must be made public for the release of alpha, beta and final product release future plans.

And one of the most crucial things you need to do is to create your tokens either on your own by using platforms like Ethereum or NEO blockchain or by hiring a developing team. You must be clear about the number of coins that need to be issued and the amount needs to be raised. And after that don’t forget to reach the mass community to attract millions.

Third Stage: ICO Launch

In the third stage, you need to create options on your website from where customers can sign up and purchase tokens in exchange for crypto coins. Also, a customer support team and marketing team must be cleared with their tasks to offer support to the queries for new users and reach the maximum people you needed respectively. In this stage, you must try to boost your sales as much as you can.

Fourth Stage: Post ICO Launch

In this stage, you must not act lazy and strictly follow the roadmaps given to the audience and work towards releasing your secured and robust final blockchain-based product.

Marketing f the products need not be stopped but the ways need to find out to list your tokens on the reputed exchanges from where potential investors can easily buy them.

ICO Launch Platforms

If you are wondering, where to launch your ICO for maximum outreach and raising the maximum of funds for your project. You need not to worry as presently several ICO launch platforms are available in the markets. Some of the widely adopted ones are:

- ICO Bench

- ICO Drops

- ICO Hunter

- Coin Launch

- Coral Protocol

- Token Market

- Coin Schedule

- ICO Creed

Summing Up

ICO’s PR launch campaign has the importance in every stage of ICO Launch and if not properly done, then you made up in not even launching your tokens. Media, publishers, conferences, guest blogs, and every other source which can help you in building up your PR campaign to reach the targeted audience, must be followed.

Articles You May Read

Blockchain technology and cryptocurrency space is ramping up exponentially after Bitcoin touched the unprecedented price of $10,000 in 2017. Though Bitcoin was launched in 2009, the crypto community started expanding a few years back. As the demand for currency increases, shortcomings of blockchain technology started coming into the picture. Now when people are looking at the digital currency as one the best assets for investment, loopholes in the decentralized model of blockchain are also being noticed. Some of the players in crypto space who are captivated by the utilization of Bitcoin are exploring the various protocols to overcome the shortcomings of Blockchain technology. In this article, you will learn about MimbleWimble and Blockchain networks. Also, you will learn -How does MimbleWimble affecting blockchain networks?

What Is MimbleWimble?

MimbleWimble (Potter heads have heard this term in one of the books of JK Rowling’s Harry Potter series) is a protocol, similar to blockchain technology but with improved features. Bitcoin sounds more magical with MimbleWimble to me (Totally! Personal opinion!) as it aims to improve the currency which is successfully captivating the eyes of the community. The architecture of MimbleWimble is relatively new but it holds the strength to remove the problems associated with blockchain technology. Let us try to explore under the hood of MimbleWimble which promises to surmount the challenges of privacy, freedom to choose, fungibility, and also scalability, faced by blockchain technology.

MimbleWimble And Blockchain Networks

Effect of MimbleWimble on blockchain networks is gradually coming into notice due to the variety of features of the new protocol that are deployed to combat the challenges of blockchain. Let us explore the loopholes and how MimbleWimble will be acting as a rescuer to blockchain:

Privacy

With the latest features of elliptic curve cryptography (enable private- public-key encryption), CoinJoins (enables anonymity), and Dandelion (contains an improved mechanism for privacy), MimbleWimble signifies its capability to maintain the privacy while transacting in cryptocurrency. Bitcoin bragged to follow the model of anonymity but as transaction history is easily traceable for particular public addresses, it defeats the model. On the contrary. MimbleWimble assures complete privacy as transaction amounts, and information of senders and receivers, cannot be traced easily as the inputs and outputs are mixed together and kept in a single block (feature of blending). As all values involved in transactions are fully obscured, no reusable or identifiable addresses are involved and every transaction seems to be the same to an outside party, assuring that MimbleWimble can fill up the loophole of Blockchain technology-based transactions.MimbleWimble affecting blockchain networks in a different way as it maintains the right of privacy and gives the ability to owners to choose the level, time, and records open for accessibility.

With the latest features of elliptic curve cryptography (enable private- public-key encryption), CoinJoins (enables anonymity), and Dandelion (contains an improved mechanism for privacy), MimbleWimble signifies its capability to maintain the privacy while transacting in cryptocurrency. Bitcoin bragged to follow the model of anonymity but as transaction history is easily traceable for particular public addresses, it defeats the model. On the contrary. MimbleWimble assures complete privacy as transaction amounts, and information of senders and receivers, cannot be traced easily as the inputs and outputs are mixed together and kept in a single block (feature of blending). As all values involved in transactions are fully obscured, no reusable or identifiable addresses are involved and every transaction seems to be the same to an outside party, assuring that MimbleWimble can fill up the loophole of Blockchain technology-based transactions.MimbleWimble affecting blockchain networks in a different way as it maintains the right of privacy and gives the ability to owners to choose the level, time, and records open for accessibility.

Scalability

As the demand for Bitcoins kicked off then the issue of scalability became the bone of contentions for investors and also to developers. To decrease the transaction with low transaction fees, i.e scalability challenge compelled the team of Bitcoin to split and launch the hard fork, Bitcoin Cash in 2017. The whitepaper of MimbleWimble protocol ensures the lesser transaction time with its cut-through feature. The feature of cut through assures that the transaction occupies minimal space in a block as it maintains the theory that if an output spends an input, transaction information does not need to be maintained on the blockchain. Thereby, the volume of transactions kept decreasing and the sufficient space in blocks was maintained for new transactions.

As the demand for Bitcoins kicked off then the issue of scalability became the bone of contentions for investors and also to developers. To decrease the transaction with low transaction fees, i.e scalability challenge compelled the team of Bitcoin to split and launch the hard fork, Bitcoin Cash in 2017. The whitepaper of MimbleWimble protocol ensures the lesser transaction time with its cut-through feature. The feature of cut through assures that the transaction occupies minimal space in a block as it maintains the theory that if an output spends an input, transaction information does not need to be maintained on the blockchain. Thereby, the volume of transactions kept decreasing and the sufficient space in blocks was maintained for new transactions.

Fungibility

Some of you might not be aware of the term fungible! It refers to the one unit of a good or any currency to be interchanged for another. For instance, the Japanese Yen is fungible as one Yen can be easily exchanged for another (without any loss of value!). Thus, equal units must be interchangeable. On the contrary, blockchain-based Bitcoin is not fungible as blockchain maintains every single input and output for lifetime, thereby preserving the legacy of each Bitcoin. Also, they are being labeled as “tainted” if used for illicit activity and cannot be utilized by any of the further merchants. But, MimbleWimble and blockchain networks differ on the issue of fungibility. In MimbleWimble, inputs and outputs are discarded when both equate to each other, making traceability of blockchain impossible. Thus, coins based on MimbleWimble can be interchanged and are fungible.

Some of you might not be aware of the term fungible! It refers to the one unit of a good or any currency to be interchanged for another. For instance, the Japanese Yen is fungible as one Yen can be easily exchanged for another (without any loss of value!). Thus, equal units must be interchangeable. On the contrary, blockchain-based Bitcoin is not fungible as blockchain maintains every single input and output for lifetime, thereby preserving the legacy of each Bitcoin. Also, they are being labeled as “tainted” if used for illicit activity and cannot be utilized by any of the further merchants. But, MimbleWimble and blockchain networks differ on the issue of fungibility. In MimbleWimble, inputs and outputs are discarded when both equate to each other, making traceability of blockchain impossible. Thus, coins based on MimbleWimble can be interchanged and are fungible.

Thus, the impact of MimbleWimble on blockchain networks can be summarised in three key points:

- Privacy is elevated by blending transactions, vanishing information from an intermediary, and excluding the public or wallet addresses from the blockchain.

- Scalability is improved by increasing the space in blocks and dumping the similar transactions.

- Fungibility is enhanced as the accessibility of historical data is not needed to verify transactions on the blockchain.

MimbleWimble protocol attempted to maintain the purpose of Bitcoin i.e. decentralized transactions while maintaining privacy, transparency, and scalability.

What Does The Future Hold For MimbleWimble?

MimbleWimble and Blockchain networks may shake hands in the future while MimbleWimble could also be deployed as a kind of sidechain or one of the extension blocks in the blockchain network to fill the loopholes. The significant issues of privacy, scalability, and fungibility are expected to be minimized by MimbleWimble protocol. Also, the size of blockchain and cost of transaction might also be reduced, giving the sigh of relief to both miners and investors. Two of the ongoing projects of Grin and Beam cryptocurrency are utilizing the MimbleWimble technology and if they would be successful in maintaining the features of the new protocol, then it may be adopted widely in the crypto space.

Cryptocurrency or digital currency is here to stay in the future but if the pace of research and innovation slows down, then the investors might return to traditional markets, developers may divert their attention to new projects and the development of digital financial space may move at a snail’s pace. So, the crypto developers must be open to new architectures and frameworks of protocols to improvise the experience of customers and attract fresh investments; ultimately diversifying the crypto sphere without defeating the purpose of decentralization, transparency, security, and anonymity.

Articles you May Read

Blockchain and crypto community is gradually expanding all across the globe. The majority of people are looking at cryptocurrencies as the source of investment which can profit them in a short span of time. While others are considering the currency as an alternative to fiat due to its digitized decentralized model. Cryptocurrency or Bitcoin was launched in 2009 with the purpose of minimizing the need for approval or authorization from an intermediary or central authority while sending money or completing the transaction. It is meant to function outside the regulated banking or monetary system of any country. Bitcoin is successfully performing its role by following the decentralized model while maintaining a high level of security, privacy, and transparency in the digital financial system.

With ramp-up popularity, blockchain technology-based cryptocurrency is captivating the attention of legislative and regulatory authorities. On one hand, true players in the crypto industry are attracting investments in crypto space, while on other shady transactions, headlines related to cybercrimes and lost coins, fake projects, crypto scammers, and many more are degrading the reputation of digitized currency. Presently, one of the most heated debates in the crypto sphere is the related future of cryptocurrency regulation– Should Cryptocurrency be regulated?

A Glance On Cryptocurrency Regulations | Should Cryptocurrency Be Regulated?

Cryptocurrency had left no country untouched from its effects since 2017 when the price of Bitcoin skyrocketed around $10,000 on some of the crypto exchanges (Obviously the community is gaining huge profits!). Also, effects seemed to trigger the regulatory authorities of the nations all across the world to formulate rules and regulations to administer the decentralized digital financial system. Acceptance of crypto coins by masses compelled the authorities to think- Is cryptocurrency really the future?

Recently, the bill labeled as “Cryptocurrency Act 2020” was put forward by the group of United States Congressman to govern the crypto world. Last year in November, the Financial Stability Oversight Council of the US necessitated tighter supervisory regulations on stablecoins and digital assets and also urged to scrutinize existing laws to review products and services in blockchain space. The Security and Exchange Commission of the country is already engaged in scrutinizing and punishing nefarious ICOs and exchanges.

In the first week of 2020, Fifth Anti Money Laundering Directive (5AMLD) was launched by the European Union to regulate some of the activities related to crypto-assets like mandatory KYC rules for cryptocurrency platforms and crypto wallet providers for the purpose of anti-money laundering. Many of the major nations like Germany, Italy, Netherlands, and many more will implement the regulations soon.

Central Bank of Russia earlier denied the integration of cryptocurrencies with the public monetary system, but after considering the stance of various banks and politicians including President Vladimir Putin, it is convinced of formulating crypto regulations instead banning.

Many of the countries like Egypt, Bolivia, China, Nepal, and many more ha actually banned the cryptocurrencies and consider them illegal. China, which was known to be the hub of cryptocurrency, banned exchanges and ICOs, snipped the power lines for BTC miners, and even cut the internet access of the platforms engaged in activities associated with cryptocurrency.

Few countries like Switzerland have adopted cryptocurrency with a welcoming hand. One of the Swiss towns of Zugg had already earned the reputation of Crypto Valley” which is a hub of more than 200 companies associated with blockchain technology and providing the services and products in crypto space.

Recently, while considering the future of cryptocurrency 2020, the Supreme Court of India declared the “blanket ban on cryptocurrency” imposed by the Reserve Bank of India (two years ago) as constitutional. Also, the Indian Parliament is expected to put a bill in the House related to the regulatory environment of crypto space in India.

Reactions of countries are like a mixed bag, where some are fully opened to accept while others are completely against the cryptocurrency and there is a majority of countries that are considering the benefits of crypto coins and engaged in designing the regulatory space to safeguard the investors while exposing to new kind of currency.

Does the Crypto World Need To Be Regulated? | Should Cryptocurrency Be Regulated?

Do you think- will cryptocurrency ever be regulated? In the current scenario, consumers and lawmakers are certainly vague over the regulatory space of the crypto world. There is an ongoing debate over which agencies are actually responsible to regulate different types of cryptocurrencies. But noticing the pace of expansion of the crypto world, where last year social media giant Facebook launched the Libra project (associated with new crypto coin backed by different fiat currencies), more than 400 new projects and service providers have launched their projects, price of Bitcoin is continuously experiencing the increased prices (cryptocurrency future value might be really high!), one of the lessons can be learned that this game needs rules.

Some of the international forums like G20 already signaled to handle the murky crypto crystal ball when the central banks of countries met in Buenos Aires in March 2020 and committed to set the regulations to monitor the transactions involving crypto assets.

How Should Cryptocurrency Be Regulated?

To benefit the crypto space and also to protect the investors and increases the confidence of a new businessman and finally to satisfy various regulators, some ground rules must be considered before introducing or restricting the crypto assets:

- Clear and crisp definition must be formulated after having consensus between regulators and renowned companies of crypto space.

- No hidden and abrupt rules are imposed on the exchanges, but the clarity of guidelines need to be maintained since the initial stage of introduction of rules

- Regulations must focus on providing a conducive and secure environment to crypto investors, rather restricting them not to get involved with crypto assets.

- Anti Money Laundering rules, guidelines related to Know your customers, verification, and authentication process, taxation rules must be clearly formulated.

- Businessmen, investors, exchanges, startups, and people associated with crypto space could be incentivized initially to follow the regulatory space.

How A Regulatory Environment Can Benefit Crypto Space?

If the regulatory crypto space successfully reduces the number of fake ICOs, develops the assurance protocols to protect investors against scams, and provides high-quality custody solutions to safeguard crypto assets, then the crypto sphere can be benefited at high scale.

- A smart and transparent regulatory environment can attract the hesitant crypto enthusiasts with fresh investments and better services.

- Regulators of different countries may start deploying the crypto with limited supply, once the anxiety related to money laundering and financial terrorism will be reduced.

- Governance in crypto space can help in developing the crypto partnerships beyond their initial stages, allowing a number of startups and developers to identify cryptocurrency as an opportunity.

- Digital coins which are still considered as doubtful currency can earn a respectable name in financial space.

What Does Cryptocurrency Regulation Future Hold?

Undoubtedly, recent meetings of the central banks, discussions among the CEOs of crypto giants, and debates around the expansion of cryptocurrency, reveals an appetite for a balanced regulatory environment. Mainstream investors must be assured of the security of their investment in crypto space but technology must not be overregulated that it loses its purpose to revolutionize the financial space. Easy of regulations must be assured for crypto exchanges but not at the cost of scamming the investors. Innovations must be welcomed but with some regulatory obligations. So, should cryptocurrency be regulated? The future of cryptocurrency regulation is undeniable but we can hope for the balance regulatory crypto space.

Articles You May Read

Bitcoin has turned into a global phenomenon. Since the prices of Bitcoin skyrocketed in 2017, the bitcoin community started to grow exponentially. Blockchain-based Bitcoin following a decentralized model and cryptographic techniques captivated the attention of investors from all across the world. As the demand for Bitcoin increases, it started facing the problem of scalability, i.e. the limited rate at which the network of Bitcoin processes transactions. To complete any transaction, blocks needed to be updated by miners after verifying the transaction (by solving complex mathematical algorithms). So as the transaction increased in number, the limited size of the block (1MB) started to become full at a higher pace, resulting in higher transaction fees charged by miners and degrading reliability. Thus, the whole purpose of ease of transaction started to fail and lead to the rift amongst the Bitcoin community who tried to find the best ways to resolve the issue of scaling. The hero of our story, Bitcoin Cash also came into the picture. But what is Bitcoin Cash? In this interesting guide, let us explore Bitcoin Cash from scratch to hatch.

What Is Bitcoin Cash? | Hard Fork Of Bitcoin

As the argument to solve the issue of scalability heated more, one of the teams wanted to increase the size of the block to facilitate more transactions per block (reduce transaction time! Developers wished for on-chain up-gradation to maintain the reliability and lower fees of transaction but after the whole of the drama, they separated from the Bitcoin network and created a new blockchain with some customized rules. In August 2017, Bitcoin Cash hard fork, was initiated with a new chain having the block size of 8MB. The hard fork started executing successfully with lower transaction fees, fast transaction time and thus the original principle of Bitcoin continued to maintain. The new cryptocurrency was accepted by investors in no time and helped Bitcoin Cash to maintain its position after Bitcoin and Ethereum in terms of market capitalization.

How To Buy Bitcoin Cash?

Bitcoin Cash might sound to you as one of the opportunities to diversify your crypto portfolio or rebalance your basket of crypto coins. So, let me help you in grabbing the handful of Bitcoin Cash coins by listing some of the platforms.

Cryptocurrency Exchanges: The majority of the crypto community must be aware of the fact that to buy or sell any crypto coin, you have to create your account on the crypto exchange which allows you to buy the specific cryptocurrency. Bitcoin Cash is relatively new in the market but the demand for the coin is continually increasing, so almost the majority of crypto exchanges have listed BCH on their platform. To name a few, Coinbase, Kraken, Bitfinex, Bittrex, Cex.io, Poloniex, and many more exchanges are either facilitating fiat to crypto or crypto-to-crypto purchase on their platform.

Some deregulated exchanges and crypto brokerage companies like Changelly, Shapeshift can also help you to buy BCH and add it to your crypto wallet. Also, peer-to-peer exchange, LocalBitcoinCash can facilitate you in purchasing BCH both via escrow service or via meetup in person.

If you wish to buy bitcoin cash with a credit card, you can create your account on one of the exchanges like Coinbase, Cex.io, Bitfinex, and many more, which supports credit card payments and have BCH as their listed currency. Also, you can use your credit card on the platforms of OTC brokers like Coingate, which can aid you to buy altcoins with credit card.

Mining: If you have the knowledge of solving mathematical algorithms and have a highly upgraded computer system with the availability of massive power supply, you can mine Bitcoin Cash coins just like any other crypto coins. Once you are successful to validate the transaction or mine a block, you will be incentivized with a number of BCH coins ( free bitcoin cash mining? Nope!). So, Is bitcoin mining profitable? It might be a profitable option, but needs high skills and proper infrastructure including bitcoin mining software and hardware. But if you really want to be a part of the miners’ community, you can join the mining pools like BTC.com, F2Pool, ViaBTC, Bitccoin.com and many more to extend your computational power and reward can be split as per the pre-decided conditions.

For Free?: Some newbies amongst you might think- how to get bitcoin cash for free? Is it possible? Yes! Of course! There are many genuine websites available in the crypt space like earn.com, who provide you with free BCH but in exchange you have to complete some online surveys, play games, refer some links to your friends, and also watch some of the videos or advertisements. Some of the apps like Coinomi, provides you free BCH just for maintaining the minimum balance on their platforms. Also, some of the games are available on Google Play Store and Apple sTore which rewards you in BCH as rewards after you win the particular game.

Where To Save Bitcoin Cash?

Like for every crypto coin, you need to read the crypto wallet reviews, and have to choose the best Bitcoin Cash crypto wallet for yourself. What is Bitcoin Cash wallet? Just like every other crypto wallet, which can be software or the best hardware crypto wallet, BCH wallet stores what we explain private key and public keyor the digital codes of the coins owned.Shh!! You are not supposed to reveal your private keys in any case.! You can choose either software wallets like Coinbase, blockchain, mycelium, and many more; or hardware wallets like Ledger Nano, Trezor, etc.

Some of the curious minds may be thinking if it is possible to create your own crypto wallet? How to make a Bitcoin Cash Wallet? So, you must be glad to know that some of the service providers like Coinaddress.org, BitcoinCashBlock explorer and a few more provide you with free and open-source javascript to generate your wallets which can be single, split, paper and of many other types.

Where Can Bitcoin Cash Be Spent?

Now suppose till the time you reach this section, you already own a few of the BCH coins. Your mind may be boggling- what can I do with Bitcoin Cash? The foremost obvious answer could be, holding the currency for the future and sell it when the selling price will be more than the buying price. That’s what most of the people do, utilizing Bitcoin cash for the purpose of investment. Some other ways are available there to utilize your currency. You can shop online at some of your favorite retail stores, you can dine with your family and friends and you can also shop in person. You just need to search the places who accept Bitcoin Cash by typing the name of the place in one of the tabs of google maps given on the official website of Bitcoin Cash.

How To Utilize Bitcoin Cash?

Do you think that it may be difficult to use the hard fork of Bitcoin? Or How to use Bitcoin Cash? You don’t have to worry because you can use Bitcoin Cash similar to how you use your Bitcoins. Once you have purchased the coins from any reputed exchange or other platforms, you first need to transfer the private keys to your crypto wallet. Now whenever you want to use these coins, you need to access your private keys and transfer the funds to the relevant site or person you wish to pay. Different websites have different procedures, some might ask you to scan QR code to complete the transaction, while others may ask you to confirm by clicking on the link sent to your email id. But the majority of them need the public key of your crypto wallet to complete the transaction.

The procedure might be longer if you had to transfer bitcoin cash to a bank account by converting it into fiat currency. Then, you have to first buy BCH from exchange, save it to your crypto wallet and then complete the transaction.

How To Transform Bitcoin Cash To Bitcoin?

Sometimes, you may get paranoid or get influenced by the various hyped announcements and tweets of the crypto giants and want to either sell your coins or convert them into BTC (always reliable one!). Don’t worry, this article is not meant to boost the sale of BCH but to guide you. So, let me respond to your question-How to convert Bitcoin Cash To Bitcoin?

There are a variety of options available in the market for conversion. The most popular one is to utilize the platform of crypto-to-crypto exchange like Binance which has the listed pair of BCH/BTC. You just need to exchange your coins with Bitcoins by completing few details. You can also use fiat-to-crypto exchange, but then you have to first sell your BCH, convert it into fiat, and then utilize it to buy BTC. Also, you can utilize the platforms like Changelly, Swampy, flyp.me, and many more which can swap your currency in a safe and secure manner with their services of an escrow account. You may also think of a barter system, that is finding a buyer on sites like LocalBitcoins who wanted to have BCH in exchange for BTC.

Summing Up

You must be satisfied enough that you started the article to get the response for-what is Bitcoin Cash? And now when you have completed reading, you are having plenty of knowledge to start your first buy. Bitcoin Cash is here to stay due to its hard-working developing team, continuously upgraded system, and high scalability. So, after having the basic technical analysis, you can have your first buy of BCH.

Articles You May Read

Cryptocurrency or Bitcoins are blockchain-based digital currency. Presently, the decentralized model which completes your transaction without any intermediary, cryptographic techniques which secure your verified transactions or blocks and distributed ledger technology which can maintain the transparency in a network, are few of the features of digital currency which are captivating the attention of investors, traders and developers also. What is the intrinsic value of cryptocurrency? It has become the fastest-growing investment asset that can help you in earning massive profits. Like any other asset, the price fluctuation of cryptocurrency depends on multiple factors. What drives the price of cryptocurrencies? In this article, let us try to find out a few of the major factors which can shake the value of cryptocurrency.

Major Factors Affecting The Value Of Cryptocurrency

Cryptocurrency is a relatively new asset for investment as compared to traditional stock markets. But like the traditional markets, it experiences the fluctuations in value of cryptocurrency when one or other factors associated with respective currency changes even for the short term. What affects Bitcoin value? Let us list out some of the major factors which influence the price of digital currency:

Supply and Demand Of Crypto coins

Like traditional currency or any other investment asset, the price of cryptocurrency follows the basic principle or market law of Price-Demand in the crypto space. When the demand for a particular crypto coin increases, the price will automatically rise and when the demand for a particular crypto coin decreases, the price will tend to fall. As the crypto marketplace is highly volatile (10% rise and fall of the price is normal) in nature, you can notice the rapid ups and downs. Taking the help of crypto charts, trend history, various trading tools, and many more, technical analysis is done to invest in cryptocurrency invest in cryptocurrency.

Mining Process

Particular participants connected to the network are constantly involved in mining the limited coins available in the crypto space. Not physically, but by solving the complex mathematical algorithm associated with any transaction involving the particular cryptocurrency, on their connected system, validating and updating the verified transaction as a block in a blockchain network. When the systems are not upgraded, power consumption is high, lack of availability of needed infrastructure, and many more factors speeds down the prices of mining, it will affect the value of cryptocurrency. Less mining, fewer coins in the market means the price rise of a particular coin takes place.

Also, every four years, when the rewards are given to miners to validate the transaction, gets halved or the event of Bitcoin Halving takes place; prices of Bitcoin get affected.

Cryptocurrency Exchanges

Cryptocurrency exchanges Cryptocurrency exchanges are the places or interfaces available in the form of websites and mobile apps facilitate the investors and traders to buy, sell, and trade their coins by charging them nominal transaction fees. Traders have to choose from already listed cryptocurrencies on the crypto exchanges as every crypto exchange doest not facilitate every currency available in the crypto market place. What affects cryptocurrency price? Thus, listing (Positive) and delisting(Negative) of cryptocurrencies on major crypto exchanges, are responsible for the fluctuations of the value of cryptocurrency. If a crypto exchange lists a newly launched cryptocurrency on its platform, then the community may take the reputation of exchange into account and willingly buy the coins.

Regulations

Cryptocurrency is a decentralized currency that is not managed or backed by any central authority, so the regulators had to come into the picture and administer the industry. What affects cryptocurrency value? Presently, every country is regulating the currency as per their choice and requirements. Countries like Switzerland which have established its own crypto valley, have an easy regulatory environment where investors and exchanges can take advantage of the price of the cryptocurrency. While countries like the US or European Union where the crypto industry has to follows strict norms, the crypto community needs to pay higher prices for purchasing or trading cryptocurrencies. Whether there is a presence of a conducive environment or the outright ban of cryptocurrency, both the situations affect the price of the coins.

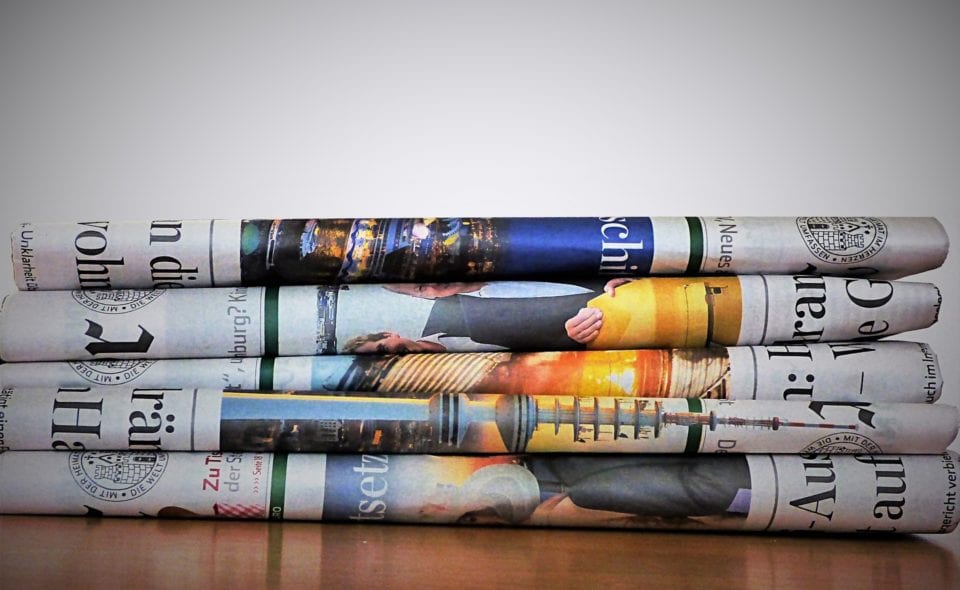

Media

Media can break or make the prices of specific cryptocurrency. Hype of the news feeds whether real or fake created by media, manipulating or over focussing the views of the prominent personalities affecting the crypto space, continuously flashing social media posts, debates on the announcements of the government, latest partnerships press releases and many more activities curated by media(digital, social, physical) impacts the price of cryptocurrency majorly. What gives cryptocurrency value? Crypto community either panic and start selling their coins or gets overenthusiastic to buy the coins, thereby fluctuating the value of cryptocurrency. Thereby, media cannot be ignored as one of the manipulators of the prices of crypto coins.

Credibility

How does cryptocurrency value increase? If the network associated with cryptocurrency successfully maintains the security of coins by saving them from various cyber-attacks, privacy by maintaining the anonymity of senders and receivers and transparency in their network, then it is likely that price of a cryptocurrency will increase due to its earned credibility in crypto space. On the other hand, if any cryptocurrency faces problems like slow transaction speed, suspicious attacks by hackers, loss of crypto coins, and even when some of the prominent members leave the team of particular cryptocurrency, the price would fall certainly as the demand of coins spike down.

Summing Up

Due to the unique features associated with digital virtual currency or cryptocurrency, it is not only surviving but gradually becoming popular among potential investors since 2009. Due to the highly volatile nature, the price prediction of a specific currency is a bit difficult without understanding the relative impacts of the various factors associated with price. Various charting diagrams, tools to study candlesticks charts, divergence-convergence models and other trading tools are available in the market which can help you in better price prediction and investment decisions regarding the rebalancing of your funds and diversifying the crypto portfolio. If you are a newbie, don’t get afraid of a number of factors influencing the value of cryptocurrency, but try to analyze them by studying the trends and don’t hesitate to start your investment (but with small amounts!)

Articles You May Read

Most of us were aware of only conventional fiat currency(paper notes and coins) till 2017, when Bitcoin came into the picture with skyrocketing prices of touching almost $10,000. Who knew that conventional money which existed since ages can be replaced? (even though dozens of problems existed with fiat). Satoshi NakamotoSatoshi Nakamoto(pseudonymous as founder of BTC), a visionary with a whitepaper associated with cryptocurrency launched Bitcoin in 2009 (after the global economic slowdown of 2008). Some of the investors took interest and tried to explore the era of the digital financial system but BTC took ten long years to gain its value in the real world. Presently, the large community of crypto enthusiasts have found a number of reasons to prove that bitcoin is better than conventional cryptocurrency. In this article, after analyzing a number of factors, we just need to explain a few of the reasons which actually signify that bitcoin can be an alternative to traditional fiat currency.

Bitcoin Is Better Than Conventional Currency | Exploring Reasons

Bitcoin is simply a digital virtual currency or a medium to conduct digital transactions by sending and receiving bitcoins directly from and to your crypto wallets. It follows the decentralized model (not backed by any intermediary or central authority!) and based on distributed ledger or blockchain technology. As the global interest is increasing day by day in BTC, it has become important to us to get you aware of the reasons behind their popularity and explain clearly about bitcoin and conventional currency.

Following are some of the benefits which makes Bitcoin better than any conventional fiat currency:

- Decentralized: Bitcoin is based on the model of decentralization. It means no central authority acts as the intermediary between the sender and receiver, rather transactions take place as peer-to-peer exchange and are recorded and completed on the network of blockchain. Practically, you can own and control your own cryptocurrency.

- Digitalized: Cryptocurrency or Bitcoins are like programmed software where completion of the transaction is based on the solution of a complex mathematical algorithm on the network of the blockchain (Don’t worry you don’t have to solve the problems!). So the problem of storage, damage, and also the huge infrastructure called banks are minimized.

- Volatility: As compared to the conventional currency whose value changes every minute depending on the Forex markets, policies announcement of regulators and various other factors; Bitcoin is less volatile as it does not belong to a particular country but participants from all across the world can mine, invest and trade in cryptocurrency.

- Traceability: Corruption is prevalent all across the world due to a lack of proper traceability mechanisms associated with fiat currency. Contrary, every transaction of bitcoin can be easily traced due to blockchain technology. Every transaction after getting verified by participants or miners gets recorded in the form of a block.

- Security: Bitcoin is relatively more secure than conventional currency as it deploys cryptographic techniques to safeguard the funds. For every verified transaction, the receiver of Bitcoins is provided with private keys (like a password) to unlock the Bitcoins at the time of selling. Also seed phrases and recovery phrases are also provided. For storing private keys, crypto wallets both online and offline are available.

- Transaction Charges: Since the bank is not responsible to maintain and administer your currency, you need not pay heavy deposit and withdrawal charges, maintenance charges, charges for credit/debit cards, charges for not maintaining the minimum amount in your account, and many more while using digital coins. You need to pay nominal transaction fees even if you wish to transfer Bitcoins worth millions of dollars.

- Counterfeiting: As the technology upgrades, there are a variety of machines available in financial space that are engaged in counterfeiting fiat currency. On a daily basis, regulatory and central authorities release notices to safeguard yourself from duplication or fake currency. In the case of Bitcoins, as every transaction is recorded on a blockchain network, there is no possibility of faking cryptocurrencies as even a single change is done, every connected node will be notified for the same.

- Accessibility: The thought of standing in the long queue of ATM might scare you every time you run out of sufficient cash. But in case of digital coins, you just need to have your smartphone or computer with internet access and you are good to go. You simply need to click a few of the options to send or receive crypto coins and you can continue buying things that you were scrolling.

- Transaction Speed: Your client had deposited a cheque of a huge amount in your account but you need the funds at the same moment he deposited it. Oops! You can’t withdraw the funds until the cheque gets clearance from the relevant authorities. Now, suppose your client has sent your payment in the form of Bitcoins, within a few minutes you can easily utilize them.

- Borderless: Transnationality is also the reason why bitcoin is better than conventional currency. With no boundaries, no exchange values, and no intermediaries, Bitcoins can be transferred easily, quickly, and smoothly all across the world from senders wallet to receivers wallet, that to minimal international charges. You are planning for a foreign trip and worrying about splitting your cash and keep it here and there at different places in suitcases or in your pockets to safeguard your cash. We have a better alternative to Bitcoin, where you just need your smartphone and not to worry about stealing and conversion rates of currency.

Summing Up

The purpose of listing out the reasons to support Bitcoin Is Better Than Conventional Currency is not to convince you against any notion but to help you in taking the judicious decision if you are thinking to invest in cryptocurrencies, or wants to split your funds between traditional and crypto markets or in case of any decision associated with Bitcoins. Cryptocurrencies have paved the path for a new digital financial revolution where the financial system will be more transparent, digitalized, decentralized, associated with minimal transaction fees, easy traceability with highly secured and private currency.