Imagine that you are watching a video of high quality which is obviously occupying the larger bandwidth. And you are facing the problem of buffering in between, no matter how hard the content delivery networks are trying to smoothly stream the video. Being the centralized content network, you are not the one who is suffering from buffering but many others are also facing this problem. Don’t you think, something needs to be done for a better experience? Theta Labs operating on Blockchain technology aims to improve the quality of video streaming, enhance resilience, and also aim to reduce the costs incurred. Recently, the prices of Theta token have shown a tremendous rise in the crypto space so I thought to get you to introduce this guide to Theta Coin and let you amuse yourself with one more application of Blockchain Technology.

What Is Theta Coin? | Guide To Theta Coin

Presently, besides the news related to halving and the Bitcoin crash of March 12, 2020, you might encounter the updates related to Theta Coin. According to data from CoinMarketCap, Theta has almost added 1000% to its price after the shock of crypto markets in March. Many of you may have wondered- What is Theta Coin? Theta is one of the innovative platforms which has integrated the Blockchain technology with live video streaming platforms to improve the quality of video for the viewers. And Theta coin or better we say Theta tokens are offered by the platform of Theta Labs to the users who wish to share their excess bandwidth and computing resources to the decentralized streaming video protocol which is running on the Blockchain technology. The peer to peer network of Theta platform aims to improve the quality of video by sharing the resources and rewarding system. Theta not only targets for better experience of viewers but also to content creators by removing the intermediaries like advertisers who used to share the large amount of funds.

How Does Theta Work? | Guide To Theta Coin

Theta basically consists of two parts. First is the video delivery network which is made up of connected nodes contributing to the bandwidth which facilitates in decentralized streaming of high-quality video. And the other is Theta Blockchain which is used to promote the Theta network as it incentivizes people to join the network in the form of Theta tokens. Theta provides a supplementary P2P mesh network to the Content Delivery Networks (CDNs) as users can lend their devices as “caching nodes”(stores video data just like cache memory) which relay streaming of video to any of the viewer across the globe. As the amount of caching and relaying points increases in the network, steam quality gets improved due to less travel of video data. People who are involved in caching the nodes or sparing bandwidth resources are supposed to be rewarded with Theta tokens, thereby making the strength of Theta network strong.

After the launch of Theta Mainnet 1.0 (official final product) in March 2019, Theta blockchain network started to promote Theta tokens by making them available for all the interested users in the following ways:

- Rewarding tokens for relaying and caching the video streams

- Viewers and content makers also got the opportunity to earn tokens as rewards from advertisers for their engagement.

- Tokens are also utilized by advertisers to fund advertising campaigns and purchasing premium content from streaming sites.

- Theta token holders are further being incentivized with Gamma tokens which involves the transaction of smart contracts and video segment payments.

Recently Theta Mainnet 2.0 was launched on May 27, 2020, with technical improvements and further enhancing the experience of viewers. The new concept of Guardian nodes will be introduced in the network of Theta which aims to add two layers of consensus mechanism to optimize the video delivery. You can easily stake your tokens to enjoy the benefits of Mainnet 2.0.

Where To Buy Theta? | Where To Store Theta?

The availability of tokens rely on their liquidity. As Theta token is highly liquid relative to its market capitalization, you can purchase them from a number of crypto exchanges. Korean crypto enthusiasts are majorly involved in Theta trading so the majority of the volume is available on Coinbit, Bithumb, and Upbit. Also, some of the top crypto exchanges like Binance and Huobi have listed the Theta token trading pairs (Bitcoin, Tether, Ether, and many more) which allow the traders to buy and sell Theta tokens. Thus, you can easily purchase the Theta coins like any other altcoins by creating your account on a particular exchange. Theta tokens can also be exchanged on peer to peer platforms like LocalBitcoin. Ans also can be exchanged or swapped on deregulated exchanges like Changelly, Shapeshift, and many more.

After the Theta launched it’s Miannet 1.0, it can be stored as any other crypto coins either in a hot or cold wallet. Hot wallets or online wallets offer you the options of mobile and desktop wallets that are easily accessible but vulnerable to cyber attacks. On the other hand, cold or offline wallets give you the option of hardware wallets like Ledger Nano, Trezor, and many more and paper wallets which are a bit difficult to access but assure the high-level security of the private keys of your Theta tokens. Also, Theta has its own online wallet where you can store your keys of Theta coins.

Summing Up

To sum up, it can be advocated that Theta network is successfully resolving the problems related to scaling, transparency, and security related to the streaming of video, thereby benefiting both viewers and content makers with its decentralized peer to peer model. Investing in Theta coins can be even a better option as recently Google endorsed the decentralized infrastructure of Theta. The tech giant Google joined Theta and thereby will be involved in validating transactions on a network of public blockchain and also act as the preferred cloud partner. Also, one of the topmost reputed crypto exchanges Binance announced the launch of Theta – US Dollar perpetual trading contract after Theta Mainnet 2.0. If you are thinking of buying some of the Theta coins and expanding your crypto portfolio, you can invest some of your funds as the network of Theta has been fulfilling the promises and has better prospects for the future indicating the bullish market ahead. Thus, Blockchain Technology successfully contributed to revamping not only the global digital economy but also the media and entertainment industry. I hope this guide to Theta coin not only resolved your doubts related to- what is Theta coin in cryptocurrency but had cleared some of the basics related to Theta coin.

Articles You May Read

Crypto community is expanding gradually as people are considering the virtual currency as the mode of investment with higher returns. People are actively buying crypto coins and trading at crypto exchanges to increase the associated profits. You must be well aware of the fact that you need a wallet to store any currency whether it is fiat or digital. For digital currency, you need digital wallets to store the private keys or digital codes of the Bitcoins. Digital or crypto wallets can be hot/online or cold/offline which are a crucial part of the crypto space. You need to be extra conscious while choosing your wallet and need to be extra aware while setting it up. Each type of wallet has a different setup procedure. In this article, we will describe the basics steps to start Bitcoin wallet, so that you can choose the best of the wallet to securely save your coins.

What is Cryptocurrency Wallet? | How To Start Bitcoin Wallet?

A cryptocurrency wallet is a mobile app or desktop interface or a USB like device or a printed piece of paper which store and retrieve digital coins. When you buy a number of crypto coins, you obviously need to keep them secure till the time you are willing to utilize it. Once you decide to spend your coins, you just need your cryptographic wallet address and the private keys to access your coins. Using your crypto wallet is as simple as scanning a QR code. But before that, you need to know how to set up your Bitcoin wallet.

Types Of Cryptocurrency Wallet

As crypto space is diversifying gradually, options for wallets are also increasing to provide more security to the private keys of your coins. As the technology is upgrading on a daily basis, advanced options for encrypting the keys are also expanding. In the next sections, you are going to read the brief introduction and set up Bitcoin wallet.

Crypto Hot Wallets

Bitcoin hot wallet or online wallets are the mobile apps or desktop programs which secure your coins with the help of highly encrypted passwords. Generally, they are easily accessible to users with Internet access only. But being an online wallet, they are vulnerable to cyber-attacks.

Crypto Mobile Wallet

Mobile wallets are the most handy crypto wallets which allow you to access your coins from your smartphone with proper Internet access. You can set up your mobile crypto wallets with the following steps:

- Prefer the multicurrency wallet which can store keys of multiple coins by reading the reviews from Google Play Store or Apple Store. For instance, Exodus, Jaxx, Freewallet, and many more.

- You need to download the wallet app from any of the stores depending on Android or iPhone users.

- Once the App is downloaded, you need to create your account by mentioning name, email id, strong password, and other required details.

- Generally wallet app has the double authentication process, where you need to verify the link sent to your email id to complete the process.

- Once you set up your wallet, you need to transfer the coins from the exchange wallet to your mobile wallet. (As it is considered safer to transfer your coins from exchange’s wallet)

- You just need to copy the wallet address and paste on the window of exchange’s wallet along with the amount you want to transfer.

- After a few minutes, you need to check on the app of your mobile wallet if funds are a transfer or not. Now, you can take a deep breath as your coins are safe.

Crypto Desktop Wallet

Crypto desktop wallet is another type of Bitcoin hot wallet which allows you to store your private keys on a specific laptop or computer. You just need to download the particular wallet for instance Electrum wallet on your system and you will be offered a combination of security and convenience. You can set up your desktop crypto wallets with the following steps:

- Review the top desktop wallets and find their site accordingly.

- You can easily download the set up of the wallet from the respective website. (Choose the wallet as per your operating systems)

- Run the setup and install the wallet (Do not forget to make shortcut on desktop)

- While completing the setup, you might need to tick the checkbox on some of the features like segwit or standard wallet (Segwit is preferable) and many more.

- Tick on the option of New seed which is basically used to create wallet address.

- Do not forget to write down your seed or recovery phrase which can help you in retrieving the private keys if you lost them.

- Make sure to set a highly strong password and you are good to go.

- You can try sending the coins from your online to desktop wallet (Start with a small amount)

Crypto Cold Wallets

Bitcoin cold wallet or offline wallets are USB like devices or just a paper which secure the digital codes or private keys. Generally, hardware wallets are preferred to choose a large number of keys as they are not vulnerable to cyber-attacks.

Crypto Hardware Wallet

Portable USB like hardware device which is used to store Bitcoins and altcoins are known as crypto hardware wallets. Generally hardware wallets are multi-currency which allow you to save the keys of various type of coins in a single hardware. Let us find out how to start Bitcoin wallet:

- You can order your hardware wallet online from any genuine website after reviewing the top hardware wallets. For instance, Ledger Nano, Trezor, etc.

- After receiving your hardware wallet, connect it to your system through USB cable.

- You need to press the button on the device to set up your hardware wallet.

- Make sure to configure the device by setting up the high strength password. (pressing the button on device itself generally)

- After that Recovery phrase (maybe of 20 words) may blink on the device itself, make sure to write it down and keep it secretly away form everyone.

- Now after configuring your device, you need to set up the wallet on your system to transfer the coins from online wallet to hardware wallet.

- Make sure you had connected the device to your system. You need to download the web extension of the hardware wallet on your computer.

- Just click on extension and you are good to go. You need to follow the same procedure as that of a hot wallet to transfer the coins. But this time, keys are getting stored in the hardware devices.

Crypto Paper Wallet

As its name says, it is a piece of paper on which you need to write down your private and public keys. Paper wallet is totally secure until your paper get misplaced or steal by anyone. It might pop up in your mind that, how to set up a Paper wallet. Let me help you.

- Firstly you need to scan your computer for viruses with effective antivirus and antimalware software.

- From the internet, you can download a paper wallet generator.

- Once the download is completed, switch off the internet connection and generate private and public keys of the BTC wallet and write it down on a paper.

- Don’t forget to clear the cache memory of your system and internet history.

- Protect the paper well. Keep in your wallet if you wanted to as this confidential paper contains the information of your Bitcoins.

Summing Up

How to get a Bitcoin wallet, might be easily answered but How to start Bitcoin wallet may need some youtube video or blog. Setting up a crypto wallet whether it is hot or cold is not a tedious task, you just need to extra careful while configuring your crypto wallet. You need to protect your seed phrases and have to keep the highest strength of your password. So, now that you have so many coins in your crypto portfolio, make it safer by transferring them to your crypto wallet.

Articles You May Read

According to Gartner, research and advisory company, there will be 20.4 billion IoT devices installed by 2020, IDC, a global provider of market intelligence and advisory services, believes that by 2020, there will be approximately 30 billion connected devices and the overly optimistic IHS Markit, the figure is estimated up to 125 billion devices of IoT by the end of 2030. IoT or Internet of Things- What does it mean? Does it need to overcome some challenges to reach the estimated installed devices? Blockchain technology which is slowly turning to be the problem solver for every other industry and revamping the other technologies by integrating with them. Can it prove as a boon to IoT also? What will be the future when IoT and Blockchain will integrate? Let us find out in this article about Blockchain as a service for IoT.

What Is the Internet of Things (IoT)? | What is Blockchain Technology?

When the sophisticated semiconductor chips, sensors, and actuators are embedded into physical devices and help in connecting people, places, and products offering the opportunity to create and capture values to convert the data into sights, this whole connected system is known as the Internet of Things (IoT). The connected network of IoT has the potential to impact business processes by better tracking the supply chain, logistics management, transparency maintenance, fewer chances of duplicacy, and many more. But it has the major issues of security and scalability which stagnates the adaptability of IoT.

Blockchain technology is another breakthrough innovation that is based on a decentralized model where direct communication is established between two users on a network. It aims to establish a highly transparent system with the help of a consensus mechanism of Proof-of-work. Blockchain network assures the secured and anonymous transaction throughout the network due to the deployment of cryptographic techniques utilized during the transaction. Not just the financial system but according to most of the researchers, it has the potential to revolutionize healthcare, education, automotive, fashion, and many other industries. Do you think Blockchain as a service for IoT or if Blockchain integrates with IoT can create the all-new experience for users?

Can We Consider Blockchain As A Service For IoT?

Distributed ledger technology or Blockchain has the capability to manage the “Distributed Network” of the Internet of Things in an efficient way. IoT establishes the interconnection among the various physical devices thereby many companies but the issue related to security and scalability always remains. The network has failed to control the leaking of confidential information, duplicacy of the data, utilizing the data for illicit activities, and also the tampering of the documents shared. Also, the network of IoT faces problems related to delayed transactions of knowledge with high transaction costs involved even among the devices/systems connected to the same network.

Blockchain IoT Security

Blockchain IoT security means Blockchain technology can help in resolving the issues related to the security of the Internet of Things.

- Being distributed ledger technology, blockchain is considered tamper-proof. It eliminates the need for intermediaries and also distributes the control of information among the various parties connected to the network of IoT.

- One more security layer can be added to store the data collected from physical devices connected to the system of IoT through Blockchain technology. Cryptographic techniques deployed by the Blockchain makes it difficult for hackers to get access to the network. Also, data overwriting seems to be almost impossible when IoT integrates with Blockchain.

- Easy traceability with Blockchain can encounter the problem of security faced by the IoT network as authorized persons can easily access the path of the transaction of information. The suspicion related to leakage of information can be easily traced by checking the specific sources.

Thus, a decentralized model of Blockchain can address the issue of centralized client-server model of IoT systems and ensures security by reducing single point failure.

Blockchain IoT Scalability

Blockchain IoT scalability means that Blockchain technology can help in resolving the issues related to the scalability of the Internet of Things.

- Blockchain technology has one of the strikethrough features of quick transactions along with coordinating with numerous connected devices. IoT networks face the problem of scalability when the number of interconnected devices increases, distributed technology can prove to be a solution to enable various solutions.

- Blockchain allows IoT gateways to reduce the cost by decreasing the intermediary charges of middlemen related to traditional protocols, hardware, or other overhead costs. This also increases the scalability by speeding the transactions.

- Smart contracts which can be utilized by Blockchain technology which helps in automated transactions when integrated by IoT. Smart contracts are coded contractual arrangements based on certain conditions and allow automatic transfer of data once the conditions are fulfilled.

Real-Time Applications

Integration of Blockchain and IoT can aid in various applications of real-time like

- Supply Chain Logistics: Various companies are engaged in designing the vehicles which are IoT enabled connecting various stakeholders like raw material providers, brokers, and many more. Blockchain is also integrated for better traceability and transparency of network. For instance, Golden State Foods integrating with IBM to optimize the supply chain by integrating both the technologies.

- Healthcare Industry: IoT Blockchain system aims to improve the traceability and tracking of the complete journey of drugs starting from developing to manufacturing and distribution to avoid the counterfeiting of drugs. For instance, Mediledger is one of the companies which tracks the legal change of ownership of prescription medicines improving the transparency and traceability in the healthcare industry.

- Agriculture: IoT coupled with Blockchain has the capability to transform the agriculture industry from farming to grocery to home. For instance, Pavo enables farmers by offering them better farming techniques by giving the insights of captured data, and also to distributors and retailers in making the decisions about the various crops.

- Automotive Industry: Blockchain-IoT combines the technology in the automotive industry to provide crucial information among the networks in an easy and quick manner. For instance, NetObjex portrays smart parking solutions by deploying Blockchain and IoT as it helps in locating vacant space in parking lots.

- Smart Homes: IoT Blockchain allows you to manage the security of your home from smartphones. Deployment of blockchain resolves the issues related to the centralized approach to exchange information on IoT networks. For instance, Testa, a media and telecommunication company of Australia, stores the data related to biometrics, voice recognition and many more on Blockchain to improve security.

Thus, Blockchain as IoT is getting explored by many companies like Chain of Things, IOTA, Riddle & code, Modium.io, Waltonchain, and many more. Blockchain as a service for IoT has numerous solutions to the modern technical problems that exist in this growing world of challenges.

Articles You May Read

Bitcoin which was once seen as suspicious currency is now adopted by many multinational companies, local stores, and supermarket chains. Bitcoin-based on blockchain technology was launched in 2009 with a decentralized model of operation. Gradually after 2017, when the prices of Bitcoin skyrocketed to almost $20,000, cryptocurrency seems to get popular as one of the modes of payments. Due to the ease of transaction, revamped security and low transaction cost, not only the e-commerce websites but the retail stores also started Bitcoins as the medium to complete the payments. Consequently the list of companies from large corporations to small retailers which are implementing the Bitcoins as their medium of exchange is increasing. In this article, we tried to mention as many online or offline businesses that accept Bitcoin as the option to purchase or buy the tangibles from their store.

List of Businesses Which Accept Bitcoin

Let us briefly mention the as much names as we can in the list of companies (both online and offline) who considers the importance of Bitcoins as the mode of payment and added it to the list of medium of exchange:

- Tesla: Automobile company Tesla dealing in luxury cars trusted Bitcoin as the medium of exchange because of the no dealership requirement and direct sale from company to customer.

- BMW: BMW is one of the dream cars of the majority of people and if you are one of the luckiest ones who are almost there to have your purchase, then you must know that most of the dealers in the US are accepting Bitcoin as a mode of payment. (offline business that accept bitcoin)

- Goldman Sachs: One of the largest Wall Street investment banking firms, is about to start crypto custody offerings and also Bitcoin trading operations.

- WorldCore: Czech based banks enables customers to allow the easy spending of digital currencies by their cards allowing accessibility of international banking by global transfer facilities.

- Subway: Our one of the favorite food chains started accepting Bitcoins as the payment in branches of some of the countries like Buenos Aires.

- Dominos: Pizza! Mouth-Watering? PizzaForCoins offers you the options to facilitate crypto payments on some of the popular takeaways pizza brands like Dominos.

- Burger King: Russian branches of Burger King accept bitcoin as payment for their finger-licking dishes.

- CheapAir.com: One of the first online travel agencies to include not only Bitcoin but other coins or altcoins as their payment mode. You can easily book your flights and hotels by paying in crypto coins.

- airBaltic: One of the first Latvian airlines accepting the payment in crypto coins from their customers across 60 destinations of Europe, the Middle East, and Russia.

- Abitsky.com: Online portal which offers flights across continental Europe has started accepting the payment in the form of digital currencies. (online business that accept bitcoin)

- Virgin Galactic: Futuristic commercial space flight venture has announced to accept the payments in digital currencies. It can become one of the space businesses which accept Bitcoin.

- European School of Management and Technology, Berlin: With a number of executive-level certified education programs, ESMT Berlin offers higher education to students in exchange for Bitcoins as fees of the course.

- Microsoft: Technology giant Microsoft known for providing the varied varieties of Windows to your computer system readily accepts Bitcoins as a mode of payment for its services like the purchase of online games and apps.

- PayPal: World’s leading payment services provider, Paypal announced the acceptance of Bitcoin after getting corroborated with Brain Tree in 2014.

- eToro: Retail FX platform eToro offers trading options like online stocks, commodities, currencies, and indices in exchange for Bitcoins.

- Red Cross: Non-profit organization Red Cross allows donors to contribute through Bitcoins for various social projects including blood donations and disaster relief management.

- Save the Children: Non-profit organization helping the children across various countries of Asia, Africa, Latin America, the Middle East, and Eurasia. Save the Children accepts donations in the form of cryptocurrencies along with other modes.

- Sharps Pixley: London based one of the oldest gold dealers of the country and member of the London Bullion Market Association, allowed its customers to use Bitcoins to buy, trade, and store precious metals.

- Bitcoin.travel: Website that offers the option to customers to book their flights, hotels, accommodations, and many more by using their Bitcoins.

- ExpressVPN: Easy to use VPN service which is compatible with most of the interfaces like Windows, iOS, Linux, Android, and many more. It offers services in exchange for cryptocurrencies.

- NameCheap: One of the oldest web services providers which is also an ICANN accredited registrar offering domain to web hosts like WordPress Web, VPS hosting, and many more. With traditional modes of payments, Bitcoins are also accepted by NameCheap.

- Shopify: Leading e-commerce websites that enable the payments in Bitcoin through BitPay exchange to purchase products via online portals.

- Bitify: It is an auction site that provides a platform to users from trading items for Bitcoins. Along with it, a feature of escrow service is also provided to ensure the security of users.

- Tradebit: It is a digital content marketplace to sell and buy downloadable products by accepting Bitcoin payment.

- OkCupid: It is an online dating site that brags to get you a suitable match after matching your given information with other members. Since its launch in 2013, it has included bitcoin as one of the payment options.

- Xbox: Xbox games and live subscriptions can be easily downloaded using Microsoft after paying in digital currencies.

- Zynga: With few of the popular games like Farmville, Castleville, Chefville, and many more, Zynga stands out as one of the mobile gaming giants accepting Bitcoins to purchase the updated versions of the games.

- Bet365: Online casino website Bet365 allows instant processing of requests of withdrawal, which makes it highly popular among the community which is one of the online businesses which accept Bitcoin.

- McDonald’s: Food chain company spread across 180 nations of the world has started accepting the digital coins in some of the countries in exchange for their mouth-watering burgers and other products.

Many other organizations like Walmart, British Airways, Google search engine, AT &T telecom services, Starbuck Corporation, Alibaba, Uber, and many more offline and online businesses are looking forward to adding Bitcoin as a mode of payment.

Summing Up

As the Bitcoin is gaining traction in financial markets, various organizations are chalking out their plans and pondering on the procedures to include the Bitcoins as a mode of payment along with their traditional modes. Low transaction fees with a speedy transfer of funds without any intermediary is considered as a boon by businesses that accept Bitcoin. Whether online or offline, payments in Bitcoin can revamp the experience of customers.

Articles You May Be Read

Cryptocurrency is taking the financial world by storm due to its numerous striking features. Blockchain-based digital currency follows the decentralized structure where you do not need any intermediary to complete your transaction. Cryptocurrencies are not only easing out the process of transaction but also gaining popularity as the commodity for investment. Crypto community is gradually expanding all across the world. To improve the experience of customers in crypto space, many of the developers and teams are coming out with their cryptocurrency apps. In this article let us learn about the cryptocurrency apps and look out for the list of best Bitcoin management mobile apps of 2020.

What Is a Cryptocurrency App? | Best Bitcoin Management Mobile Apps

A cryptocurrency app is like any other mobile app which can be downloaded from Google Play Store for Android users and Apple store for iPhone users. Form storing your private keys of crypto coins to buy, sell and exchange cryptocurrencies, maintaining crypto portfolio to analyze the trends of the number of digital currencies available in the market to keep the track of latest partnerships and new services and product launch, from earning the rewards and cashback to tracking the mining pool, these apps allow you to manage your funds invested in cryptocurrencies.

Mobile Apps generally have an intuitive interface, simple login procedure with two-way authentication, and multiple interesting features to improve the experience of the crypto community. Either you are a newbie or an advanced trader, you need to have few cryptocurrency apps for better management which can be categorized:

Exchanges: To sell and buy or trade cryptocurrencies with different modes of payment, you need to have the app of some popular crypto exchanges like Coinbase, Binance, or as per your choice and requirement.

Wallets: Must have app in your phone which allows you to store private keys of your crypto coins securely rather than selling or buying of coins. The app which accepts multi-cryptocurrency is preferable.

Tracker: Crypto exchanges run for 24/7 so you need an app that can track the progress of market capitalization, trading volume, and also other trends of at least well-known crypto coins.

Analysis: Crypto space is highly volatile and depends on numerous factors so manual analysis is a bit difficult. Crypto analytical apps have become a necessity for crypto traders in the present time.

News: Every other day, ICO is launching, collaborations are happening, cyber attacks are taking place and many major events are taking place, so one needs to get updated with the latest news of crypto space, thereby needing an app that covers the latest news of crypto space.

Best Bitcoin Management Mobile Apps

We tried to update the list of the best Bitcoin Management Mobile Apps 2020 in as many categories as possible:

Coinbase is a well-known name in crypto Space. Being in the list of top ten exchanges, the platform of Coinbase can be accessed through the app available for users. It is basically a wallet app but let you sell, buy, and store your coins. It has the potential to store your coins even if you lose or misplace your phone.

Coinbase is a well-known name in crypto Space. Being in the list of top ten exchanges, the platform of Coinbase can be accessed through the app available for users. It is basically a wallet app but let you sell, buy, and store your coins. It has the potential to store your coins even if you lose or misplace your phone.

Coins.ph is also a crypto wallet which allows you to check transfer funds, making payments, and also offers you online shopping options. One of the special features of coin.ph is that it allows you to locate retailers and banks.

Coins.ph is also a crypto wallet which allows you to check transfer funds, making payments, and also offers you online shopping options. One of the special features of coin.ph is that it allows you to locate retailers and banks.

Cryptonator is an app for advanced traders with a wide range of features. Cryptonator is a portfolio management app that offers you the option to convert more than 500 varieties of crypto coins and interface to review currencies based on their location.

Cryptonator is an app for advanced traders with a wide range of features. Cryptonator is a portfolio management app that offers you the option to convert more than 500 varieties of crypto coins and interface to review currencies based on their location.

Coin stats is one of the crypto tracker apps which traces the trend of approximately 3000 currencies over more than 100 crypto exchanges. Coin stats give you the various options to customize portfolio also. Along with price alerts, Coin Stats provides you weekly updates of the crypto world, which further adds to your knowledge of crypto space.

Coin stats is one of the crypto tracker apps which traces the trend of approximately 3000 currencies over more than 100 crypto exchanges. Coin stats give you the various options to customize portfolio also. Along with price alerts, Coin Stats provides you weekly updates of the crypto world, which further adds to your knowledge of crypto space.

Bitcoin Checker is one of the most popular apps among beginners who wish to trade in cryptocurrencies as it provides the information related to the majority of products associated with Bitcoins. As it is completely free, user friendly with simple easy features, it is preferred by most of the newbies.

Bitcoin Checker is one of the most popular apps among beginners who wish to trade in cryptocurrencies as it provides the information related to the majority of products associated with Bitcoins. As it is completely free, user friendly with simple easy features, it is preferred by most of the newbies.

Bitmap crypto app helps you to locate local shops near you accepting Bitcoins just like Google Maps. As Bitcoin is gaining traction in financial markets, many of the supermarket chains, local stores, and retailer shops accept the payment in cryptocurrencies.

Bitmap crypto app helps you to locate local shops near you accepting Bitcoins just like Google Maps. As Bitcoin is gaining traction in financial markets, many of the supermarket chains, local stores, and retailer shops accept the payment in cryptocurrencies.

zTrader is an app for if you are a serious trader, which can help you in learning analysis curve and also built-in room to consult with experts of industry.

zTrader is an app for if you are a serious trader, which can help you in learning analysis curve and also built-in room to consult with experts of industry.

eToro app helps you in developing your trading skills by offering you $100,000 dummy coins to invest in a virtual portfolio.eToro connects you to the professionals around the world to share strategy and talk about the trends of the market.

eToro app helps you in developing your trading skills by offering you $100,000 dummy coins to invest in a virtual portfolio.eToro connects you to the professionals around the world to share strategy and talk about the trends of the market.

Blockfolio is a financial app that helps in quickly glancing your portfolio, notify you about the specified threshold of the prices, and also give the latest notifications of crypto space.

Blockfolio is a financial app that helps in quickly glancing your portfolio, notify you about the specified threshold of the prices, and also give the latest notifications of crypto space.

For a regular digital trader, Bitcoin Ticker seems to be perfect to get the regular update of current currency exchange rates and can be deployed as a widget on your home screen.

For a regular digital trader, Bitcoin Ticker seems to be perfect to get the regular update of current currency exchange rates and can be deployed as a widget on your home screen.

Cex.io is also a crypto wallet app which along with storing your Bitcoins and Ether, allows you to purchase cryptocurrencies with the help of fiat currencies. The user-friendly app of Cex.io offers the services of margin trading also.

Cex.io is also a crypto wallet app which along with storing your Bitcoins and Ether, allows you to purchase cryptocurrencies with the help of fiat currencies. The user-friendly app of Cex.io offers the services of margin trading also.

Summing Up

Undoubtedly, cryptocurrency apps are meant to ease out your crypto life and can help you in making sound choices related to investment. You need to be extra careful about three things while choosing or downloading any app: High-level security, Real-time data is available and accessibility in your area.No matter if you are a newbie or an advance trader, you need to have one or other crypto app in your mobile to get yourself updated and double your investments in cryptocurrencies. And we hope that the list of best Bitcoin Management mobile app would help you in choosing some of the apps for your required purpose.

Blockchain is not only popular in the financial world but is a buzzword among the latest technologies of the present time. With the feature of facilitating the transaction without any central authority or following the decentralization model of operability, Blockchain is expected to revolutionize the traditional financial system. Blockchain technology is not only meant for fintech but for various sectors like healthcare, supply chain management, fashion industry, and many more where database management, traceability of records, record of transactions with transparency need to be maintained at large scale. As the community is expanding daily, the majority of people associated with blockchain technology is anxious about the non-availability of standards for the interconnections or communication of various blockchain networks. This lack of standardization leads to the issue of lack of interoperability among the various stakeholders of the industry. In this article, we are going to understand about the interoperability issues in blockchain and the solutions related to it.

What Is Interoperability? | Interoperability Issues In Blockchain

According to the coding site GitHub, there are more than 7000 active blockchain projects with different coding languages, protocols, mechanisms of consensus, privacy guidelines, and other different parameters. The problem associated with many of the different networks is that they are unable to interact with each other due to a lack of uniform universal standards. Interoperability simply means expectations related to freely sharing values across blockchain networks with no intermediaries in between. If a system is interoperable, one can interact with customers of other blockchain networks without putting resources on translation or experiencing delays. As per the survey of Deloitte, lack of communication or interoperation can grant freedom to blockchain coders and developers but a headache to IT departments as the translation help is required to communicate with various networks. In short, the absence of interoperability among the protocols of Blockchain leads to inconsistency from basic processes like security, privacy resulting in problems of mass adoption.

Benefits of Interoperability

Interoperability in blockchain can offer the benefits as follows:

- The information-sharing process among blockchain networks can become smooth.

- Opportunity to develop healthy partnerships among the blockchain community leading to application development, product and services collaboration, and many more.

- Execution of smart contracts become easier and less time taken

- Deeper understanding of various protocols is possible if the network supports interoperability

Problems And Solutions Related To Interoperability

Blockchain wishes to make the distributed Web 3.0 a reality where seamless interconnection can take place between multiple public (Bitcoin and Ethereum), private(Hyperledger Fabric, R3, etc), public and private and also blockchain with legacy systems. But the challenges exist due to different blockchain networks differing in parameters like consensus mechanism, schemes related to transaction, security protocols, guidelines related to the authentication process, and many more. Standardization is a real issue because not even the basic mainframe is similar in the majority of Blockchain networks.

Blockchain community understood the fact that to strengthen the community, interoperability issues in blockchain need to be addressed. So, the efforts divided into two groups:

- Open Protocols: These are the standardized protocol that helps in communicating with different blockchain networks and that too without any intermediary. For instance: Atomic Swapping offered by crypto exchanges.

- Multi Chain Frameworks: Majorly referred to as “internet of blockchains, multi-chain framework allows the blockchain to plug into the framework so as to become part of a standardized ecosystem and can transfer data and value amongst each other.

Organizations are also focusing on designing the standard version (like data standards GS1 are deployed by both IBM and Microsoft) of blockchain and are enthusiastically collaborating to strengthen the network by overcoming the issue of interoperability. Interconnectivity and standardization are increasing among the networks by enabling cross-blockchain transactions. So to solve the problem of interoperability we need to integrate with existing systems, initiate transactions between the networks, transact interchain with solutions on other technologies, and also aim to enhance the experience users while transacting between different platforms.

Projects Focussing Interoperability Issue In Blockchain

Several projects are relentlessly working to develop the interconnectivity of cross-chain platforms. Some of the popular projects are as follows:

- Cosmos: Independent platforms can get connected to Cosmos Hub by plugging on the Cosmos network. The standardized protocol of Cosmos maintains the interaction while conserving their consensus mechanism.

- Polkadot: Not only digital currency but data can be easily exchanged between the two different networks with the help of Polkadot. Connected networks need to give up their consensus mechanism to the network of Polkadot but freedom of developing structure remains to the networks.

- Aion: Aion stands out among other projects solving the issue of interoperability as it deploys Artificial Intelligence in its consensus model. With the high performance of the virtual machines and scalable databases, Aion is successfully accepted among networks.

- Ark: It allows the automated creation of new blockchains within its ecosystem within minutes. It works as open protocols for the developers working with different coding languages.

The issue of interoperability if addressed in a proper way, would be helpful in supply chain management involving various stakeholders, the fashion industry by authenticating luxury records, the automotive industry by providing the common purchase platform, and also blockchain interoperability healthcare in maintaining the records of the number of treatments across the world.

Summing Up

Christoper Ferris, co-leader of the Hyperledger Fabric Project advocated that a true inter-platform requires the development of a single standardized protocol, which is difficult to develop but the interoperability issues can be managed by utilizing the services available in the market rather than operating in complete isolation. Interoperability issues in blockchain must be addressed seriously by the Blockchain community to strengthen their network and increase the adoption. Interoperability not only eases the transaction of payments but also the sharing of databases, different protocols while improving the understanding of other networks and gives the opportunity to collaborate and develop an all-new network to enhance the experience of customers. The vector of growth has already been initiated by the several organizations which will ultimately lead-in revamping the network of blockchain technology as per the requirements.

Articles You May Read

Cryptocurrency is based on Blockchain technology which follows the model of decentralization while transferring the funds from the sender to the receiver end. Digital currency tends to solve the challenges related to the involvement of an intermediary, tracking of the transaction, the security of funds while maintaining privacy and maintenance of transparency while transferring the funds. As the industry started to grow, rather than be the solution for problems, the mentioned challenges were somehow witnessed in the industry itself. In this article, we are going to understand the problems to scale security and transparency issue along with their advocated solutions in the crypto industry.

Issues Related To Security | Improving Security In Crypto Industry | To Scale The Security And Transparency Issue

CNBC reported that Binance was hacked and $40 million have been lost. Bloomberg reported that Cardano was hit by DDoS attacks. Headlines related to exchange hacks, cyber-attacks, vulnerable wallets, and many issues related to the security of the crypto industry have become common these days. Investors and crypto enthusiasts have become slightly hesitant in investing their funds in crypto markets. Some of the common issues faced in the industry are:

- Exposed Crypto Wallets: Hot or online wallets were already prone to cyber-attacks related to malware, viruses, and many more. But, recently news flashed related to hampered security of highly encrypted cold or hardware wallets also.

- Cyber Attacks: The bruises of the infamous attacks of Mt. Gox are still not dried among the crypto community. Cyber attacks are getting sophisticated with the growth of industry. Also, DDoS(Distributed Denial of Service) attacks are also becoming prevalent.

- Double Spending: People intended to hamper the network sometimes try to benefit from utilizing the same coin twice in the same transaction.

- 51 percent attacks: When certain mining pools become too powerful to control (proof of work mechanism) more than 50 percent of computational power, they tend to manipulate the mining and thereby create security issues.

Fortunately, concerns related to the security of data and funds are well known to exchanges and service providers and many projects including that of exchanges have already started working to solve the problems related to security and coming up with following solutions:

- Crypto wallets can be made secured with the help of few features like auto rejection of duplicate payments, more than two-factor authentication, and by adhering to the higher standards of security with a multi-layer approach.

- Cryptocurrency custody solutions are also coming into picture after Fidelity announced the services under the banner of Fidelity Digital Asset Services where a third party supposed to secure your funds while you are involved in trading.

- Dapps, websites, crypto wallets, as well as crypto exchanges, are working to increase the strength of firewalls and introducing new compliance approaches to assure security.

- Many of the crypto services providers are present in the crypto industry to assure the security by educating the team of the company, detecting the threats on the network, monitoring leaks, and also alerting the people associated with potential threats.

- Crypto enthusiasts must look for reputed exchanges for trading and do not get captivated by lucrative offers by the so-called fake sites. Even if the well-known exchanges got hacked, there will be a maximum possibility of getting your funds back.

Thus, security is invariably an important consideration when it is associated with financial transactions. Thus, by deploying several solutions and providing the required confidence to the crypto community, challenges related to security can be sorted out.

Issues Related To Transparency | Improving Transparency In Crypto Industry |To Scale The Security And Transparency Issue

Recently, news flashed that renowned crypto exchange Bitfinex misled investors by locking up $850 million with a shady capital firm. Also, another company QuadrigaCX was forcefully made solvent by the owner of exchanges by siphoning his own investments into customer withdrawals. Adding to the above cases, many crypto exchanges are involved in trading and reporting fake volumes of in and out of cryptocurrencies. These cases portray that transparency is also one of the important concerns of the crypto ecosystem. Basically, two major issues are the challenges for maintaining transparency.

- Proof of Solvency: Investors are least aware of the financial details of the internal operations of the companies they are investing their funds in as the company did not reveal their reports due to fear of losing the competition in markets.

- Proof of Legitimate trading volumes: Wash trading and fake trading volumes by the exchanges are the common practices employed to captivate the interest of investors and traders.

Issues related transparency are considered by the crypto community seriously and several companies enthusiastically coming upfront with various solutions like:

- By providing the average solvency to clients rather than revealing the complete internal data to maintain healthy competition in the crypto marketplace, issues of transparency can be sorted out. For instance, services provided by Arpa.

- By publishing quarterly financial reports, proof of reserves or custodial protocols exchanges are assuring the status of solvency to their potential investors like that of Poloniex crypto exchange.

- Some of the exchanges assure transparency and legacy by backing their crypto coins with stablecoins along with providing the information related to security audits too like that of the Gemini crypto exchange, Kraken exchange, and many more.

- Some websites provide metrics of real volume on crypto exchanges, giving details of inconsistencies related to traffic of websites and trading volumes. For instance BTI, Nomics, and many more.

Thus, various solutions are considered in the market to solve the problems related to “Proof of solvency” and “Proof of legitimate trading volumes” like sharing of internal financial reports, metric representation of real trading volumes, and other relevant information.

Summing Up

With the rise of security and transparency issues, the crypto community is trying every effort to scale the security and transparency issue and captivate the fresh investments. Cryptocurrencies are here to stay and to ease the problems related to payment and financial system, so the problems need to be addressed as soon as possible to maintain the interest and investments of the crypto community, and also adding new funds to the industry.

Articles You May Read

Whether you are a newbie or an advanced trader, whether a developer of DApps or miners of Bitcoins or even a crypto enthusiast, you must be well aware of the “Halving” event of crypto space. Crypto community all across the globe was eagerly waiting for the event till May 11, 2020, when the third halving took place. But this time, the situation is a little different from the previous two events because of the impacts of the global pandemic of COVID-19. The infamous Corona is not only associated with health crises but with global economic slowdown also. Crypto space had not been left untouched by the virus of COVID even though it is based on the decentralized model of Blockchain technology. Also the hype and impacts of Corona on Bitcoin Halving 2020 have been noticed. Some of crypto giants though explained that the immediate impact on Bitcoin prices was not observed even in two previous halving events, so maybe it is not Corona but the usual trend in crypto markets. In this article, let us have a closer view of the halving event of 2020 and also try to understand the impact of COVID-19 on Bitcoin Halving.

What Is Bitcoin Halving?

Technically, Bitcoin halving is the inflation control event in the crypto space. Bitcoin protocol was pre-programmed with a limited supply of 21 million Bitcoins. When a new Bitcoin enters the crypto sphere (every 10 minutes) with the efforts of miners who are constantly involved in solving the complex mathematical algorithm and validating the transaction. With every block mined or Bitcoin introduced, miners, are being rewarded with some Bitcoins as the compensation for their computational power utilized and incentives to keep up with the process of mining Bitcoins. So, to control the rate at which the Bitcoins are introduced in the market, rewards given to miners tend to half every four years, called a Bitcoin Halving event.

Brief Of Halving 2012 And Halving 2016

Since the launch of Bitcoin in 2009, the halving of 2020 was a third-time event. Previously, halving took place in July 2016 when rewards halved from 25 BTC to 12.5 BTC, and the first time it took place in November 2012 when the initial reward of 50 BTC was halved to 25 BTC. Both the halving effects impacted the price of BTC resulting in 81 times in 2012 and 30 times in 2016 within the duration of almost 18 months, thereby creating the bull run. The point could be noted that immediate impact was not noticed but the long term trend in the surging prices of Bitcoin prices was noticed in both the events. When new buyers came into the market and demanded for Bitcoins, the prices were raised. It can be employed that actually controlled supply did not affect the price but demand for Bitcoins influenced the prices, following the simple law of “Price-Demand” of traditional markets.

Bitcoin Halving 2020 | Impacts of COVID-19

On May 11,2020, the Bitcoin Halving 2020 took place when the reward to incentivize miners were reduced to 6.25 BTC from 12.5 BTC per block. Simple logic was followed this time halving too that- if the supply of BTC decreases but the demand remains almost the same, then the price of BTC will increase. And in case the demand will increase then the prices of BTC can significantly move to attract fresh investments too. But this time, the situation is a bit different from the other two events majorly due to the impacts of COVID-19 all across the globe and a few other factors.

Overview Of Prices of Bitcoin- Jan-May, 2020 | Before Halving 2020

- At the beginning of the year 2020, the prices of Bitcoin shot up from $3300 to $12,000(more than 47%). Many of the crypt enthusiasts argued that halving had already been priced in and accordingly the majority of smart investors had made the supply adjustments to assure their profits. Many of the analysts predicted that the upward trend will be observed for the coming years after halving.

- Like other investment classes, Bitcoin was also collapsed by the effects of COVID-19 in Mid of March,2020 when the price dropped below $5000 within 24 hours (more than 60%). Investors started taking off their money and the demand for Bitcoin started reducing.

- Thanks to the volatile nature of crypto markets and the expected Bitcoin halving 2020 countdown which again surged the demand for Bitcoins leading to rebounding of prices of Bitcoin up to 160%. The sharp rise was noticed in both demand and prices of Bitcoin a few days before Halving. The deflationary impact of the pandemic started diluting in crypto space, though the swing in impacts was highly huge.

Overview of Prices of Bitcoin After May 11,2020 | After Halving 2020

Billionaire Bitcoin bull Tim Draper advocated that price of one BTC could raise up to $250,000; former Goldman Sachs GS, Raoul Pal predicted the price of BTC to raise up to $1,000,000 within 3 years while the Silk Road founder Riss Ulbricht employed that the rice may it $333,000,000 within few decades, before the Bitcoin Halving 2020. Till the time COVID 19 hit the world, crypt enthusiasts were far more than optimistic related to prices of Bitcoin. But the Black Swan event turned the world around leading to the economic slowdown, liquidity crunch, and dropping of prices of Bitcoin too.

While relating Bitcoin Halving and COVID-19, analysts and crypto traders are having mixed opinions. Ryan Watkins, research analyst at Messari believes that the outbreak of Corona is a major obstacle in a bull run after halving while on the other hand, Jake Yocom-Piatt, project lead at Decred advocated that pandemic will prove as opportunity to Bitcoin Halving. Let us throw light upon some of the factors and try to understand if it is actually COVID 19 which impacted the Halving or prices of BTC after halving or it is the nature of crypto space.

- Earlier when halving took place, the derivatives market of crypto was in its infant stage, the involvement of institutional investors was minimal and the analytical tools were merely new. Market was merely affected by the process of mining but now during the third halving event, besides COVID-19, there are tons of factors affecting the market. Latest ICOs, announcements of partnerships, new products and services, self-adjustments tools, already analyzed impacts with analytical tools and technical analysis, whales of spaces, and many more affect the crypto space.

- In the previous two halving events, the impact on price was not noticed in a few days or weeks but the impacts were seen almost after a year. So, blaming the Corona for the prices of BTC not being bullish after Halving might not be justified. Let us just wait for a few months to finally advocate the long term effects of Halving.

- COVID-19 might be considered as one of the factors in reducing the hash rate of the mining process. As the pandemic led to the lowering down of manufacturing and movement of Bitcoin mining hardware, so the small miners might drop down the process of mining after the rewards get reduced to half. Jay Hao, the CEO of cryptocurrency exchange OKEx also stated that COVID and halving can prove as misfortunes for small Bitcoin miners.

- The Bitcoin halving event amid the global pandemic might prove to be the “safe haven” asset for the majority of investors. As the COVID had squeezed up the global economy resulting in the expected inflationary atmosphere, Bitcoin can become an alternative to hedge the economic issues. Now when the demand is expected to increase in the digital currencies, its supply has been reduced which may result in an increase in prices of Bitcoin.

Thus, it can be concluded that COVID-19 had impacted the event of Bitcoin halving 2020. But if someone asks me- why bitcoin halving 2020 is not successful? Then, I could only respond that it happened just a week ago and we need to wait to notice long term impacts. It is merely difficult to predict this time that what will happen in the coming months if the global economy will ramp, if the second wave of Corona will hit the world more drastically, if everything becomes normal and many more situations. We could just hope that the prices and demand for Bitcoin will increase in the coming decades.

Articles You May Read

Cryptocurrencies are storming the financial markets with its breakthrough technology of Blockchain-based on decentralisation model. Currency has attracted the attention of potential investors, developers, enthusiasts, and community who wanted to revolutionize digital financial markets. The ability of cryptocurrency to assure the guaranteed security and easing the process of transactions has captivated the interests all across the globe. You might have heard of Bitcoin or Ethereum or Ripple or of many digital currencies as there are thousands of them available in crypto space. With the revamping of Blockchain technology, which irreversibly authenticates the possession of digital assets, many people wonder how to build a cryptocurrency. So, why not you? Why not add one more in the pack of thousands of digital currency? This guide is all about to make you understand how to create your own cryptocurrency online?

Create Your Own Cryptocurrency Online | Coin Or Token?

Whether to create a coin or token is a big choice to make. But how to decide? Coins and tokens, both are cryptocurrencies. One of the major differences between them is that a coin is made on its own Blockchain while a token is designed on already existing Blockchain. Thus, a number of tokens can be built on Blockchain and there can only be one coin.

Creating Coin

Building Blockchain from scratch might sound difficult to beginners but might be fascinating to the enthusiastic coders. You can construct the Blockchain technology but this would take much of your time. You have to code the Blocks in the particular programming language by following certain norms and conditions. Technology experts and experienced professionals can download the open sources and understand the basic coding done to design their own Blockchain technology to build your crypto coins. Or you can just copy-paste the code of the existing coin, change the variable, and here is your all-new coin. After coding the backend of your coin, you need to launch in the mainstream so that you can become popular and be utilized by the crypto community.

Creating Token

Building a Token might not be stressful for beginners as you need to code on already existing Blockchain available in the crypto space. Forking cryptocurrency or creating a token on popular blockchains available allows in deploying their trust, adaptability, and consensus mechanism. Building a token on an already existing blockchain also reduces the chances of fraudulent attacks. You cannot completely own the Blockchain while making the token, but building a token might prove to be a feasible way to design your own cryptocurrency. The creation of a token can be less expensive in terms of money and time, and an accessible way to utilize the decentralized architecture to ease out the transaction. But, don’t be in the illusion that creating a token won’t take much time, it relatively takes less time and skills to develop a token than coin. Various platforms like Ethereum, NEO, EOS, and many more can be utilized to develop your own token by downloading their already existing protocols and codes and a few of the other tools needed to complement a particular platform.

Thus, whether it is coin or token, you need a clear purpose, Coding, and cryptocurrency knowledge and at last a major part of the community who can trust and buy cryptocurrency developed by you and your team.

How Much Cost Is Incurred In Creating Your Crypto? Is It Worth It?

You might be considering developing your own crypto but did you wonder, how much does it cost to start a cryptocurrency? Have you considered the worth of money that will be used in making your coins or tokens? How to create a cryptocurrency website to make it adaptable? To be frank, you need money to pay for the team if developing the coin or developing token, website needed to build the trust in the crypto community, publish a whitepaper mentioning the vision, missions and implementation plan, marketing of currency and also in PR management.

The money spent could be worth it if your Initial Coin Offering captivates the interest of people and would be capable of attracting their investments too. Providing the trustworthy decentralized architecture with a variety of marketing methods and with the help of airdrops, you can turn your coin into worth your money business. Thus, money incurred and worth totally depends on the specific needs of the particular project, cost of development of popularity of currency.

Programming Basics for Creating Cryptocurrency

You can easily get the codes from GitHub or any other website, but in this guide, let us brief you about the basic concepts that need to be focussed while coding:

- You need to start with building the first Block class which is the basic unit of Blockchain and if one is tempered, the rest of the chain can prove to be invalid.

- SHA-256 must be imported into the project to assist hash of the blocks, which assures the security of the network.

- You can use a variety of methods to build or chain the Blockchain class. Constructor method, constructing genesis block, and many more.

- You can anytime add the data to transactions by accepting the three parameters that are details of the sender and receiver and the quantity needed to transfer.

- The proof-of-work mechanism which is used to prevent abuse of the network must be made while deploying the complex algorithm.

- Last block must not be mis-conceptualized. It is actually the current block of the blockchain which needed the utmost focus.

- Coding is done in various coding languages having JavaScript like Python, Solidity, and many more.

Thus, creating your website must require the coding expertise and a development team.

Summing Up

To create your own cryptocurrency online, you need to have the knowledge of coding language and also the skills of marketing too. Building a cryptocurrency might sound difficult but it is as fascinating as you can think of. And in the ever-growing world of cryptocurrency, you must step ahead if you are thinking of launching one of your own cryptocurrency and wish to earn profits associated with them!

Articles You May Read

Ethereum, one of the popular Blockchain networks after that of Bitcoin in crypto space was launched in 2016 with some of the new approaches. Ethereum was introduced by the Canadian Russian programmer, Viltalik Buterin with the mission to improve the crypto space by solving the challenges faced by the Bitcoin network. Consensus mechanism or Proof-of-Work, Better security infrastructure, improved opportunity for app developers, and digital contracts were introduced by the Ethereum network. The success of the network is significantly dedicated to the platform for DApps and the implementation of smart contracts. Efforts of Nick Szabo, back in 1996, conceptualizing the smart contracts inspired Vitalik who later introduced the concept in mainstream. This article aims to act as a guide to Ethereum smart contract and will help you in understanding the basics of developing smart contracts.

What Is Ethereum Smart Contract?

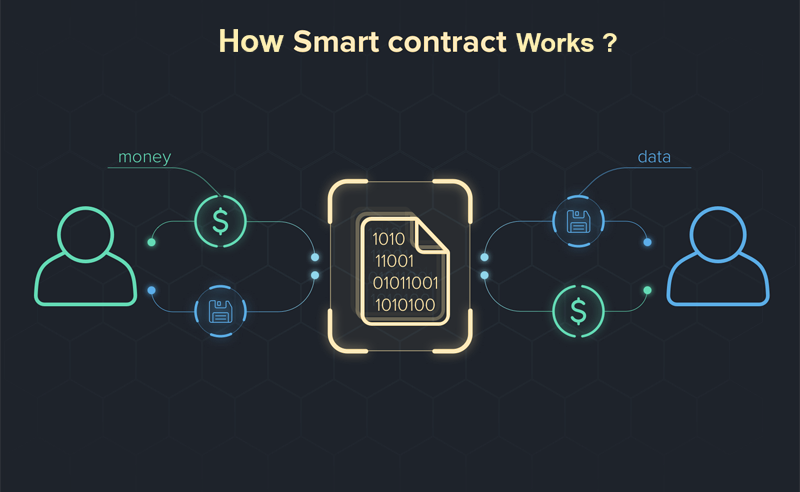

The first question that obviously hit your mind might be- What is Ethereum Smart Contract? In simple terms, a smart contract is like a traditional contract but made on blockchain technology and facilitating the transaction in digital assets. It can be defined as programmed/user-defined codes or protocols validating the transfer of payments among the people associated with that contract. Also, it is in a way account to satisfy common contractual conditions according to which calculation of transacting tokens take place.

Particularly, Ethereum smart contract is a script written in Solidity coding language and compiled in JSON (lightweight data-interchange format) and utilized by a particular address on the blockchain. Like you call a URL endpoint of a RESTful API to run any logic via HttpRequest, similarly smart contracts can be executed at a particular address after entering precise data on the Ethereum network to call the Solidity function (compiled and deployed). In a way, Ethereum smart contract can be termed as the fee proportional to the storage size of the block containing codes.

How Does Ethereum Contract Work?

Do I need to sign an agreement? Do I need a stamp paper to make a contract? What if, the other party back off? How does Ethereum smart contract work? Many of the similar questions might be banging in your head related to digital contracts. Let us help in clear some of your doubts. So, smart contract works on the principle of “If-Then”. If you pay a certain amount of your digital assets, Then the particular object or thing or any asset mentioned in the contract will be yours or you will own that thing. Ethereum network covers the issues related to the security and safety of your funds by priorly asking for your wallet address and providing the services related to the escrow account. The risk of losing the money or the transfer of a particular object gets minimalized by the blockchain network of Ethereum. Thus, smart contracts functions in an automated way leaving the possibility of negligible fraudulent practices.

How To Develop Ethereum Smart Contract?

Developing the Ethereum smart contract might not be a simple task if you are not skilled in particular coding language deployed by the Ethereum network. But through this guide to Ethereum smart contract, you can try to understand the process and requisites needed to build a contract.

Tools Needed To Write Smart Contracts

Before developing the Ethereum smart contract, you need to make sure that you have the listed tools in your system.

- Mist Browser: You need to download separate browser to interact with dApps needed to run Ethereum smart contract

- Truffle Framework: This tool is a development framework for Ethereum having built-in smart contract compilation, linking, deployment, and binary management.

- MetaMask: This tool helps in testing the Ethereum smart contract by allowing users to run Ethereum dApps in their browser without running all the nodes.

- Remix: It is a web browser-based Integrated Development Environment (IDE) allowing users to code in Solidity (contract oriented high-level language) smart contracts and then running and deploying them.

How to Build Smart Contract On Ethereum?

You can build a smart contract by going through the following steps:

- Once you had installed MetaMask in your browser, you need to create the wallet on the browser. Select or assure that you are working on Ethereum Network on the Meta browser.

- Now, you can start with writing the conditions of smart contract on the Remix browser IDE in Solidity programming language. With Remix, you can enjoy the features like checking overlapping variable names, syntax, error highlighting, integrated debugger, and many more.

- You need to create a .sol extension file on your browser by clicking on the “plus” icon on the left side.

- After you are done with coding, select the appropriate version of Compiler from Remix to compile solidity Ethereum smart contract code.

- Finally, you can utilize the smart contracts at the Ethereum test network by clicking on “Deploy”. Wait till the address of your smart contract is visible on the window of Remix.

- Don’t forget to have a test run of your code before deploying it to the mainstream.

Creating an Ethereum can be a daunting task, but the essential knowledge and individuals having the skills of writing codes can easily build Ethereum smart contracts.

Summing Up

Blockchain technology amazes with every new concept introduced on it. And now it is a smart contract which must be appreciated for its functionality, security and performance. Smart Contracts ensures the accuracy, timely transaction, and less chances of inaccuracy. Unlike the traditional contracts, alteration of the smart contracts is not an easy task, which helps in assuring the authenticity of the contract. This guide to Ethereum smart contracts mentions that Ethereum blockchain made the task of building the smart contracts easy as it provides the platform with inbuilt customizable protocols like that of ERC20, which can reduce the pain of coding the contract from scratch. Many other platforms like NEO, Nxt is also available for designing the blockchain-based smart contracts. With a number of benefits, smart contracts can be easily deployed in any type of process whether it is supply chain management, administering the logistics, database keeping, records maintaining while avoiding the chances of fraudulent practices.

Articles You May Read

- Cryptocurrency digest: US law enforcement caught crypto scammers

- Cryptocurrency Airdrops | Know Everything About Latest Airdrop

- How Does Blockchain Smart Contract Work? | Complete Guide On Smart Contract