Bitcoin was born in 2008 amid the infamous global financial collapse. Cryptocurrency or Bitcoin was born to facilitate privacy-oriented value storage and transfer of digital assets. One of the main aims of the introduction of Blockchain-based crypto assets is to avoid the interference of the intermediary or any central entity with an effort to protect the identity of the customers while maintaining the security on the transparent network. The central element of their philosophy was to combat the inherent distrust of the states in favor of sovereignty and self-determinism of the individual. But as the industry started to grow, many criminals started invading the crypto space and government regulatory bodies started imposing the rules and regulations to create a conducive environment for the investors. Some of the players followed the protocols while others just stuck to the core principles of anonymity and privacy. In this article, we are going to discuss KYC compliance which was being imposed by the several authorities and the exchanges who consider that KYC non-compliance can retain their core principles.

Why Do Some Crypto Platforms Consider KYC Unnecessary?

Wendy McElroy, author of The Satoshi Revolution advocated that the government should not be permitted to monopolize the financial affairs of their citizens. The term “law” turns into the matter of power or dominance of people of government authorities. In terms of regulation, crypto space lacks a consensus in protecting investors. Some exchanges have deemed Know Your Customer (KYC) as unnecessary claiming that it infringes the right to privacy of users while others consider the regulations as the obligation to perform KYC.

Non-compliant crypto exchanges argue that KYC Compliance discourages new investors, increases the cost of compliance, and hampers innovation also. One of the renowned exchanges, Kraken advocated the cost of compliance related to handling subpoenas as turning into a barrier of entry. Rather than dissuading the criminals and enhancing transparency, many of the traditional crypto investors advocate that KYC compliance financially excludes billions of unbanked populations lacking documentation. Critics of the regulations remain convinced that regulations harm more than good. While some exchanges are evading the compliance by operating offshore and bans US investors from signing up, the majority of the platforms forcefully to regulatory demands or face the results.

KYC Non-Compliance | Platforms Not Requiring KYC Authentication

Are you interested in buying cryptocurrencies without the chaos of the KYC process and trust enough on your platform for maintaining your funds? In this section, you will get to learn the various exchange platforms where KYC compliance is not necessary.

Centralized Exchanges | KYC Non-Compliance

- Binance: One of the renowned crypto exchanges with more than 6 million users, Hong Kong-based exchange with huge trading volumes does not ask to complete the KYC procedure for trading less than 2 BTC for non-US investors. But if you have to trade more than 2 BTC you need to complete the KYC procedure. With high-level security protocols in its infrastructure, Binance has to be compliant with regulations to avoid heavy penalties.

- Kraken: US-based crypto exchange Kraken is also popular among the crypto investors which is also KYC non-compliant and trust on its infrastructure to maintain the security of the funds of the users and respects the core principle of anonymity of crypto space.

- KuCoin: Crypto to crypto exchange platform hosting more than 450 trading pairs with high trading volumes and meager transaction fees also have the hassle-free login process without any requirement to complete the procedure of KYC.

- BitFinex: Launched in 2012, it was initially peer-to-peer exchange but turned to a centralized crypto exchange which allows the users to trade, deposit and withdraw funds up to 10 BTC worth a day without any KYC compliance or procedure but about that users have to provide the details to identify the entity.

Decentralized Exchanges | KYC Non-Compliance

- ShapeShift: The [perks of using decentralized exchanges is that you do not have to create your account to buy or sell cryptocurrencies and also you need not submit the personal details for trading, withdrawing, and depositing the digital assets. There is always a challenge for these exchanges to maintain security along with anonymity. Shapeshift without being KYC compliant assures that users can safely trade by maintaining some of the terms and conditions like keeping all assets of affected users for making refund claims within 90 days. With a variety of crypto assets along with Bitcoins, it allows us to swiftly swap the coins either with fiat or crypto.

- Changelly: Changelly is also a decentralized exchange that instantly offers the peer-to-peer exchange of the crypto assets. Serving more than 15000 exchanges a day with more than 100 coins to trade, Changelly is a well-known platform for maintaining the safe network being non-compliant of KYC norms. Users with legitimate wallet addresses can use the platform for the swapping of crypto assets.

- OpenLedger: DEX platform created on the BitShares Blockchain network allows users to list their coins or exchange their digital currencies with the other users connected to the platform. Users can easily convert BTC owned by them or EOS paired with BitShares token to fiat-backed SmartCoins, which can be easily cashed out by utilizing the gateway of Ripple, Paypal and many more. The platform also supports a number of stablecoins.

- IDEX: It is a decentralized exchange specifically for Ethereum and Ethereum based tokens boasting the high trading volume. Users on the IDEX platform are known by their wallet addresses rather than verified personal details.

Summing Up

In the present scenario of increasing crimes and cyberattacks, there has been the question in the crypto space- Will KYC Non-compliance can create the conducive environment for safeguarding the investors and retaining them in crypto space. Some of the core believers of the Blockchain-based cryptocurrency might argue that the highly secured cryptographic infrastructure can safeguard the interests of citizens along with maintaining their anonymity. To maintain financial sovereignty, personal freedom and liberty are the main features of the Bitcoin space which must not be hampered by the regulators after imposing certain compliance and discourage the new investors or platforms who can accelerate the crypto movement in future.

Articles You May Read

At the time when even the digital payment system is not known, Satoshi Nakamoto introduced the concept of digital currency with Blockchain-based Bitcoin. Initially, Bitcoin or cryptocurrency was not accepted and it costs only a few cents. But after the prices skyrocketed in 2017 and the investors started considering it as the source investment, the demand for the cryptocurrencies increased all across the world. As the industry started growing, the threat of money laundering, scams, forgery and many more also came in the picture. To assure that decentralised crypto space does not turn into the dark web, regulators made some compliances, rules and regulations essential for crypto stakeholders. In this article, we are going to discuss KYC Compliance which is mandatory not only to confirm the set of rules and regulations of regulatory bodies but for the purpose of safeguarding own business and financial interests.

What Does KYC Compliance Mean?

KYC Compliance or Know Your Customer process or identity verification process is not a new concept but already associated with financial institutions. Still, to freshen up your memory, it can be briefed as to the process of identifying that you really are who you say you are with the help of authenticated documents containing your personal details. The main purpose of this process is not only to safeguard the interest of institutions involved but to make sure that individuals are protected from fraud and also from identity theft.

KYC Compliance or Know Your Customer process or identity verification process is not a new concept but already associated with financial institutions. Still, to freshen up your memory, it can be briefed as to the process of identifying that you really are who you say you are with the help of authenticated documents containing your personal details. The main purpose of this process is not only to safeguard the interest of institutions involved but to make sure that individuals are protected from fraud and also from identity theft.

As the huge number of investors are putting their money in digital assets, the entire process of KYC has become essential to safeguard the interests and money of the community. KYC process is a two-step online process in case of digital currency in which you need to confirm your phone number by entering the specific OTP sent to your number and provide the personal ID to verify your identity on various platforms of crypto exchanges, wallets and many more in the crypto market place (Don’t worry, it is a one-time process and is completely online!)

How KYC Compliance Can Encourage Better Crypto Space?

Traditional crypto enthusiasts and investors consider that KYC compliance can hamper the basic structure of decentralisation and anonymity of the blockchain-based cryptocurrency. But, modern players in the industry are exploring the advantages of KYC procedure for the growth of Bitcoin and diversification of crypto industry. Let us discuss the KYC with the eyes of the supporters of the process:

Compliance To Regulations

Government agencies and financial regulators all across the globe are imposing strict regulations on the Bitcoin industry (because when they can’t manage, they thought of regulating it!). For instance, in the USA, FinCEN imposed the rule on every crypto exchange to complete the KYC process of users and follow effective AML rules; similarly, legislators in the EU imposed the KYC rules on fiat to crypto exchanges like that of Coinbase. With the aim to prevent money laundering and safeguard the money of users from fraud, government authorities and watchdogs needed the compliance of exchanges by completing the KYC Authentication process, in a way making the crypto industry less deceptive. So, it would be better for exchanges to adopt the digital KYC process, otherwise, they may invite the resistance from investors along with delayed recognition across the world.

Legitimacy

The KYC authentication process offers a great opportunity for crypto platforms and crypto enthusiasts to earn credentials and legitimate status. This tool to regulate the cryptomarkets aims to stabilize the exchanges in the coming years. People are still sceptical and have doubts while investing in digital assets, but staunching KYC programs are serving the purpose to signify that the crypto space has legitimate entities.

Transparency

As per the modern crypto investors who wish to boost the legitimate status of the crypto industry considers that KYC is not an artificial tool which can undermine the functional aspect of crypto exchanges but can ensure transparency. As virtual currencies and exchanges have their history by scams, hacks, attacks and many more, new investors hesitate to invest in the currency. By the implication of KYC procedures, exchanges can demonstrate the transparency and trustworthiness of the network. Systems involved in verifying the identities do not aid the customers only but exchanges also by verifying and breeding the trustworthy customers.

Anonymity

Anonymity is one of the features which is being described uniquely to crypto space. But in a way, it has added to the problems leading to increased criminal elements including the risks of money laundering and threats of terror funding. Enhanced and trustworthy KYC solutions can aid in solving issues related to anonymity without hampering the technological aspect of the feature. Especially, in the peer-to-peer exchanges, unfortunate traders can easily be trapped in the high-end tactics like that of dots and commas, chargebacks, dirty money tricks and many more of the scammers. In this sense, KYC regulations play an important role in highlighting high-risk users and weed out criminals.

Safety

For the users to completely trust in the system, they need to be assured of the risk management system of exchanges. Security of customers with KYC solutions can shape up the multi-layered safety approach to the cryptocurrency transaction. Also, crimes like tax fraud, terror funding, money laundering and many more which can be easily avoided by following the KYC solutions. Thus, authentication through the process of KYC can help in detecting the spoilers of crypto space and minimise their impact on the industry.

Summing Up

Generally, well-reputed exchanges are deploying KYC solutions to assure a safe and transparent platform. For instance, Coinbase uses digital ID solution along with biometric facial recognition to ensure the KYC regulations while a user is selling or buying the coins on the platform; Binance ask the users to submit the copy of PII, valid government ID and social security number for the users of USA trading with more than 2BTC; peer-to-peer Bitcoin platform Paxful deploys the AI-powered identity verification system to the know-your-customer procedure to minimize the risk of fraud and guaranteeing the safe along with open system; India’s largest exchange CoinDCX digitally automates the procedure of KYC with the help of Onfido’s technology. Thus, achieving the goal of deploying the solutions for KYC Compliance could help in revolutionising the crypto space and achieving the large scale adoption of cryptocurrencies.

Articles You May Read

Cryptomarkets are diversifying at a huge pace across the globe after the prices hiked up to $20,000 in 2017 in some of the crypto exchanges. Investors are considering the cryptocurrencies as the opportunity to double their money in no time. The price of Bitcoin is affected by several factors like demand-supply, historical trends, announcements, crypto whales and many more. In this article, we are going to discuss one of the major factor reflecting the price of cryptocurrency, i.e. Bitcoin whale. Whales in cryptomarket are the big fishes having a strong impact on the market. They are the people with a massive amount of money which have the potential to alter the markets. Thus, it is important to know about them before making any strategy of investment.

Who Is Bitcoin Whale?

In the context of money, Bitcoin and crypto space are ruled by the top 500 hundred holders of the cryptocurrency called “whales”. Bitcoin whale can be institutional investors, significant entities of traditional markets, maverick funds who ventured into startups or the big industrialists turn investors. As they hold a massive amount of or a significant portion of the circulating crypto coins, their moves can cause the tidal waves in the crypto markets resulting in the change in prices of highly volatile cryptocurrency. Considering the already volatile situations and manipulations of price by other factors, Whales’ disproportionate power adds the problem in the crypto market place for the beginners who knows less about their impact.

By the analogy, if the crypto market is a stormy ocean and small fishes move with the current to survive and earn the profits in the crypto industry then there are big fishes like that of whales who can influence the current while getting hold of the storm of volatility in bear markets. When the whales act combining together then they can even deflect current in the direction for themselves. Whales always wish to maximize their profits from larger trades by convincing the small investors, assessing the mood of retailers and analysing the willingness of participants of crypto market players to follow the particular direction of the current.

How Do Bitcoin Whales Influence The Crypto Markets?

Indirectly or directly, Bitcoin whale (s) decide the rise and fall of the prices of cryptocurrency in the market by purchasing and selling the huge amount of crypto coins. Once they found the opportunity, they use different tactics to influence the markets.

Panic Sales Trigger/ Rinse and Repeat

Sometimes it is being noticed in the crypto markets that price of Bitcoin drops violently without any major announcement or recent development, but some of you might get an idea that sudden fall is the result of the superpower of Whales. The situation of sudden drop generally results in further sell-off (even the traditional HODLers sell some portion of BTC amid the dramatic fall). Whales try to play with the psychology of the small investors who tend to sale more of their assets under the panic of crashing cryptomarket. But after the price lowers down as per their strategy, they tend to purchase the coins at a highly lower price to profit from the recovery. This tactic is known as “rinse and repeat” in which whales tend to force down the prices with the motive to trigger panic selling. Thus, when you notice the sudden price drop of around “10%”, then try not to sell your assets in anticipation but wait for some time to see the market recovering.

Utilizing Buy and Sell Walls

Absence of large banks and relatively clueless participants than traditional markets, whales find the crypto markets as the paradise for speculation and earning the huge profits. Sometimes, whales do not have to either sell or buy their cryptocurrencies to manipulate the markets, they can bluff with buy and sell walls. Crypto exchanges maintain the order books to aid the traders by setting up the order to purchase or sell at a particular price (not that of spot price). Suppose, when the market drops, traders tend to buy at the lower bid and sell when the price touches the higher level. But to place the order, one needs to have sufficient funds to cover the orders. Thus, whales in several ways can deceive the traders by creating illusionary selling or buying wall.

OTC Markets and Dark Pools

Most of the crypto whales are the early birds of the crypto markets with a huge amount of capital and influence in crypto markets. Whales generally operate together to coordinate their actions even when they operate from the over the counter trading platforms or dark pools. Institutional investors sometimes purchase huge amounts of Bitcoins from dark pools to avid being noticed in traditional exchanges and plan to execute a more thoughtful strategy. Generally, OTC and dark pools indirectly push the whales to influence the Bitcoin markets.

Summing Up

The dominance of whales is not new to the crypto market place, neither called as well know to the small investors and beginners in the crypto space. Mainly, whales are those few people who trusted the potential of Bitcoins at an earlier stage and grab as much cryptocurrency as they could with a handful of dollars. Becoming a whale with the present price of Bitcoin might be expensive but you can save yourself from the influence of whales easily by understanding the trends in the crypto marketplace.

To turn the marketplace into a non-manipulative place by whales, the crypto community needs to be expanded who can at least own few of the coins. As the community of small investors grow, the influence of the whales can be diluted gradually. Undoubtedly, it is difficult to take Bitcoin away from whales but buying and selling not according to them might drag away the crypto markets from whales. Our small investments can bring evolution into crypto space and can create the level field for the investors wish to enter into crypto space and want to earn from the money they can afford to lose without worrying about the Bitcoin whale prevalent in the market.

Articles You May Read

Blockchain technology which came into the picture after the introduction of Bitcoin in 2009 through the whitepaper by Satoshi Nakamoto. Though the technology was known before also but the Bitcoin made it popular. Presently, Blockchain is not only limited to the financial industry but has diversified in other fields also like that of healthcare, education, agriculture, automotive, gaming and entertainment and many more. Basically, the fact that Blockchain technology is based on a decentralised model where the intermediary is not needed to maintain and administer is needed, attracted many industries. With the added advantages of transparency, security and privacy of the network which is assured by the Blockchain, many organisations are deploying the technology into the mainstream. In this article, let us see the Blockchain in gaming industry.

Blockchain In Gaming Industry | Applications

Gaming industry especially the online platforms are captivating the interest of a number of players across the world. But as the players are increasing day by day, the number of problems are being faced by them related to security, projection of the value of rewards, control over the favourite games, transparency is distribution, shutting down of game if the server fails and many more. Blockchain technology started rescuing the gaming industry and found the applications and the opportunity to revive the industry in the following ways:

Secure Environment for Developers and Entrepreneurs

Cryptographic techniques like private keys for a transaction, digital signature authentication and many more are deployed by the Blockchain to add the extra layer of security. As a developer of any game or entrepreneur developing the network for supporting particular games can assure the security from cyber attacks like DDoS, malware, ransomware and many more by deploying the Blockchain technology. Accessibility of the network can be given to a few of the participants on the basis of consensus mechanism and the security and safety can be assured.

Assures Removal of Grey Markets Trading

Game developers are supposed to design their games in closed ecosystems which assures that the value fed in the system cannot be extracted. If a player wants to sell his assets in exchange for money or wish to utilise in another game, he has to follow the days’ long procedure and finally turning to the grey market. Blockchain technology allows the owners to embed the rules into tokenized assets which would only impose the transaction fee every time the token been used for the transaction. Thus, the player will be to utilise the token in the way he wants to and this behaviour may lead to the ever-growing grey markets.

Ensures Interoperable Profiles of Players

Generally while playing different online games, you have to create a login account and set up the payment options by either filling your card details or online wallet details. But if Blockchain technology will be deployed in the gaming network, then the interoperable profiles of players can be assured. For instance, a unique public address can help you in playing different games rather than creating an account every time. Also, a transaction in cryptocurrencies from similar public address can be assured in a hassle-free manner with lower transaction fees.

Faster And Assured Transaction Of Rewards

Sometimes, the transaction after the game has been completed online, takeS longer than usual time to get transferred to the winning players. This results in decreasing credibility of the gaming platform along with decreased traffic too. But the smart contracts deployed by the Blockchain Technology can assure the timely payment. Smart contracts are meant to govern the transactions based on the pre-written conditions inside the contract and agreed by both the parties which ensure the timely payment along with maintaining the utmost transparency in the system.

Increased Control Of The Players

In the gaming industry, most players are at the disadvantageous end due to lack of any control over the games they wish to play or lack of notification of the changed rules, payment policy, number of players and many more. Decentralised apps based on Blockchain gaming platform can assure the tamper-proof or non-immutable data, even if it changes, it would be automatically informed to players connected to the network. With the decentralisation model, interference of middleman can be avoided, establishing direct contact between the players and owners of the game.

Allow The Infusion Of Creative Ideas

Either you are a developer or player in the gaming industry, you always crave for sometimes better or always have some better ideas. But either due to lack of developing skills or lack of knowledge of what actually players want to experience, you end up with the usual gaming. Blockchain applications in gaming will give you to learn to develop the DApp, building your games with the open-source codes, enable open communication between player and developer due to no centrality entity to control the structure and many more ideas to infuse for having the games meant for an adrenaline rush, brainstorming and fun along with winning the prize.

Some of the players inspired by the utility of Blockchain Technology developed hundreds of DApps and games as gaming Blockchain projects. Basically, Dapps functions on Ethereum blockchain network along with other blockchains like EOS, TRON, NEO and many more. Games like Cryptokitties, Gods Unchained, Cheeze Wizards, HyperSnaakes, EOS Dynasty, etc.

Summing Up

The intersection of Blockchain technology and the gaming industry is like making the lifelike reality possible in a virtual world. With the advance in Virtual reality, 3D mapping and many other technologies in the gaming sector, Blockchain is also trying to reinventing the experience of all the stakeholders of the industry. Blockchain in the gaming industry is not only meant for developers and entrepreneurs but for the players’ experience too. The new technology and online gaming can be the inseparable partners creating the history of Blockchain gaming for maintaining the transparency, security and ging value to the assets of the industry. Not only this, but it can also result in the expansion of the gaming industry due to evolved experience and increased facilities and the community.

Articles You May Read

Since the launch of Bitcoin in 2009, thousands of crypto coins or altcoins have flooded the digital marketplace. While some coins stay and others just swipe off if they do not have enough unique features to captivate the interest of investors. In this guide, we are going to talk about the recently hyped Dogecoin. Some of the animal lovers might get attracted with the cute fluffy face of Shiba Inu which is like a trademark of Dogecoin but some of the crypto enthusiasts might be aware of the fact that Dogecoin was created as a joke. Dogecoin is the sixth oldest currency of the crypto market place and was launched in 2013, is known to be one of the fastest-growing cryptocurrencies of the world. Let us explore more about the Dogecoin value which was started as a joke and now a viable currency.

What Is Dogecoin? | Dogecoin Value

Dogecoin or Doge was founded by Billy Markus and Jackson Marker in the cryptomarket on December 06, 2013. At the time of launch, it was open-source code and did not expect to gain traction in future. It was taken as a joke initially because the name “doge” was inspired by the meme and the community considered the coin as a joke. To keep the joke rolling in the crypto space, many of the investors kept on purchasing the coin and the market capitalisation continued to increase. Within just a few months, the coin which was started as the joke raised massive funds, became the star of the crypto marketplace and captured a huge percentage in crypto share. Ultimately the production of coins or Dogecoin mining increased as within two years of launch 100 billion coins were in circulation across the world which is growing till now. Recently, amid the pandemic and decrease in the credibility of Chinese mobile apps, Dogecoin news flashed that the circulation of coins has certainly increased by a huge percentage.

How? | Where? | Buy Dogecoin

Like any other cryptocurrency, you need to have a crypto wallet before purchasing or buying the Dogecoin either from centralised or decentralised crypto exchanges. Dogecoin being Reddit famous, so you can also find the Reddit subreddits willingly offering the help to purchase Dogecoins. One of the most common ways to buy Dogecoins is to log in on any reputed exchange either fiat to crypto or crypto to crypto (Binance, Poloniex, Bittrex, Kraken and many more) and can buy the number of coins from bank transfers, credit or debit cards, Paypal, etc. Another method is to sign in decentralised exchanges or the exchange offering the peer to peer exchange like Changelly, Shapeshift, Coinmama and many more. Just like any other cryptocurrency, you need to find out the seller of Dogecoin in return for the coins you hold and you can simply exchange them after the negotiation.

Storage of Dogecoins | Dogecoin Wallet

The easiest way to store your Dogecoins is your own hardware crypto wallet which can keep your coin safe and secured. Another simple way is to download the Dogecoin wallet from their website as per your requirements and compatibility of the operating system. Crypto Wallets actually stores the digital codes of the transaction, not any kind of coins. So, if you wish to have the best Dogecoin wallet, you can choose from the following options.

- Software Wallets: Website of Dogecoin offers two software wallets which can be downloaded from their site easily. First one is Dogecoin core which contains the Dogecoin Blockchain and can turn your system into a Dogecoin node. The second one is MultiDoge, which stores the information to utilise Dogecoin.

- Online Wallets: Online wallet available on the official site of Dogecoin allows you to secure your private keys with the customised features.

- Paper Wallets: Printable wallets which can be kept secure at any vault can also be used to store the keys of Dogecoin. Paper wallets can be easily generated from websites like Bitaddress, etc.

- Hardware Wallets: USB like devices are considered as the safest crypto wallets available in the market. You can choose from Ledger, Trezor and many more from any website and deliver it to your home. These hardware devices are compatible to store Dogecoins also.

Is Dogecoin A Good Option For Investment?

Cryptomarket is highly volatile and it would be difficult to advocate if the coin is good for investment or not. Let us still try to find out if Dogecoin price can prove to be a source of earning profits or not.

- With incredibly lower transaction fees and faster transactions with relatively stable value, traders are utilising Dogecoin as a means of trade and investment.

- Dogecoin is used for withdrawing money from a crypto exchange as it is less expensive than Bitcoin. So, many of the traders can be chosen to first trade their Bitcoin for Dogecoin and then withdraw the currency as Dogecoin before converting into something.

- Many of the investors use Dogecoin for speculation purposes by purchasing the hundreds of coins without spending a fortune and even a small increase can make reasonable gains.

- Dogecoin is accepted by various reputed exchanges,(both centralised and decentralised) so it can be said that the coin can be considered as the good option for investment.

- Short block time of Dogecoin gives the added advantage to it as it becomes more accessible than Bitcoin. Thus, Dogecoin can be easily accessed from crypto markets. Thus, Dogecoin can be an interesting cryptocurrency and can be the option for investment in crypto markets.

Summing Up

Dogecoin was initiated as a joke and was constructed after the meme of Dog but gradually strengthened its position on the charts of the top 50 cryptocurrencies in terms of market capitalisation. Recent events and Dogecoin price are showing that the global adoption of this cryptocurrency is increasing at a higher pace with a better chance of survival. Dogecoin value is increasing day by day though it has faced the downfall in the past, but presently it seems that it can prove a good option of investment and can aid in earning high profits in future.

Articles You May Read

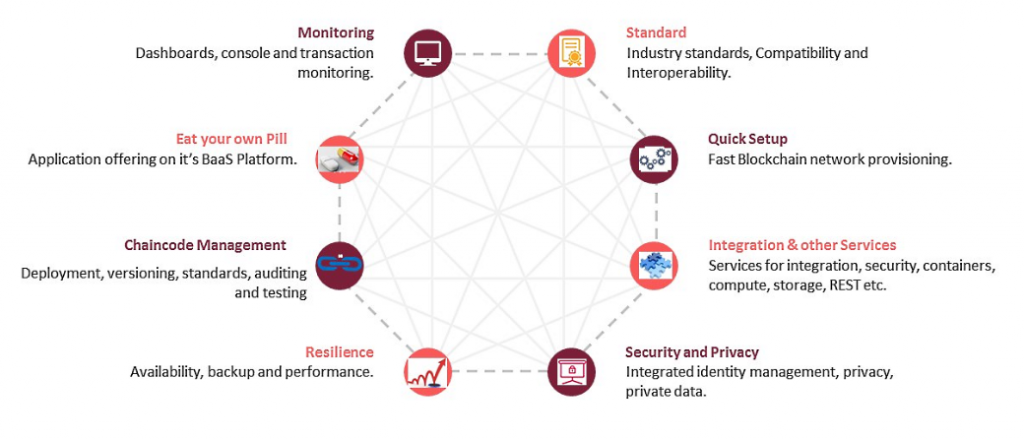

The Fourth Industrial Revolution is pacing up in all the dimensions with the technological advances and extraordinary efforts of the humans. The businesses are pushed to the razor’s edge with the intervention of technologies like Artificial Intelligence, Internet of Things, Blockchain, Cloud computing and many more. In this article, we are going to talk about Blockchain as a Service solutions which are successfully transforming the IT sector while maintaining their core competencies. Blockchain is still in the nascent stage, still misconceived as the technology meant for the fintech or financial sector and trying to constantly grow among the businesses and individual communities. Let us start the BaaS journey which might help you in the early adoption of Blockchain.

What Is Blockchain as a Service (BaaS)?

Blockchain as a Service (BaaS) is a kind of Blockchain services that offer business customers to deploy cloud-based solutions. It helps in developing, hosting and adopting their blockchain applications like smart contracts, Decentralised Apps and many other solutions along with partnering cloud-based IT infrastructure for the management of the required tasks and activities to maintain the functioning. Blockchain landscape has achieved the milestone with the emergence of Blockchain As A Service in the mainstream which can aid in accelerating the adoption of distributed ledger technology in the sectors beyond the cryptocurrency.

Need Of Blockchain as a Service Solutions To Organisations

As per blockchain as a service pdf of reputed surveys, organisations whether IT or non ITs constantly explores the adoption of tech-based solutions to ease out their operations. Nowadays, BaaS is considered as a viable solution to the major issues faced by industries. blockchain as a service benefits can be stated as:

- Savings: The aim of every enterprise is to have profit or cost saving in their every process of development. BaaS solutions can help in saving costs related to the recruitment process, managing the employees’ headcount, administration of internal expenses and many more.

- Easy To Use: With the help of BaaS providers, your enterprise can have the exposure of pay and plug templates within a short time frame with essential programming languages. Businesses can leverage the already made platforms to circumvent the research process.

- Customization: In house tech teams can focus on the requirements of businesses rather than platforms and can mould the platforms accordingly with the BaaS providers which will take care of the management of bandwidth, allocation of resources, security protocols, etc.

- Optimisation of Resources: BaaS providers ease out the operations and allow the IT team to focus on the core strengths and helps employees to dedicate themselves in value-adding projects. Thus, results in the optimisation of resources.

Working of BaaS Model | Explained

Blockchain or blockchain-based services are considered as one of the high-end technologies which is difficult to understand. Let us try to explain the Blockchain as a Service solutions in simpler words. When any company or customer signs up for the contract based on Blockchain or BaaS with an IT partner, an agreement is made where the BaaS partner sets up the necessary infrastructure for Blockchain to work along with other activities like management of bandwidth, incident administration, prevention of cyber attacks and many more, for a predefined service fee mentioned in the contract. The responsibility of maintaining the Blockchain related artefacts and the proper functioning of the infrastructure is of BaaSpartner only. Thereby, Baas helps in empowering the customers in executing distributed ledger workloads with a high degree of fault tolerance.

Choosing Right BaaS Partner | Parameters To Consider

Some of the basic parameters must keep in mind before choosing your BaaS partner like:

- Backend Services: With the unique needs of the business, backend services differ. The compatibility of backend with mainstream technologies must be considered while opting for a BaaS provider.

- Data Security: Data is the new oil in this digital era which must be protected at any cost. Make sure your data is secured enough and protected from vulnerabilities from the associated BaaS provider.

- Cost control: As compared to many other platforms, BaaS offers highly cost-effective solutions to the organisations. But you must always look for the hidden charges if any.

- Integration: With multiple layers of processes, workflows and many more, companies must adopt the BaaS which could easily integrate with the system and does not affect the already running system.

Blockchain as a Service (BaaS) Service Providers

With a rich source of practical experience of the industry and wisdom, BaaS service providers can help you in revolutionising your business. Some of the premium service providers are:

- IBM Blockchain platform: Developed by the tech giant International Business Machine (IBM) back in 2008 to provide the public cloud service for the development of Blockchain platforms.

- Microsoft Azure: Azure was developed by Microsoft to provide a platform for the development of high-quality Blockchain applications.

- Amazon Blockchain Template: With inbuilt Blockchain templates to save up the time and energy of customers, e-commerce giant Amazon developed the Blockchain platform to deploy high-end Blockchain applications.

- Oracle Blockchain Cloud Service: With the number of customised features, Cloud service platform of Oracle is known for high-performance Blockchain applications.

- Baidu Blockchain Open Platform: Chinese search engine Baidu offers the open platform for the designing of user-friendly Blockchain services.

Summing Up

As per the recent survey of Gartner, many of the enterprises have started replacing the applications with Blockchain as a Service solutions for the last two years. It can be considered that Blockchain is not only being hyped but adoptable by enterprises. Undoubtedly, Blockchain requires the understanding in terms of laws of security, decentralised model of governance, commercial architectures and many more but once the concept is understood, it can do the miracles in the industry. Blockchain as a Service has strengthened the market presence and has developed the faith among enterprises for the Blockchain technology. Blockchain might be associated with cryptocurrency only in past but the present and future will be linked to the number of applications, services and products all across the various sector for the management of data in the transparent network while maintaining the privacy and security.

Articles You May Read

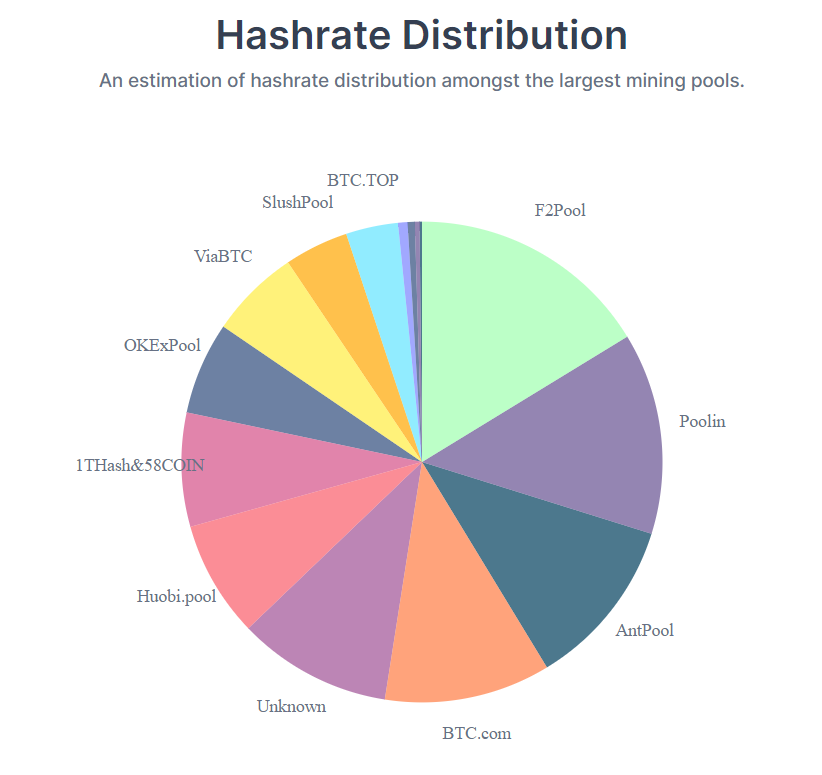

How do cryptocurrencies are produced? They are not physical money which can be printed or minted. Cryptocurrencies are digital assets which are mined. Don’t get confused, it is not at all similar to digging metals and non-metals from layers of Earth. In crypto space, mining is the process of validating the transactions and updating the block of information in the Blockchain. In short, mining is responsible for the existence of cryptocurrency. As it requires high computing power, mining hardware and software and also the coding expertise, most of the people who even mine the coins earn the crypto coins as the incentives used to remain far away from the process. But as the crypto sector started diversifying, many mining pools were introduced which gave you an opportunity to mine the coins. In this article, let us learn more about free Bitcoin mining sites or mining pools.

What Is a Mining Pool?

Miners or the participants connected to the Blockchain network solve the complex mathematical algorithm to enter a new crypto coin into circulation. As a result, miners who managed to crack the problem are rewarded with some coins. The crypto industry is expanding, as a result, mining difficulty is also increasing due to the larger involvement of miners. Mining pools came to the rescue when the mining started becoming non-profitable due to the increased hash power and heavy electricity bills. Mining pools are the group of miners who wish to pool their resources(mining) to increase their combined hashing or computational power. Pools manage to validate the transaction faster than the solo miner, then the rewards will split among the members of the pool depending upon the payment method. Mining pools are the opportunity to earn rewards via the process of mining just by sharing your computational power.

How To Choose a Mining Pool?

There are a number of mining pools available in crypto market space. You might get confused while choosing one of them. To select the pool, you should at least consider the mentioned parameters:

- Pool Size: In crypto mining place, bigger the pools means the regular payments. But with the smaller payouts, the profit is shared among a number of members. In the smaller pools, the opposite situation exists.

- Fees: Some mining pools are free of cost while some charge up to 4% of the rewards depending upon the features offered by them.

- Reliability and Security: Cybersecurity is one of the most important factors which must be considered while choosing the pool. Also, the mining pool must be reliable who don’t steal or deceive the funds of the members. You can read the review on the web before selecting the pool.

- Payout Policy: Make sure to read the payout policy, if the pool is paying the rewards on a regular basis or monthly or after every block validation.

Types of Rewards Offered By Mining Pools

There are varied kinds of rewards offered by the mining pools depending upon their payout policy. You must be aware of those type of awards:

- Pay per share (PPS): Fixed amount is paid to each user after the submission of shared computing power.

- Proportional: Award proportional to share contributed will be paid to users.

- Score based: Prominence is given to the newer shares and rewarded on the basis of submission time.

- Pay Per Last N Shares (PPLNS): Vary with the rewards each share paid in multiple rounds.

- Fully pay per share (FPPS): Similar to PPS but transaction fees get distributed (proportional to hash power) among the miners along with rewards.

- Shared Maximum Pay Per Share (SMPPS): Similar to PPS but lesser share than earned is paid to members.

Based on the payout policy, mining pools differ from Bitcoin cloud mining as mining pools involve sharing of rewards in accordance with share while in cloud mining, you need to pay the service provider of mining and get the rewards.

Best Bitcoin Mining Pools

Since 2010, after the first mining pool was launched, various service providers invaded the crypto ecosystem with a number of features. Let us find out a few of the most popular pools:

Based in China, Poolin is known to mine around 18% of all the blocks. While providing worldwide access with decent support of cryptocurrencies, Poolin charges a 2.5% FPPS BTC fee of the rewards earned. It was founded by the employees of one of the popular crypto exchanges and stands among the top five mining pools in the world. Not only Bitcoins but BCH, BSV, LTC and many more coins can be mined.

Based in China, Poolin is known to mine around 18% of all the blocks. While providing worldwide access with decent support of cryptocurrencies, Poolin charges a 2.5% FPPS BTC fee of the rewards earned. It was founded by the employees of one of the popular crypto exchanges and stands among the top five mining pools in the world. Not only Bitcoins but BCH, BSV, LTC and many more coins can be mined.

F2Pools also stands among the top 5 Bitcoin mining pools in the world, mining almost 17% of total BTC blocks. With low pay threshold and daily payouts, F2Pool has become popular among the mining enthusiasts. With the PPS reward system, it charges 2.5% fees, supporting LTC, ETH, ZEC and many more along with BTC.

F2Pools also stands among the top 5 Bitcoin mining pools in the world, mining almost 17% of total BTC blocks. With low pay threshold and daily payouts, F2Pool has become popular among the mining enthusiasts. With the PPS reward system, it charges 2.5% fees, supporting LTC, ETH, ZEC and many more along with BTC.

Based in China and owned by Bitmain, Antpool mines 11% of total blocks with two types of rewarding systems, both PPLNS (one of the free Bitcoin mining sites) and PPS. payments in Antpool are done on a daily basis only when the amount exceeds 0.002 BTC. With a user-friendly intuitive interface, generally, beginners find the website useful to mine. Antpool has taken care of the security judiciously by deploying two-factor authentication, email alerts and a variety of wallet locking systems.

Based in China and owned by Bitmain, Antpool mines 11% of total blocks with two types of rewarding systems, both PPLNS (one of the free Bitcoin mining sites) and PPS. payments in Antpool are done on a daily basis only when the amount exceeds 0.002 BTC. With a user-friendly intuitive interface, generally, beginners find the website useful to mine. Antpool has taken care of the security judiciously by deploying two-factor authentication, email alerts and a variety of wallet locking systems.

Slushpool was the first mining pool launched in 2010 by SatoshiLabs based in the Czech Republic. Slushpool is one who actually circulates the idea of sharing computational power to ease the mining difficulty. Presently, it mines around 11% of the total BTC blocks. To mitigate the risk of cheating, it utilises the score-based method to reward the users. It is a medium-sized Bitcoin mining pool but has been popular among the crypto community since its launch.

Slushpool was the first mining pool launched in 2010 by SatoshiLabs based in the Czech Republic. Slushpool is one who actually circulates the idea of sharing computational power to ease the mining difficulty. Presently, it mines around 11% of the total BTC blocks. To mitigate the risk of cheating, it utilises the score-based method to reward the users. It is a medium-sized Bitcoin mining pool but has been popular among the crypto community since its launch.

Conclusion

To sum up, it can be said that joining a mining pool either free Bitcoin mining sites or paid ones will be more efficient in making money than mining by your own or individually accumulating the resources for the purpose. If you are a novice, it is advisable to join the established mining pool even if you need to pay more charges for gaining experience. Once you get aware, you might choose the pools with lower fees to earn more profits.

Articles You May Read

Crypto industry started with only a few crypto exchanges but presently there are thousands of crypto exchanges open to buy, sell or trade the crypto assets all across the globe. Recently, businesses are aspiring for their own crypto trading platform but maintaining the infrastructure and customer support is not an easy task for any company. So, the crypto space has paved the way to accelerate the way for crypto exchange by having the alternative of White label cryptocurrency exchange platforms. But what are white label exchange platforms? How are they empowering smaller exchanges and businesses by providing robust infrastructure? In this article let us discuss in detail about white label crypto exchange platform.

What Is A White Label Cryptocurrency Exchange Platform?

Are you thinking of setting up the crypto exchanges? Are you also thinking about the chaos you need to handle while setting up the whole infrastructure? Don’t worry! You don’t have to develop a crypto exchange platform from scratch but just have to buy turnkey, the white-label cryptocurrency exchange platform which allows you to set up an exchange in no time. Basically, a white-label platform provides the infrastructure of an already established and running exchange to another company for the purpose of rebranding. White label crypto exchange software is a completely ready product with high scalability which can be customized as per the requirements of particular businesses.

Benefits of White Label Crypto Exchange Platform

White label platform has the following benefits:

- The time needed to build the crypto exchange from scratch will be saved, thereby faster deployment.

- Saving of finances which have been deployed to hire technical resources

- Chaotic trial and error phases in the creation of exchange can be skipped easily

- The initial investment can potentially turn to huge profits of the new exchange

- With the option of customisation, white-label offers the option to be competitive as the leading-edge platform.

- With extensive experience, risks of failure get reduced and best of breed solutions can be made easily.

- Scaling up of capacity can be easily done without hampering the existing functions on the platform.

Best White Label Crypto Exchange Platform Solutions Provider

As the crypto industry is expanding at an exponential rate, the number of service providers are offering solutions or turnkey for white label crypto exchange platforms.

HashCash Consultants

Software company specialized in Blockchain and crypto-based services and products also provide the white-label exchange software. Highly customizable with considerable scalability, the software offers the high-frequency trading platform while supporting all the major fiat currencies across the globe is offered by HashCash Consultants. Some of the specific features are order book and matching engine, CMS, document management, wallet manager, KYC Verification and many more. White label crypto lending solutions are provided by Hash Cash Consultants.

Skalex Country

High-level security and extensive customization are significant features of the white label crypto exchange software provided by Skalex. The product of Skalex has features like API integration, crypto to fiat exchange, enablement of multi-currency and many more. Skalex is one of the best white label crypto exchange platforms available in crypto space.

Infinite Block Tech

Infinite Block Tech is a cryptocurrency exchange software development company providing the highly functional white label exchange platform for digital assets lending. The foremost priority of this company is a security which has been the high concern of both crypto exchanges and customers. Admin back end panel, support of multi-language, trading matching engine, secured payment gateway are some the features provided by the Infinite Block Tech to their software product.

Antier Solutions

Various companies wishing for the creation of customisable crypto exchange with the help of turnkey opt for the software of white label exchange by Antier Solutions. Businesses might highly leverage scalable and customizable options for the rebranding of seamless trading platforms. With high TPS/transaction per second, options of liquidity, margin trading, smart contract development and many more features, the product of Antier Solutions stands out in the cryptomarket.

BitHolla-HollaEx Kit

HollaEx Kit was designed by BitHolla, a Seoul based tech company which specializes in solutions for Blockchain technology and services to the companies associated with the latest technologies. It offers a free white label exchange platform available as open-source with a self-launch kit which provides the opportunity to everyone to launch their exchange. With an intuitive dashboard and customising features, even the non-coders (non-crypto exchange developer) can develop their platform in a hassle-free manner. With the special feature of reclaiming, it is easy for users to stop the services whenever he wishes to close the exchange.

AlphaPoint

AlphaPoint has been operating since 2013 offering the high-end products to the users especially in terms of crypto exchange technology. A highly expert management team and people with the strong background of traditional financial systems are constantly involved in the development of white label exchange software which is sufficient for both primary issuance and solutions for secondary trading. Exchange platform currently supports more than 20 cryptocurrencies and a dashboard to maintain the list of customers, partners and also investors. One of the strikethrough features of the product provided by AlphaPoint is that it can be easily integrated with most of the banking structures, payment gateways and also fiat currencies in a non-chaotic manner.

Wrapping Up

White label crypto exchange platform is one of the solutions provided by crypto fintech which can help in accelerating the crypto movement. Presently, there are more than 3000 cryptocurrencies and hundreds of crypto exchanges (both centralised and decentralized) for the convenience of customers. But as the industry is expanding at a higher pace, the need for the exchanges will also increase with new products and services. As the crypto industry is becoming lucrative for investors in terms of gaining extra money, consultants, developers, fintech companies also find the opportunities in the crypto space in terms of setting up the business and providing the innovative solutions for the better experience of already existed users and attracting the fresh investors.

So, if you are thinking to develop the crypto exchange, you must definitely try white-label exchange software so as to have the beforehand demo for your own exchange.

Articles You May Read

The Blockchain industry is growing gradually but along with revolutionising the various sectors, the vulnerability of cyber attacks is also increasing. Some of the groups like that of Lazarus of South Korea are constantly engaging in developing sophisticated techniques to attack the Blockchain network and steal the money during the transaction. In this article, we are going to focus one of those Blockchain attacks which seemed to be unrealistic a few years back but has become reality now. Yes! I am talking about 51% attacks. Maybe you have heard it but have you ever wonder how to prevent 51% attack in Blockchain? Let us start exploring the dreadful world 51% attacks and methods to escape them.

What Is A 51% Attack In Blockchain?

Blockchain network is based on a consensus mechanism which confirming the transaction of digital assets from one part to another. All the nodes or participants or systems connected to the network validates the transaction by using their computing power for solving the complex mathematical algorithm, this mechanism is known as “Proof of Work”.Generally, the longest version of Blockchain or that utilises the most computing power to generate or validate block is considered as the correct one and will be given the privilege to update block.

As per 51% attack Wikipedia, when a suspicious actor took the efforts to control a massive percentage of the computing power of the network such that it would able to build and verify blocks much faster than the competing participants, it would certainly result in the network which will accept the version of attackers as the real version for validation of block. With this kind of capturing power, an attacker could have the deciding power for submission of transactions which can be approved and added to the Blockchain. Also, they might use this superpower to create a new “longest chain” which could start from a block which got added before that transactions to the blockchain, as that new longest chain would not include the transactions (which are meant to be erased). Thus, there might be a fear of double-spending of digital assets but it is nearly impossible as Nakamoto explained in the whitepaper that attackers cannot create value out of thin air or take money which never belonged to that attacker.

Six Steps Of 51% Attack | How Does It Takes Place?

To unfold the solutions for the dangerous attack, you need to understand the process of attack to break the chain and have the solution. So to get the answer for how to prevent 51% attack in Blockchain, we should first know how does attack take place. Let us briefly understand the Six steps 51% attack:

- Firstly, an attacker tries to gain control of a majority or 51% of the peer-to-peer network of Blockchain.

- Then, the process of secret mining starts on an alternative Blockchain, running parallel to the chain on which rest of the nodes of the network mine. While mining the new blocks, the attacker does not disclose it to the other 49% participants of the network.

- In the next step, the attackers try to transfer some of the crypto coins native to the Blockchain which is intended to attack. Most of the times, attackers trade the funds on the centralized exchange (as the fraudulent chain does not acknowledge the transaction),

- Process of mining the blocks continue until the fraudulent chain become longer than the actual chain and the blocks mined remain announced till that time.

- After the chain become the longest one, the attacker announces the blocks mined to the remaining 49% of participants and as per the “longest chain rule”, the remaining network was compelled to accept the fraudulent chain of blocks.

- Finally, the attacker can enjoy the funds spent again (double spending) which was not recorded on the accepted chain. That is how a 51% attack takes place (The risk of a 51 attack is high in a private blockchain)

How To Prevent 51 Percent Attack?

With a number of technological innovations, real-world has offered valuable insights to inform the developments of the next generation. So, the developer team of Blockchain can reconsider the following points to avoid the terror of the 51% attack.

Attack Resistance Mechanism

Designing of the Blockchain can be strengthened so as to detect and resist the 51 per cent attack. For instance, Horizon (formerly ZenCash) in their whitepaper explained that “Block acceptance time delay” for alternative Blockchain (that is created by an attacker) can be kept hidden till the attacker announced the longest chain. This mechanism could penalize attacker accordingly based on the number of blocks added on the fraudulent chain.

Alternative Consensus Mechanisms

Consensus mechanism of “Proof-of-work” is deployed mostly by every Blockchain network which is highly vulnerable to 51% attack as the cost incurred by the attacker is nominal to convince to other participants and group up to conquer 51% of computing power. Proof-of-stake, Delayed Proof-of-work and few more are trying to reinvent the Blockchain industry by minimising the chances of 51 per cent of attacks.

Hash Rate Level Playing Field

In the crypto space, better the hashing rate or computing power faster will be the rate of mining the block. To protect the network from the fraudulent chain, guarding against computing or hashing power can be considered by deploying some of the measures like that of quantum computing to maximize the decentralisation of hash rate.

Governance of Private And Hybrid Blockchain

In terms of a private Blockchain, the number of nodes is significantly lesser than that of public Blockchain with some degree of centralisation. In private Blockchain, risk of the 51% attacks is the highest. Thus, it becomes important that the coding of the governance mechanism must be strengthened to anticipate the scenarios and resist the attack.

Conclusion

Bitcoin attack history briefs that successful 51% attacks include even reputable exchanges, proving that threat is real which must be taken care of seriously to accelerate the Blockchain environment and diversify the network. Every Blockchain must consider the 51 per cent attack cost not only in terms of loss funds but also in terms of negative media coverage, reduction in trust, chances of delisting from crypto exchanges and also in decreased likelihood in the investments. As the industry is expanding at a higher pace- it would surely come with the flooded responses to how to prevent 51% attack in Blockchain.

Articles You May Read

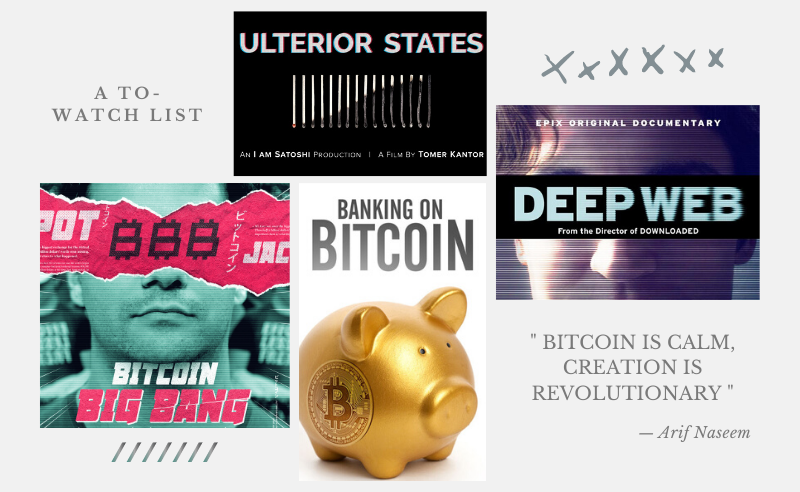

When Satoshi rubbed the magical lamp of Blockchain, a genie named Bitcoin came out in 2008. Though it remained hidden with no media exposure for many years, finally after 2017 it started showing its magic tricks in the form of increased Bitcoin prices up to $20,000. Bitcoin is exactly like one of those Theo James movies, wherein the protagonist emerges without giving any inkling of its rise. Since the day of the launch of Bitcoin, it remained a mystical confusing concept for the majority of the community. People even find it monotonous to read about the Bitcoin and Blockchain technology so the crypto community or enthusiasts find out the ways to spread the word about the crypto ecosystem. So, if you are a beginner and wish to learn about one of the trending technology in a fun and interesting way, then you had landed on the right article as I am going to tell you about some of the crypto movies and documentaries which can clear your concept and understanding.

Review Of The Crypto Movies | Blockchain Movies

So, now when you have realised that Blockchain is one of the strike-through innovation after the world wide web and cryptocurrency might be treated as the alternative for fiat currency, get ready with some caramel popcorns and cheesy nachos to explore some of the crypto movies.

Rise and Rise of Bitcoin (2014)

Bitcoin was the first cryptocurrency launched in 2009 by Satoshi Nakamoto with the aim to revolutionise the financial transaction system. Being the first one in the crypto industry, it still trades with hight market capitalisation. The Rise and Rise of Bitcoin is the documentary which sums up the story of Bitcoin’s popularity. It advocates about the reasons which led to the adoption of Bitcoin among masses through the help of interviews conducted with a number of companies and the crypto enthusiasts which are involved in the crypto movement. This documentary consists of the stories of early adoption of Bitcoin like that of Gavin Andresen who communicated directly with Nakamoto. Thus, the course of evolution of Bitcoin is summed up in this movie.

Life On Bitcoin(2014)

Have you ever think of not paying in cash or credit cards? Have you imagined a world in which everything can be purchased using crypto can be portrayed in crypto movies? If you love the frictional world having the potential of true future, then this movie “Life on Bitcoin” could be for you. This documentary is about a couple, Austin and Becky, who plans to live their life using the Bitcoin-only with no bank accounts, no cash and no other fiat currency. The crypto movie is all about a social experiment where a couple shares the journey of 100 days with Bitcoin and paying everything in Bitcoin.

Trust Machine: The Story of Blockchain (2018)

Trust Machine is one of the Blockchain funded, Blockchain distributed and Blockchain focussed documentary ever made. Trust machine: the story of Blockchain unveils the journey of cryptocurrency, Blockchain technology and decentralisation in an interesting manner. As per the reviews, the movie describes the role of technology in addressing the real-world problems, for instance, hunger, income inequality and many more. It was the first movie which was funded by cryptocurrency which was quite conventional portraying the fact that the crypto can be utilised in the funding of the entertainment industry.

Bitcoin: The End Of Money As We Know It (2015)

Torsten Hoffmann created Bitcoin: The End of Money as We Know It in 2015 to explain the impacts of Bitcoin in disrupting the traditional financial system. This movie tried to show the time travel of cryptocurrency from its origin in Wall Street era. It was a jargon-free documentary which even suited for common people who does not know about the Bitcoin. As per the critics, some of the scenes of the movie blatantly raised the questions related to the monetary system and the behaviour of people towards it. The movie was created after interviewing the number of Blockchain experts and influentials which proves that it is not something fictitious but based on real incidences.

Banking On Bitcoin (2016)

Banking on Bitcoin is somehow similar to the movie mentioned above, “Rise and Rise of Bitcoin” but covers the larger paradigm and shed more light on the benefits of Bitcoin on society. The movie has comprehensively covered the various real-life implications like that of intrusion of crypto coins in the banking system; arrest of Charlie Shrem who was accused of laundering $ 1 million and many more. One of the famous quotes from the movie was “ Early adopters make the roads that we all travel. The first guy through the door gets shot. But somebody’s gotta go through the door.”

Bitcoin Big Bang (2018)

The crypto space is growing gradually along with the sophisticated hacking techniques utilised for cybercrimes. Bitcoin Big Bang is about one of the infamous cyberattacks on Mt. Gox (Bitcoin exchange based in Tokyo) which was one of the famous exchange handling almost 70% of Bitcoin transaction that time. This movie shows you about the potential risks and vulnerabilities associated with crypto marketplace and indirectly signals you about the areas which need to be specifically taken care of while trading and investing.

I Am Satoshi (2015)

Blockchain awards (yes! They do exist) titled “Most Creative Video” to the documentary named as I am Satoshi (an eye-opener title) among many cryptos movies. This movie beautifully gives insights into the world of Bitcoin differentiating the crypto marketplace form the traditional banking system. This movie with amazing cinematography showed the details of the crypto space.

Magic Money: The Bitcoin Revolution (2017)

Magic money tries to tell the magical story of Bitcoin which have the potential to turn the society along with changing their habits of transaction and mode of payment from fiat to crypto. With the slang free easy language, the movie helps you in understanding the basic concepts of Blockchain technology and cryptocurrency.

Wrapping Up

Crypto movies will surely offer you the opportunity to get self-educated and ponder about the cryptocurrency which has been slowly adopting by the people across the globe. Documentaries will surely allow you to think about the different perspective and the issues related to fiat currency which might be minimalised by using cryptocurrency or Bitcoins. Thus, I hope after reading the reviews you might end up in watching at least two or more crypto movies.