Before you go on and invest your money in ICO, here are some things you should keep in mind. The first being 99% of ICOs fail to collect enough or even close funds in the crowd sale. There are more than 5000 cryptocurrencies in the market and only the top 100 or 500 of them have a bright future. What about all the others especially the ones below in the list. Why Do ICOs Fail?

I’ll tell you about some of the ICOs success stories. In 2017, BAT ICO collected $35 million in just 30 seconds. Yes, you read it right, we said BAT token raised $35 million in its ICO in 30 seconds. Another project called Bancor collected $153 million in 3 hours. There are projects that succeeded in ICO’s but in comparison to the others that failed, the percentage is really low.

Have you heard about the Ethereum based token UET? No worries, we’ll tell you about it. It is a joke coin named the useless Ethereum coin. If you read the pitch of the UET token on its website, it was clearly mentioned that the token has no use. It says you can hold this Ethereum token or transfer it but beyond it, there’s no use of it. Well, the useless Ethereum token mentioned it openly, there are others who don’t. Which means if you are investing in an ICO, you are entering a world full of risks.

Not to mention if the token turns out to be the next Ethereum, it’s going to be a treat. So, let’s get started and look at the reasons why ICOs fail.

Top Reasons Why ICOs Fail

The Greater Fool Theory

It is the hype around the ICOs in the market that’s being the reason for its failure. Nowadays, people who just stepped into the crypto industry and hardly know anything about it are using ICO as a method of earning benefits. So instead of investing money in a project that actually holds value, they invest in projects with attractive white papers.

This is the reason for the increase in the ICOs that operate with the Greater Fool Theory. So, what is greater fool theory exactly? According to this theory, it is possible to make money from security even if it is overvalued or not because there would always be a greater fool ready to buy it at a higher price. To avoid being a greater fool, one should be very careful and sell the security before the inflation bubble bursts.

This is the major reason that 99% of ICOs fail because they are nonetheless based on hypes and the greater fool theory than the actual value.

Product with No Demand

More than 50% of ICO fails in the initial stage is that they have no value or demand in the market. If you are also planning to launch your ICO, make sure you target the right audience. In short, before launching your ICO, create a community of people who are aware of your products. Also, for the success of your ICO, it is very important that you build trust and reputation among the community. To develop a community, you should announce your ICO on every possible platform, especially the major one and be active on all social accounts.

Insufficient Marketing

One of the major reasons why ICOs fail is that they don’t do enough marketing or take it seriously. Clearly, you cannot get investors to fund your ICO without spreading the word about. How are people going to consider your project when they don’t even know about it? The more people will know about your ICO, the more you’ll attract potential investors and eventually collect more funds.

For this, you would have to invest properly for advertisements and marketing of your ICO. you can also conduct interviews and visit public conferences to pitch your business strategy. Consider your ICO as a product for which you need to do marketing the right way or else it won’t survive the competition. To understand this you should know your target audience, where you can find them, and at last how to make them interested in your project.

Security Issues

All things on a side, security issues aside. In the last few years, the number of security breaches in ICOs has increased. If your project lacks proper security, you could end up losing all your funds and eventually the trust of your investors. Whether you used a poor code or didn’t use the proper method to store private keys, the result would be hazardous. It won’t take minutes to spread the word about the breach even if it is a little and your ICO would already be a failure. No one wants to invest in a project with poor security.

So How To Ensure The Success Of Your ICO?

We’ve already mentioned the major reasons why ICOs fail and cannot survive the market. Now, let’s discuss the things that will ensure the success of your ICO. Before you plan to launch your own ICO or start working on your idea, here are a few things you should keep in mind.

- Research thoroughly about the ICOs that have been successful in the past, such as Bitcoin, Ethereum etc and learn from them.

- Make a team of talented professionals that would help you take your ICO to the heights. Sometimes, it’s the team that becomes the reasons for ICO failure.

- Once, you are ready to start working for your ICO, prepare an attractive white paper. To know how to create a compelling white paper, read A Complete Guide On How To Write The Most Compelling White Paper.

- Focus on the marketing strategy to attract potential investors. The more you invest in the marketing of your ICO, the more the audience will be interested in your project.

- Clear all the legal issues and hire legal attorneys or find advisors.

- Make sure your blockchain or project has a strong foundation and you use all the security measures to keep it safe from thefts.

These are just some of the points that you should remember for the success of your ICO. if you want details about launching a successful ICO, find more tips here “Things To Do To Make ICO Successful, Best ICO Tips”

Articles You May Read

It all started after the creation of Bitcoin, the whole new technology, the whole new sector, blockchain and cryptocurrency came into existence. With it came the need for new talents with such technical and blockchain skills. In the last year, the requirement for the blockchain sector has increased more than 200% and not to mention most of these jobs have high salaries including the blockchain developer salary. If you are also wondering to jump into the blockchain career, then it’s the right time to do it. Why? Because currently there’s a high demand for skilled blockchain talents and even the competition in the market is low. That being said with a little hard work you can be someone on the top.

In this guide, we are going to tell you about how to be a blockchain developer. If you are already in the technical line or know web designing, coding, and computer programming, you can pursue this career easily after learning a few more things. However, if you are a complete beginner to computer programming and does not possess any technical skill, you might have to invest some time to learn about it. Let’s get started without any further delay.

What Is The Job Of Blockchain Developer?

As you can tell by its title, a blockchain developer is someone who develops the blockchain software. In detail, the responsibility of a blockchain developer is to develop protocols, dApps, architecture, smart contracts for a particular blockchain. For this, you’ll need sufficient knowledge of blockchain and distributed ledger technology and computer programming.

That was the responsibilities of a blockchain developer in nutshell. Now let’s know about it in detail.

For starters, there are two types of blockchain developers, i.e. the core blockchain developer and the blockchain software developer. The core blockchain developer is someone who builds the base of the blockchain i.e. the architecture and designs its security. Blockchain software developers then use this architecture built by the core developer for creating dApps, smart contracts etc. Although, both the responsibilities can also be fulfilled by the same person and it depends on the company if they want to hire two different developers or just one to manage all these tasks. Most probably in big firms, you’ll get to choose a title but in small businesses, you might have to manage it all by yourself.

The many responsibilities of Blockchain Developer are as follows:

- Developing protocols for the blockchain

- Creating smart contracts as well as managing it

- Designing dApps on blockchain

- Designing the core architecture of blockchain

- Maintaining security issues and updates

- Come up with new attractive ideas to constantly improve the blockchain

Moreover, a developer has to accomplish complex tasks like debugging software. To fulfil all these responsibilities, the developer must have knowledge of various programming languages and a range of blockchain platforms.

So, How To Be A Blockchain Developer From Scratch

Well, if you are completely new to programming, here are the things you can do to get a blockchain developer job.

Start With Learning About The History Of Blockchain

When we say, starting from scratch, it should be from scratch i.e. the foundation of blockchain. The technology came into existence with the first cryptocurrency Bitcoin. So, in order to learn about the history of blockchain you must learn about the history of Bitcoin, why it was created, what was the motive behind it and everything else.

Not only that you should collect the knowledge about bitcoin, but also buy, sell and trade in it to get some practical experience about how everything happens, we’ll talk about that in detail in the next section. Also, keep yourself updated with the latest Bitcoin news and follow forums on Reddit, go through blockchain developer tutorials and read as many articles as possible. Leave no topic unread and no question unanswered.

Get Yourself To Real Action

Before you learn the skills about how to become a blockchain developer, see how a blockchain works in real life. To do this you need to examine the work of exchanges and wallets and for that, you would have to buy cryptocurrencies, trade online, and experiment with as many features as you can. However, make sure you don’t put a lot of capital at stake or else you’ll end up with losses. As you buy crypto or tokens from exchanges, give attention to the procedure and how everything happens. Then you should learn the use of crypto wallets, what are the features that make a wallet best and everything else about it. Learn about the various types of crypto wallets and what types of wallets are considered safest.

Next time when anyone asks you about which crypto exchange is best or which crypto wallet is most secure, you better be prepared with the answer.

C++, Javascript, Python, Get A Grasp At Multiple Programming Languages

Before you step into the coding and programming of blockchain, learn all the required programming languages that you might need. This includes C++, Python, SQL, JavaScript and many more. The more languages you know, the better it would be for your career. But make sure you have a clear grasp at whatever languages you already know.

Smart Contracts and Solidity

As you know Smart Contracts is now one of the crucial parts of the blockchain, if you want to build a career and learn how to be a blockchain developer, you must learn about it. To learn how smart contract work and how to build, first, you’ll need to learn the programming language used to write it. Solidity is the language used for creating Smart contracts, it is quite similar to JavaScript but with much more surprises. So, if you know about JavaScript, you might grasp its concept pretty soon.

You can learn the basics of solidity from CryptoZombies, Space Doggos or Ethernaut. These games would help you learn the coding language in an interesting way, however, to get the entire knowledge about the blockchain language you should also read its official documentation. There you can learn about many things like the structure of the smart contract, the basics of solidity, about its variables etc.

At last, we recommend you to take courses for blockchain development from an accredited blockchain training provider.

Articles You May Read

Looking for new and exciting careers in blockchain? You’ve come to the right place. Today we are going to talk about how to become a blockchain consultant and why you should consider this career. One of the major reasons, of course, is that you will get high pay and it is one of the most reputable as well as a demanding career in the blockchain sector. However, you cannot become a blockchain consultant overnight and you need to acquire both technical skills that include coding and smart contracts and an understanding of distributed ledger and how blockchain works.

If you think that you can only benefit from crypto by trading and investing, then you need to reconsider it. There are tons of high paying job opportunities in the crypto and blockchain sector but due to lack of blockchain skills, not even half of them are fulfilled. Let’s start with our today’s article by learning what is blockchain consulting and move on to the other parts where we will explain why you should go for it.

What Is Blockchain Consulting?

As you know every company needs a consultant for various purposes, there are business consultants, IT consultants, financial advisory consultants, and now there are blockchain consultants too. The salary packages might differ according to the company but it is definite that like other jobs in blockchain, this has also high wages. Let’s find out more about the Blockchain consulting career.

Basically, the job of blockchain consultants is to examine the, suggest updates and any improvements and come up with other plans and technologies to make the blockchain better. At last, they have to send reports about their suggestions to the concerned developers’ team to get the changes applied.

So, clearly, in order to be able to do all these tasks, you must have deep knowledge about the blockchain and should also acquire the technical skills like what is blockchain development and its concepts. Continue reading to know more about how to become a blockchain consultant.

How to Become a Blockchain Consultant?

In order to become a blockchain consultant, you must acquire the following skills.

Computer Programming

As a blockchain consultant, you must have a great command over coding skills. That being said, you might have to work sometimes along with the developers in the blockchain projects, so you should also know everything about blockchain development including the programming languages, at least the ones basically used in blockchain projects. Some of the programming language used in major blockchain projects are C++, C#, Java, and Python. Moreover, you’ll also need the knowledge of web development languages including HTML, JavaScript and CSS.

These are all the coding skills any blockchain consultant should acquire. However, as it is said, the more, the better. So if you’ll have the knowledge of other coding languages like Solidity which is used for developing smart contracts, you can land in a big blockchain firm.

Clear Your Concepts of Blockchain

Of course, if you are planning to do a job in the blockchain sector, doesn’t matter where or at what destination, you should acquire wholesome knowledge about blockchain. Before you apply for an interview for Blockchain consultant, clear your concepts about the distributed ledger, use cases of blockchain, as well as the blockchain platforms like Ethereum, Ripple, Tezos etc.

How To Develop, Manage And Run Smart Contracts

Etheruem was the first blockchain with the ability to build and manage Smart Contracts on the platforms. Now there are plenty of blockchain projects who either have this ability or are trying to build it to make their blockchain better. In order to work as a blockchain consultant, you must know everything about Smart Contracts including how to create it and how to manage etc.

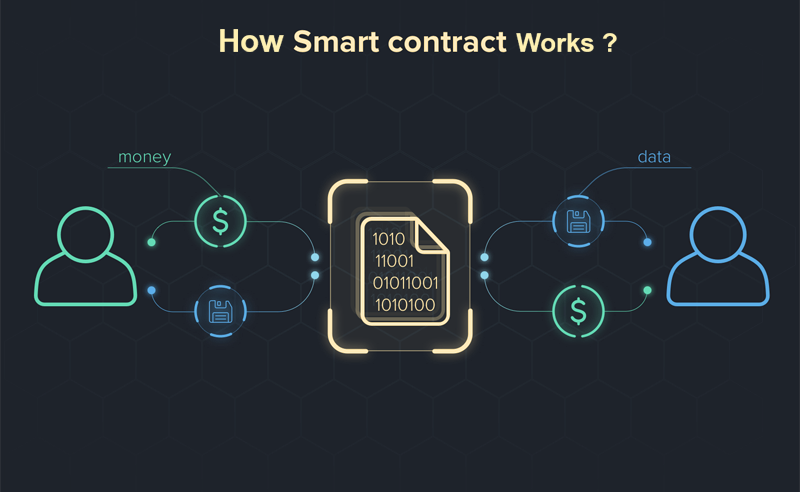

For your information, smart contracts are digital contracts that work automatically by verifying, updating and implementing contracts on the actions of its user.

For instance, think of it like if you subscribe to online services i.e. news, website or a magazine, a smart contract is created automatically. This contract contains all the information about your subscription including when was it started and when will it end. Any changes made to this subscription, like if you forget to pay for the subscription, the smart contract will be automatically updated and your subscription will get terminated.

Due to the decentralized nature of blockchain, they are considered ideal for managing smart contracts and as a business consultant, you must require the skill to create it.

Everything About Distributed Ledger

Just knowing what is distributed ledger isn’t enough. If you want to secure a job in the blockchain sector, you must understand the working of distributed ledger and acquire the skills to manage it. In simple words, distributed ledgers are a bunch of computer networks interacting with each other and the blockchain technology is based on it. Learn about the concept as well as the protocols used in distributed networks for interacting.

Reasons You Should Go For The Jobs Of Blockchain Consultant

Now, that you know how to become a blockchain consultant, let’s talk about why you should consider this job.

- The first reason, of course, is that consultant jobs have high salaries and you have to work with high-end clients. As a fresher, you can get a salary package between $60 – $ 170, it depends on the consulting service you are providing.

- Another reason for going for this career is that there’s a high demand for Blockchain consultants in the market. It is due to the fact that the technology is new and there are only a few who have significant knowledge about it. One of the responsibilities of the blockchain consultant would be to teach the CEOs and COOs about this technology.

- Next, as there is not much competition in the market yet, you can easily rise to the top with a little hard work. And it’s not like you are only getting high salaries, there would be other benefits like high bonuses, vacations and many more.

- The job of blockchain consultant is to consult the CEOs and concerned parties for updates or any change in the blockchain. As a consultant, you’ll start from a very high position as compared to other jobs that take years to get you to that position.

Articles You May Read

Crypto is still a sector that is full of excitement as well as uncertainty. Although the market has evolved greatly in the past few years, it still has miles to walk to get to a point of complete success. Crypto market is subjective to high risks but that isn’t stopping people from trying their chances because the higher the risks the higher are the chances of success. Whether you are someone looking to invest in an ICO or planning to launch your own ICO, in this article we are going to tell you about some tips that will help it be a success. As an investor, you’ll get to know about what ICO projects you can trust and as a startup founder, you’ll get know about things to do to make your ICO successful. Let’s not waste time and start with it right away.

Things To Do To Make ICO Successful

Start From The Scratch, Prepare A Compelling Whitepaper

The First thing to do to make your ICO working is preparing a white paper. If you are going to launch your ICO, a white paper is a must. We hope you weren’t planning to go live without it but there are a few things that you need to remember before preparing a white paper for your ICO. as it is going to be the foundation of your project, it should be prepared in a perfect way, make sure you won’t leave any gossip to go against your project and leave a good impression on your future investors. Cryptocurrencies have come past the time when investors used to fund ICO projects without reading their white papers. At the moment, there’s already high competition in the market and investors have so many options to choose from. There no way one would choose a project with no white paper over a project that seems officially legal in their eyes. No one is going to believe you and your talks unless you prepare an official white paper and that too a compelling one to prove your project worthy.

To know how to create a good white paper read our article A Complete Guide On How To Write The Most Compelling White Paper. A successful white paper might not guarantee the success of your ICO, but a problematic or no white paper can surely cut your chances of being successful.

Prepare Your Business Strategy

Well, if you are stepping out to do business in the crypto world, don’t expect to succeed unless you have a proper business plan. Although this goes unsaid, it is an important step and worth mentioning. Your focus should be to earn profit from your business and that’s only going to be possible if you have a clear vision about how everything is going to work out at each step i.e. if you have a prepared roadmap for your project.

Focus On Team Of Professionals

What investors need is security and trust from a project and that is only going to happen if you have a team of dedicated professionals. Don’t only focus on representing the team charming on whitepaper because when the investors will do some research they’ll learn the truth already. If you want your ICO to be successful, it should consist of experienced as well as qualified professionals capable of taking your project to the heights. Moreover, you can also attach the resumes and social account buttons of your team members on your website. This will help earn the trust of your potential investors.

Legal Attorneys and Advisors

After the team members come Legal Advisors and lawyers of your ICO. In order to find legal advisors for your company, you would need to do a little work. Look on the sites of ICOs and blockchain projects that have been successful in the past and contact their legal advisors. On the other note, the more advisors you will get, the chances of your ICO of being a success will increase. Make sure your advisor has some experience of working with ICOs or at least a law degree. If you can find advisors for your project you can also contract lawyer, the one with some experience in the crypto industry. Having a legal attorney would also help you with KYC and AML regulations.

Built A Community And Announce Your ICO On Multiple Platforms

This is really important step as people will only be interested in your project if they’ll know about it. So you should announce about your ICO on as many platforms as possible, at least the major ones. By major platforms we mean, all the social media platforms, ICO listing platforms as well as Discussion platforms. Some of the major social media platforms are Twitter, Facebook, Youtube, telegram, linedIn, Discord etc. Then you can get your ICO listed on ICO listing platforms like ICOAlert, Coinschedule, ListICO etc. at last comes the discussion platforms that includes Bitcoin Talk, Medium, Reddit, and GitHub.

Besides, you should also engage in interviews and visit conferences where you can promote your ICO, pitch it to the industry’s veterans as well as make connections with highly experienced advisors.

Make Sure To Secure Your ICO From Hackers

At last but not least, comes the security of your ICO. ICOs are a one-time thing and company’s collect tons of funds in this time, so it is important that you maintain the security of your websites. Get your smart contract examined by specialists so that you won’t face any issue with it in the near future. You might have to invest a little more here for hiring a specialist to audit your smart contract but at last, it all would be worth.

Final Thoughts

These were the things you need To Do To Make ICO Successful. You can also read our article about the Common Mistakes To Avoid While Writing An ICO White Paper, to prepare a dazzling white paper for your ICO and attract tons of easy. Apart from all these tips, we hope you have done your thorough research and reviewed other successful ICOs. This would help you understand the whole process of ICO and analyze any issue with your ICO as well.

Articles You May Read

When the crypto market was new, it was easy to decide which cryptocurrency would be worth investing. But now as the market is growing there are thousands of options available and every project brings something new to the industry. Some are good in terms of security whereas some offer instant payment solutions internationally, some promise anonymity while some provide the ability to build smart contracts and dApps. Although, not all of them are as worthy as they claim and it is your responsibility to find out which crypto can provide you max benefit. Nevertheless, in this article, we are going to talk about one such crypto that provides you with the ability to develop decentralized apps. So, what is Tezos cryptocurrency and how it is unique from others? As you know the first-ever blockchain to provide such features was Ethereum and it is still the second-largest crypto.

So, what about Tezos that is better than other cryptos and why should you invest in it? Let’s dig in deep and get all the answers right away.

Let’s Find Out What Is Tezos

Just like Ethereum, Tezos is a blockchain platform that can build smart contracts and decentralized applications. But the difference is that it works on proof of stake protocol while Ethereum uses proof of work. The protocol used in Tezos is what makes it unique as well as eco friendly. Moreover, those who own the Tez coin can contribute to the decision of the blockchain that concerns its future. Due to the fact that the Blockchain is based on proof of stake, there’s no need for miners, those who verify transactions are known as bakers instead.

Know Everything About Tezos History

Now that you know what is Tezos, let’s dig into its history. Tezos blockchain was developed by Kathleen Breitman and her husband Arthur Breitman. Both husband and wife have commendable experience in blockchain and finance. Kathleen Breitman was once a senior strategy partner at R3, one of the largest blockchain consortium.

So, the blockchain came into existence when Arthur Breitman released what is Tezos cryptocurrency. The project raised a significant amount of $232 in its ICO and the mainnet was released by September 2018.

The launch of the coin was delayed because of the conflicts between the president and co-founders of Tezos foundation. It was the Tezos price which almost surged to the 2017s all-time high at $3.96 in February 2020, that renewed its excitement in the market. If you are also wondering whether Tezos is worth investing or not then read this guide till the end and find out yourself.

What Makes Tezos Unique Than Other Blockchains?

So you know what is Tezos but what’s about it that makes it unique? First of all, unlike other blockchains that are dependent on developers and miners for decision making about the network, Tezos allows all the users to participate in it. Which means anyone using blockchain will have the say in the decisions of the network’s future upgrades. According to the developers of the platform, Tezos stands out from the crowd by allowing stakeholders to take part in decision making regarding the protocol upgrades.

Unlike Ethereum, the smart contracts built on latest tezo news as well as the verification methods used are more secure which eliminates the risk of token burning. This makes it a perfect blockchain for developing financial contracts.

Another thing you should what is Tezos cryptocurrency that counts as a plus point is that it allows people to code in many programming languages. For example, it allows the use of python language and JavaScript using SmartPy and Fi. However, in Ethereum, one can only code in the native languages of the blockchain that are LLL, Solidity and Vyper.

The Thing About Baking

As we’ve mentioned above, in Tezos, you don’t actually mine cryptocurrency but produce it by baking. This baking has nothing to do with the baking you do in your kitchen. The process of producing and validating blocks in Tezos blockchain is known as baking. Here’s how it works!

- First of all, the user must have more than 8,000 XTZ (Tez coins) to take part in the proof of stake system of the blockchain. The chances of you getting selected as a baker depend on how much you put at stake. That being said the more XTZ coins you put at stake, the higher are your chances of earning baking rewards.

- If you have enough technical knowledge as well as infrastructure that works 24*7 Besides the minimum amount of coins, you can go for Solo baking to get all the rewards to yourself.

- An alternative is to lend your coins to a baker and share the profits. The person who lends the coins is known as a delegator. This method is useful if you don’t have the required infrastructure to bake blocks on your own.

Now that all your doubts about what is Tezos are clear, let’s have a look at how you can buy them and where.

How To Buy XTZ?

Tezos is available for trading on all major exchanges, however, you might find it difficult to buy it directly with fiat currency. Even the crypto exchanges that support fiat currency deposit, does not let you buy the cryptocurrency directly from it but by exchanging it with other cryptos. So, what you can do in this case is to buy the supported cryptocurrency using fiat like Bitcoin and Ethereum and then exchange it for Tezos. You can also look at P2P platforms if someone is taking fiat for XTZ and vice versa. Some of the major crypto exchanges that let you buy Tezos are Coinbase, Kraken, Bitfinex, ChangeNow and eToro.

Once you buy Tezos coins, you must have the best Tezos wallet to store it somewhere safe. You should not leave your coins in the exchange wallet due to security reasons but store it in a hardware wallet. Hardware wallets are safest among all but you will have to invest around $50 to get them. Some of the best Tezos hardware wallets are Ledger Nano S, Ledger Nano S, and Trezor One. In case, you want to go with software wallets, you can use TezBox and Atomic Wallet.

Articles You May Read

Even if you are new to cryptocurrencies, you must have heard about KYC and AML regulations. Initially, when cryptocurrencies were just launched, there weren’t such rules surrounding the industry. But as the industry is growing, so is the need to get it regulated. In this article, we are going to talk about impact of KYC on crypto adoption which are now mandatory for all crypto exchange and institutions. We’ll talk about the impact of KYC on crypto adoption and how the world is taking this new regulatory change.

Note that if you are planning to start your crypto exchange or ICO, you need to hire a legal lawyer to deal with such matters. It will not be smart to take legal advice from online articles as they are only for knowledge purposes.

What Do you Mean By KYC In Crypto

In order to understand the impact of AML compliance on crypto adoption, we should learn about what’s KYC and AML first. Talking about KYC, it is the same KYC you do in banks to get yourself verified. KYC is popular among financial institutions as well as many other organizations. KYC aka Know your customer is a process due to which organizations verify the identity of their customers by collecting their necessary details and documents. This is to prevent frauds, terrorism, money laundering and other such criminal behaviour from occurring in the organization. For KYC compliance, you must provide your details like mobile number, email address, home address with address proof, Photo ID with selfie etc.

KYC verification makes it possible for organizations to better manage risk as well as monitor customer activities. There are no fixed rules for the KYC process, instead, different organizations follow different KYC formats. It depends on financial institutions what details and documents they like to collect for verifying a user.

What Is AML In Crypto

The two terms impact of KYC on crypto adoption are rather used together or interchangeably in cryptocurrency. AML verification is to prevent money laundering, criminal funding and other financial crimes. The rules of AML are decided by the financial action task force (FATF) which differs from place to place. Organization and financial institutions need to stick to their domestic AML laws.

Although cryptocurrencies have the better potential to deal with money laundering and reduce such crimes, AML compliance is now a requirement for all crypto exchanges. There have been many instances in the past and that too in big exchanges like Mt. Gox that resulted in bankruptcy. Many exchanges suffered bankruptcy while others suffered high losses. To tackle this it was now necessary to bring AML regulations to crypto. This way it could not only benefit the crypto firms from thefts and criminals but also their customers who eventually suffer the circumstances. Now, you can think yourself, what would have happened to the customers of Mt Gox when it went bankrupt. Nonetheless, there are many people who are opposing this new rule for KYC and AML regulations due to the fact that cryptocurrencies were supposed to keep the users anonymous. Let’s find out what’s the impact of KYC on crypto adoption and how it could benefit the industry.

Impact of KYC/AML On Crypto Adoption

At first, it was the US government which made it mandatory for all crypto exchanges to follow KYC/AML regulations. This was the reason many exchanges stopped providing services there and it’s still the issue in many cases. Any exchange which is based in the US needs to comply with the rules and regulations of FinCEN. Even the exchanges that are based out of the US are rolling out different platforms that are compliant with the US rules to keep themselves alive in the market. So, pretty soon every crypto exchange would become KYC and AML compliant because there’s no other option.

And those not having proper infrastructure to meet the KYC requirement will eventually come to end. This includes startups and smaller exchange. At the moment, such exchanges have already stopped their services in the area where KYC is now mandatory like the US. That being said, that time is not far when KYC requirements in the crypto industry would become a standard in all countries i.e. worldwide. It would be better if these startups would adapt to KYC/AML as soon as possible or else they would suffer the consequences. Not that any of this is going to happen overnight but it surely would affect low budget firms and startups trying to survive the market.

With the demand for KYC and AML regulation, the industry is only heading towards betterment and a bright future. And there’s no doubt that these new rules would only help reduce financial crimes, terrorist funding, money laundering and tons of such issues in the industry. Whether you are okay or reliant to adapt to these new changes, it’s not going to change the fact that it’s happening and there’s nothing in your hand. Moreover, it has it’s benefits if we ignore the negative points. The truth is that KYC is the only way left for crypto to survive in the long run and manage money laundering risks.

Bottom Line

KYC regulation in crypto is only the step to centralize the industry, KYC is going to help the industry further grow, it is in the best interest of crypto firms as well as users, there’s no point of decentralized nature of cryptocurrency if we have to provide our details anyway, everyone has their own views on the KYC and AML regulations. Let us know what you think about the impact of KYC on crypto adoption in the comment box.

As the government is taking new steps to reduce fraud and crime in the industry, you must also take all the possible precautions to keep yourself at the safe side. This includes verifying the reputation of the exchange before opening an account in it, storing your assets in a private offline wallet, not sharing your passcode, passwords and private keys with anyone and many more. To know more regarding this topic, read about the best wallets to keep your crypto coins safe from hackers.

Articles You May Read

In today’s guide, we are going to learn about Segwit and how it works. If you have heard about this term in cryptocurrency and it made you wonder what it is, then you should give this article a read. As you know like every computer program, cryptocurrencies also need to be updated. These updates are implemented in order to fix some glitches in the protocol. So, what is Segwit and what does it have to do with all of this? The reason we mentioned updates here is that Segwit is also a kind of update that was implemented to Bitcoin’s protocol.

Let’s know about what is SegWit in detail and how it works. If you are new to cryptocurrency and first like to clear your concept about Bitcoin, read our beginners guide to Bitcoin and blockchain. As soon as you grab the basic knowledge about Bitcoin and cryptocurrencies, you can read this article to know about Segwit.

What Is SegWit?

In simple words, Segwit was a modification made to Bitcoin protocol so that it could process more transactions in less time. The process is done by increasing the block size limit on the blockchain by removing signature data from the transactions of Bitcoin. Removing signature data from bitcoin transactions makes more space for transactions on a single block. Segwit means Segregated witness, in which segregate means to separate and witnesses refer to transaction signatures. So, the meaning of Segregated witness is to separate transaction signatures.

The SegWit upgrade was first suggested by a Bitcoin developer, Pieter Wullie in 2015. It was to fix the issue of scalability and transaction malleability in Bitcoin. Transaction malleability is an issue in Bitcoin that allows users to steal Bitcoin by changing the unique transaction ID even before it is confirmed. This way the person can get the bitcoin and make it look like the transaction didn’t happen. To fix these issues, Pieter Wuliie proposed the idea of SegWit which was finally performed in August 2017. Before that, the patch was implemented to the Litecoin protocol as it has the same issue of transaction malleability.

The Problems That Needed To Be Addressed

Before we get into details about what is Segwit, let’s learn why it was proposed in the first place. In bitcoin, blocks are created every ten minutes and the block size is limited to 1MB. The issue is that there are so many transactions made on the chain that it is delaying the whole process.

Think of it like there’s only one roadway to a particular destination which runs easily when there are up to 2000 cars driven on it. But if the number of cars starts to increase, it creates delays and jamming. The same was happening with Bitcoin’s block, which could only process a limited transaction at a time. Now that the cryptocurrency is very famous, more and more people are using it to process transactions, the time taken to process each transaction was increased from 10 minutes to hours and days.

Learn How Segwit Works To Fix These Bugs

SegWit was proposed to improve the block size of Bitcoin so that it could process more transactions in less time. The protocol does two parts of the original block one of which remains the same as before and the second is the extended block known as “witness” block. The signature data is removed from the transaction from the original block and placed into the new extended block. This eventually makes more space in the original block making it able to store more data. Nothing of this changes the original size of the block, only signature data is separated and kept in an extended block which is one-fourth of the size or block.

The original block still contained the sender’s and receivers data and the extended block has all the signatures and codes.

When in July 2017, the majority of miners agreed upon the implementation of SegWit it was activated the next month. There wasn’t much dispute in the community regarding the SegWit upgrade as it was a soft fork. SegWit is backwards compatible and the updated nodes can still work with the previous non-updated nodes.

SegWit Pros and Cons

The Pros

- SegWit upgrade has successfully fixed the issue of transaction malleability which was one of the significant glitches in Bitcoin’s protocol.

- More transactions can be processed on the blockchain while the size of the block is still the same.

- The more the speed of transaction, the less would be transaction fees. So, SegWit has reduced the transaction fee of Bitcoin which used to be higher.

- SegWit makes it possible to solve scalability issue on a larger scale with projects like Lighting network.

The Cons

- Although SegWit was a great achievement of bitcoin, not everyone has welcomed it with open arms. A lot of miners disapprove using SegWit as it reduces the transaction fees which lowers their profits. This is the reason the adoption of SegWit was slow, although the percentage has crossed 65% by now.

- The upgrade hasn’t solved much of the scalability problem and it’s only a short-term solution.

- It has become the reason for so much dispute amongst the Bitcoin community and has already caused many hard forks, one of which is Bitcoin Cash.

Conclusion

We hope the information provided above was easy to understand and at least now you know What is SegWit. Bitcoin was the first-ever cryptocurrency to be created and it is still leading the race. However, there are many other cryptocurrencies in the market now with various capabilities and use cases. If you are also interested to know about them, read our guide best altcoin to invest in 2020.

Now that you know everything about how SegWit works, what’s your opinion about it? Do you think SegWit has helped Bitcoin become better or are you on the other side? Before you get onto any conclusion, how about knowing what is Bitcoin Lightning Network and its working.

Articles you May Read

Today, we’ll learn about the many opportunities available in the job sector for Blockchain. If you are someone looking for a job in the IT sector or want to try out something new like blockchain, then you should read this blog.

It all started when bitcoin was created, the leading cryptocurrency took the world by storm. Not that it only provided the world with new amazing technology, it also created new job opportunities for people. You might wonder that the blockchain jobs are for tech-savvy engineers only, but it’s not true. As the blockchain sector is growing rapidly, more and more jobs are coming out for all including those who are not tech-savvy.

Recently, LinkedIn mentioned blockchain as the most in-demand skill for 2020. Not to mention that it is among one of the highest paying careers available at the moment. If you are also interested in working in the blockchain career careers and acquire the skills, find out the top blockchain careers and get yourself prepared.

Top Blockchain Careers You Must Know About

Tech Jobs

Given below are the top blockchain careers that require you to have the technical knowledge of blockchain and coding. These jobs offer sky-high salaries because of the limited resources available to learn all these skills.

Blockchain Developer

In order to start any business related to Blockchain, one needs to build a blockchain first. For that, the company need to hire someone who has the skill to build a blockchain as well as a strong background in coding. According to research, the jobs for blockchain developers increased by 115 per cent in 2017. A blockchain developer requires the knowledge of C++, machine learning, javascript, cryptography and python.

Basically, the skills companies are looking for while hiring blockchain developers are MVC, AJAX, .NET, C++, C, C#, SOAP, Javascript, FTP, REST, Node.js, XML, XCOD, JQuery, Microsoft SQL Server, Neural-network, HTML, Agile Scrum, XSLT, MYSQL, Regression.

Blockchain developers are paid between $50 to $100 for an hour.

Web Designer

To build blockchain-enabled platform such as crypto exchanges, trading platform, companies need web designers with excellent skills. If you think you can build amazing user interfaces for desktop as well as mobile devices, blockchain firms are waiting for you. The average per hour salary for blockchain web designers varies from $25 to $75.

Smart Contract Developer

This is yet another job in blockchain companies. B2C firms that connect buyers to sellers need Smart Contracts Developer. For this you require, sufficient technical knowledge about the blockchain used the company, mostly Ethereum. Moreover, you would also need to help the company with building new apps and platforms.

Non-Tech Jobs

Before you proceed any further, we would like to inform you that by Non-tech jobs we mean you don’t have to create any blockchain or need the coding skills. Although, you still need complete knowledge about blockchain and cryptocurrencies to pursue these top blockchain careers.

Blockchain Writers

Unlike normal content writers, blockchain writers need to have certain knowledge about the field. You just can’t jump into the opportunity before making yourself proficient at blockchain technology. Moreover, you should also acquire the skill to create great copies of blockchain services and projects. You might have to write blog posts, white papers, news, landing pages etc as a blockchain writer.

Project Lead

Of course, you need a little technical knowledge but the job doesn’t require you to create any blockchain or do coding or any such tasks. You would need to communicate between developer and organization with limited technical know-how skills. A project lead or project manager is someone who plays the role of a bridge between technical designers and developers and the people who take decisions at the organization.

Blockchain Attorney or Lawyer

With every new blockchain or blockchain-related technology arises many legal questions. This brings the need for a legal attorney to provide answers as well as solve any legal issue. Mostly, a blockchain lawyer has to deal with questions about privacy, finance etc.

Some firms also require you to build Smart Contract to keep the public relations and legalize partnership and create contracts.

Is Blockchain a Good Career?

With no doubt, blockchain is one of the best careers one can pursue at the time. It is highly in demand and you get to be a part of something big. Not to mention, you will get high salaries in these top blockchain careers. It is due to the fact that the need for such positions are high and the people with relative knowledge are less. Among all the jobs required in the field, only half of them are being met. This means that there’s a shortage of blockchain professional with sufficient technical knowledge.

If we talk about top blockchain jobs salary, it depends on various factors like where you are working, what’s your skill sets and how much you are experienced. As a blockchain developer, you can get from as low as $50,000 to as high as $120,000 per year. Mostly, if you work in startups, you won’t get sky-high salaries and their packages typically start from 50,000 USD for freshers. If you have experienced above 5 years, you can earn around $70,000 annually.

Next comes the high techs firms that offer the highest salaries in the field. Initially, you can earn around $70,000 which increases with experience and after five years you can get as high as $120,000. The reason for such a big gap between the salaries of startups and established tech firms is due to the fact that blockchain developers are more interested in starting their own firms rather than working for others.

At last but not least, comes jobs at government institutions. You might not get the best salaries here but as you know govt. Jobs have their own benefits. The salary packages offered at govt. Institutions are even less than startup firms.

Articles You May Read

With the growing interest of people in cryptocurrencies and ICOs comes the need for rules and guidelines. Initially, when there were not too many cryptocurrencies, many ICO launched without whitepaper, not that it left a good impact. But nowadays there’s already too much competition in the market with over 5000 existing altcoins and new ICO openings every now and then.

At this time if you want to attract investors to your ICO, you would have to work really hard to get it at every point. The first being creating an attractive white paper. After all, it’s the only way they are going to know about your idea and only then they’ll think about it. How can you expect anyone to be interested in your project if they don’t even know about your plan? In this article, we are going to help you out with the process of creating compelling white papers and attract potential investors to your project. Let’s get to the point right away!

What Is An ICO White Paper?

In simple words, an ICO white paper as your business strategy that you are going to sell to your angel investors. It is the way you can attract investors to your project for crowdfunding and make your idea work. A compelling white paper includes all the information about your project, issues that need to be addressed in the crypto space, how you can provide the solution, details about your token distribution, roadmap, team members collaboration as well as advisors. You should remember that to invest in your ICO, investors must believe your idea first. There’s no way anyone would invest in your project if they don’t even believe in it.

Besides making your white paper attractive, also add some real facts and information in it. The first thing, of course, is your plan and the fact that if it is actually going to work or not. All things including how attractive your white paper looks come next. You wouldn’t get points for a compelling whitepaper with attractive front and back covers if your project is a flop.

How To Create A Compelling White Paper?

Before you start writing your white paper, let’s talk about all the things that it should include. Any ICO white paper should have an abstract at the very beginning followed by a table of content, and then the introduction, the problem, the solution, how your product is going to help, roadmap i.e. what all is ready and your plans after the ICO, description about the token, token sales, and at last mention the team members included.

At last, you can summarize all that you’ve mentioned in your whitepaper. Keep reading to know the details about how to write an ICO white paper.

How to Begin?

The beginning of the white paper is its necessary segment. This is the most important section of your white paper as after this only, the interest of the reader will continue and he’ll end up reading the entire document. What to add at the beginning of your white papers to maintain the interest of the reader?

You can start with a disclaimer, legal notice or any important notification and step directly to the Introduction part. The abstract should be catchy and easy to understand. A good thing would be to add a table of content before you start with the introduction so that the readers can know what is included in the white paper. An ICO white paper is a long technical document that can go up to 25 to 30 pages which is why adding a table of content makes it more convenient for the readers. However, you should not focus on writing more, instead, be point to point and do not include any unnecessary information.

An introduction can vary from a page to two. You can write it in the form of a letter from the company’s CEO writing to crypto users.

What’s Next?

The next part would be where you will address the problem with examples and elaborate it. Mention why it is necessary to address this problem and continue with its consequences and effects on the industry.

This is the section where you can grab the interest of your reader and make them believe that you have some point. Make use of necessary tools to support your compelling white paper like graphs, charts etc.

Moreover, if you’ve used some technical terms in your content that you think needs to be defined, add a glossary at the last of the page or section.

Your Project

Continue writing by adding more sections as mentioned above. Make sure to elaborate your project in detail. Start with what is your project, what does it include and add the facts why it is necessary. Don’t expect the investors to believe in your words and back up your document with research and analysis. Most of the investors would only be interested in your project if you have something read to offer. Things like having an existing user base or ecosystem will make you attract the most potential investor as then the survival rate of your project would be high.

Your Plans Regarding Token Distribution

Talk about your token, how it is unique from others or how it can be successful, when it would be distributed, how many tokens would be distributed in the ICO etc. also you can add the financial details about your project that interests the potential investors. For example, how much capital the project would need and where the funds collected will be used. Make sure to clarify that the funds collected would be used in the development of the project and nowhere else.

Project’s Roadmap And Team Members

The roadmap should include the plans of at least the next 2-3 years. Highlight the tasks that have already been achieved as it would help attract the attention of the reader.

Your last section should be where you would talk about the team members of the project. Unless you are sure that your project is going to be the next Bitcoin, you would need to explain why the team behind the project is crucial. Provide a short biography and explain their achievements in the segment. Unlike other sections, you can give this section a little creativity by adding images of every person.

Conclusion

Now that you know how to write a compelling white paper, we must suggest you read as many white papers of successful projects as possible. At this time of high competition in the crypto industry, it would be hazardous to make even a single mistake in your white paper. Before you begin writing your paper, read our guide about Common Mistakes To Avoid While Writing An ICO White Paper.

Don’t forget us when your project would be successful.

Articles You May Read

Just like any new machine like a refrigerator, washing machine, microwave, comes with a user manual, ICO comes with its white paper. But in the case of ICO, a whitepaper is more important than a user manual. It decides the future of your project and whether it is going to work or not. Don’t mistake an ICO white paper with the introduction of your project because it is more than that. An ICO whitepaper should include various information such as the explanation of how you are going to make your idea work, the description of the token sale, even the roadmap of your entire project. It should also include the details of the team members and partners who will be accompanying you with your project throughout the journey.

Writing a good whitepaper doesn’t guarantee success for your project but it could greatly affect your project negatively if not written properly. This is the reason you should avoid even small mistakes in your ICO white paper.

Writing a good ICO paper is not an affair of a single person and it requires proper collaboration between the team members of the project. There have been many cases of such projects in the past that merely got flop because of the poor whitepaper. If you don’t want the same thing to happen to your idea, keep reading about the mistakes to avoid while writing an ICO white paper.

Format Of An ICO WhitePaper

An ICO makes fundraising easy for your business project. If you are wondering to do an ICO without a whitepaper then you are already out of the game. Think of it like if you go to the business angel without an actual strategy of your business. What do you expect would happen? Will you be able to raise money for your project? Of course not! There’s no shortcut or an easy way of doing ICO, you would need to be fully prepared with your idea and a perfect ICO to attract your potential investors. Before we start mentioning the common mistakes to avoid while writing an ICO white paper, let’s know about the format it should be written in.

The format of an ICO white paper should be as follows:

- First of all, the title of your Whitepaper should be attractive enough to make the reader interested in your idea. Being creative will not make you earn the trust of investors, instead, your title should be concise and understandable.

- Before you step directly to the introduction, abstract of your project. This abstract should outline your project’s idea including what is in your whitepaper and why should investors read it.

- Now you can introduce your project.

- Problems that needed to be addressed in the Market

- Their potential solution

- The entire Roadmap of your project

- Token Details and distribution

- Describe how your product can assist these problems in the market

- Legal Security plan

- The team behind the project

In the end, you must include a summary of your Whitepaper.

Some ICO White Paper Writing Mistakes

Given below are some of the common mistakes to avoid while writing an ICO white paper.

Unnecessary Details

A book might need the information regarding the background of the author, theme etc for various purposes but there’s no such requirement of background details in Whitepaper. It’s pointless to add information regarding the history of blockchain and cryptocurrency. Remember you are here to introduce your project idea, so just stick to it. Adding unnecessary details like this, you will only bore away your potential investors.

Grammatical Errors

It was long ago when people were not aware of cryptocurrencies much but nowadays investors read the ICO White Paper very carefully. Any mistake in your White Paper would give them a wrong impression about your project. Spelling mistakes and grammatical errors are the most common issues seen in the universe of Whitepaper.

If you are situated in the area where English is not your first language, then you would need to hire someone to write the whitepaper for you. Don’t just hire someone with good English but who has experience in writing cryptocurrency ICO. Even if you are not hiring a professional ICO Whitepaper writer, you should get it proofread by someone experienced. If you want your project to be successful, you would have to invest in it first and you know very well that it would be worth it.

Just Targeting Crypto Savvy Audience

It was the initial days of cryptocurrency when only crypto savvy investors were interested in reading the Whitepaper. But now crypto space has hit the mainstream and even common people are showing interest in it. If you’ll add too much technical details into your White paper, you’ll already lose a lot of interested investors. Although, for technical information, you can create a separate technical reader so that the audience will have a choice and it will also leave a good impression of your project.

The Longer The Better

Writing a long whitepaper, won’t make investors attracted instead they wouldn’t even complete reading it. Investors don’t have enough patience as well as time to read unnecessary information. They would dismiss your Whitepaper as soon as they realized that it’s just fluffed with words and have no point. Try to make your Whitepaper point to point with facts, case studies as well as technical details. When you are done writing your Whitepaper, take some time to proofread it and cut out everything that is not necessary.

Formatting Errors

This happens most of the time and it leaves a bad impression of your company on the investors. The first thing any reader is going to pay attention to is the format of your WhitePaper. It should look clean, tidy and worth reading. It’s always worth it to get a graphic designer who can manage all these things. Get a front cover and back cover designed for your whitepaper. The images, styles and layout used in your document should be consistent.

Final Thoughts

So, these were the most common mistakes to avoid while writing an ICO white paper. In case, you want to know more about how to write a WhitePaper, you should read our guide on how to write the most compelling white papers.

The ICO Whitepaper of your project represents the vision of your idea in a written form. By making these silly mistakes, you will not only leave a bad impression on the readers but also lose your potential investors as well as long term supporters. While a good whitepaper does not guarantee the success of the project, a bad one can definitely affect it badly.